Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A manufacturing company locally produces a product at CU200 per unit. It received an order of 30,000 units from its distribution company located abroad

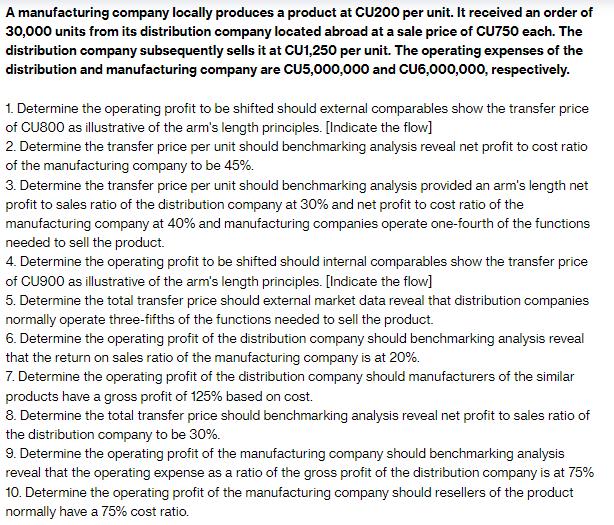

A manufacturing company locally produces a product at CU200 per unit. It received an order of 30,000 units from its distribution company located abroad at a sale price of CU750 each. The distribution company subsequently sells it at CU1,250 per unit. The operating expenses of the distribution and manufacturing company are CU5,000,000 and CU6,000,000, respectively. 1. Determine the operating profit to be shifted should external comparables show the transfer price of CU800 as illustrative of the arm's length principles. [Indicate the flow] 2. Determine the transfer price per unit should benchmarking analysis reveal net profit to cost ratio of the manufacturing company to be 45%. 3. Determine the transfer price per unit should benchmarking analysis provided an arm's length net profit to sales ratio of the distribution company at 30% and net profit to cost ratio of the manufacturing company at 40% and manufacturing companies operate one-fourth of the functions needed to sell the product. 4. Determine the operating profit to be shifted should internal comparables show the transfer price of CU900 as illustrative of the arm's length principles. [Indicate the flow] 5. Determine the total transfer price should external market data reveal that distribution companies normally operate three-fifths of the functions needed to sell the product. 6. Determine the operating profit of the distribution company should benchmarking analysis reveal that the return on sales ratio of the manufacturing company is at 20%. 7. Determine the operating profit of the distribution company should manufacturers of the similar products have a gross profit of 125% based on cost. 8. Determine the total transfer price should benchmarking analysis reveal net profit to sales ratio of the distribution company to be 30%. 9. Determine the operating profit of the manufacturing company should benchmarking analysis reveal that the operating expense as a ratio of the gross profit of the distribution company is at 75% 10. Determine the operating profit of the manufacturing company should resellers of the product normally have a 75% cost ratio.

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 The operating profit to be shifted can be determined using the following flow Sales revenue 30000 x CU800 CU24000000 Cost of goods sold 30000 x CU200 CU6000000 Gross profit CU18000000 Opera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started