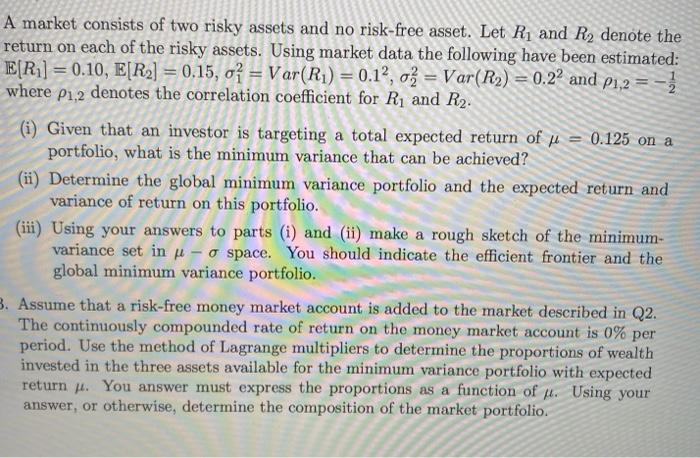

A market consists of two risky assets and no risk-free asset. Let R and R, denote the return on each of the risky assets. Using market data the following have been estimated: E[R1] = 0.10, E[R2] = 0.15, o = Var(Ri) = 0.12, a = Var(R2) = 0.22 and 21,2 = -1 where P1,2 denotes the correlation coefficient for R and R2. (i) Given that an investor is targeting a total expected return of u = 0.125 on a portfolio, what is the minimum variance that can be achieved? (ii) Determine the global minimum variance portfolio and the expected return and variance of return on this portfolio. (iii) Using your answers to parts (i) and (ii) make a rough sketch of the minimum variance set in ki - o space. You should indicate the efficient frontier and the global minimum variance portfolio. 3. Assume that a risk-free money market account is added to the market described in Q2. The continuously compounded rate of return on the money market account is 0% per period. Use the method of Lagrange multipliers to determine the proportions of wealth invested in the three assets available for the minimum variance portfolio with expected return . You answer must express the proportions as a function of u. Using your answer, or otherwise, determine the composition of the market portfolio. A market consists of two risky assets and no risk-free asset. Let R and R, denote the return on each of the risky assets. Using market data the following have been estimated: E[R1] = 0.10, E[R2] = 0.15, o = Var(Ri) = 0.12, a = Var(R2) = 0.22 and 21,2 = -1 where P1,2 denotes the correlation coefficient for R and R2. (i) Given that an investor is targeting a total expected return of u = 0.125 on a portfolio, what is the minimum variance that can be achieved? (ii) Determine the global minimum variance portfolio and the expected return and variance of return on this portfolio. (iii) Using your answers to parts (i) and (ii) make a rough sketch of the minimum variance set in ki - o space. You should indicate the efficient frontier and the global minimum variance portfolio. 3. Assume that a risk-free money market account is added to the market described in Q2. The continuously compounded rate of return on the money market account is 0% per period. Use the method of Lagrange multipliers to determine the proportions of wealth invested in the three assets available for the minimum variance portfolio with expected return . You answer must express the proportions as a function of u. Using your answer, or otherwise, determine the composition of the market portfolio