Answered step by step

Verified Expert Solution

Question

1 Approved Answer

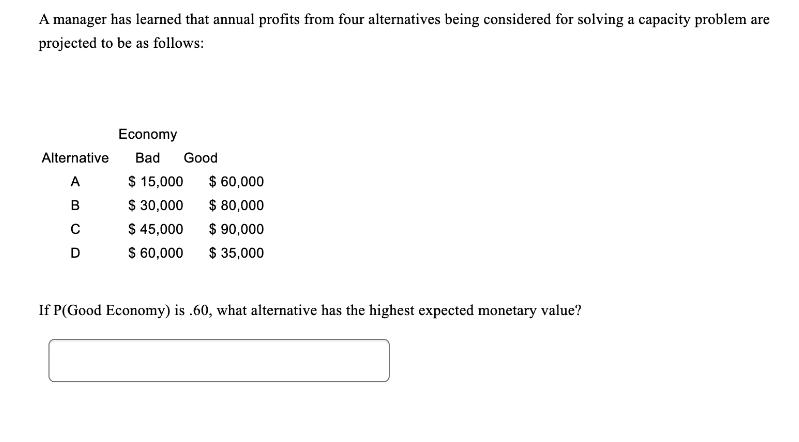

A manager has learned that annual profits from four alternatives being considered for solving a capacity problem are projected to be as follows: Economy

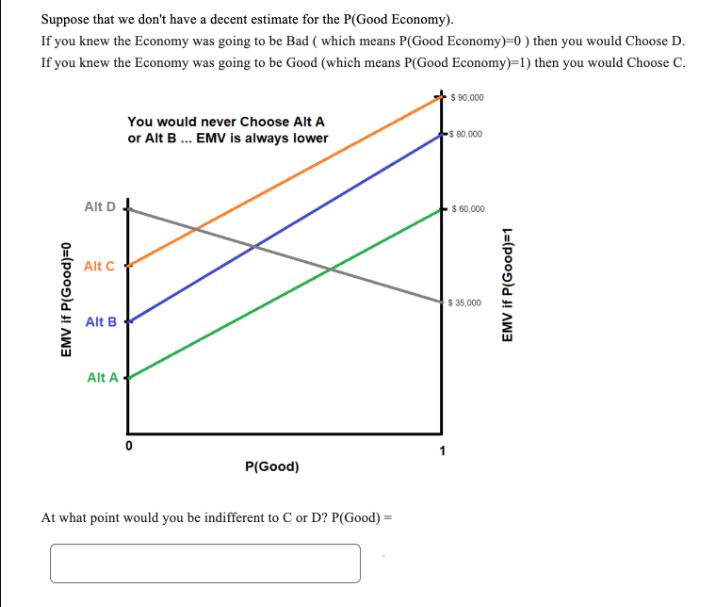

A manager has learned that annual profits from four alternatives being considered for solving a capacity problem are projected to be as follows: Economy Alternative Bad Good ABCD D $ 15,000 $ 30,000 $ 45,000 $ 60,000 $ 60,000 $ 80,000 $ 90,000 $ 35,000 If P(Good Economy) is .60, what alternative has the highest expected monetary value? Suppose that we don't have a decent estimate for the P(Good Economy). If you knew the Economy was going to be Bad (which means P(Good Economy)=0 ) then you would Choose D. If you knew the Economy was going to be Good (which means P(Good Economy)=1) then you would Choose C. EMV if P(Good)=0 Alt D Alt C Alt B Alt A You would never Choose Alt A or Alt B... EMV is always lower O P(Good) At what point would you be indifferent to C or D? P(Good) = $ 90,000 -$80,000 $ 60,000 $ 35,000 EMV if P(Good)=1

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the alternative with the highest expected monetary value we need to calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started