Answered step by step

Verified Expert Solution

Question

1 Approved Answer

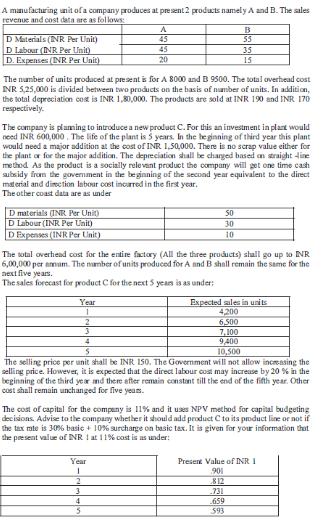

A manufacturing unit of a company produces at present 2 products namely A and B. The sales revenue and cost data are as follows:

A manufacturing unit of a company produces at present 2 products namely A and B. The sales revenue and cost data are as follows: D Materials (INR Per Unit) D Labour (INR Per Unit) D. Expenses (INR Per Unit) D materials (INR Per Unit) D Labour (INR Per Unit) D Expenses (INR Per Unit) The number of units produced at present is for A 8000 and B 9500. The total overhead cost INR 5,25,000 is divided between two products on the basis of number of units. In addition, the total depreciation cost is INR 1,80,000. The products are sold at INR 190 and INR 170 respectively. A 45 45 20 The company is planning to introduce a new product C. For this an investment in plant would need INR 600,000. The life of the plant is 5 years. In the beginning of third year this plant would need a major addition at the cost of INR 1,50,000. There is no scrap value either for the plant or for the major addition. The depreciation shall be charged based on straight line method. As the product is a socially relevant product the company will get one time cash subsidy from the government in the beginning of the second year equivalent to the direct material and direction labour cost incurred in the first year. The other coast data are as under Year 1 4 5 50 30 B 55 35 The total overhead cost for the entire factory (All the three products) shall go up to INR 6,00,000 per amam. The number of units produced for A and B shall remain the same for the next five years. The sales forecast for product C for the next 5 years is as under: Year 1 2 3 4 5 15 10 Expected sales in units 4,200 6,500 7,100 9,400 10,500 The selling price per unit shall be INR 150. The Government will not allow increasing the selling price. However, it is expected that the direct labour cost may increase by 20 % in the beginning of the third year and there after remain constant till the end of the fifth year. Other cost shall remain unchanged for five years. The cost of capital for the company is 11% and it uses NPV method for capital budgeting decisions. Advise to the company whether it should add product C to its product line or not if the tax rate is 30% basic + 10% surcharge on basic tax. It is given for your information that the present value of NR 1 at 1: % cost is as under: 731 659 593 Present Value of INR I 901 812

Step by Step Solution

★★★★★

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started