Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a . Monthly factory equipment depreciation, straight - line method is used Monthly electric cost for a convenience store; $ 5 0 base monthly fee

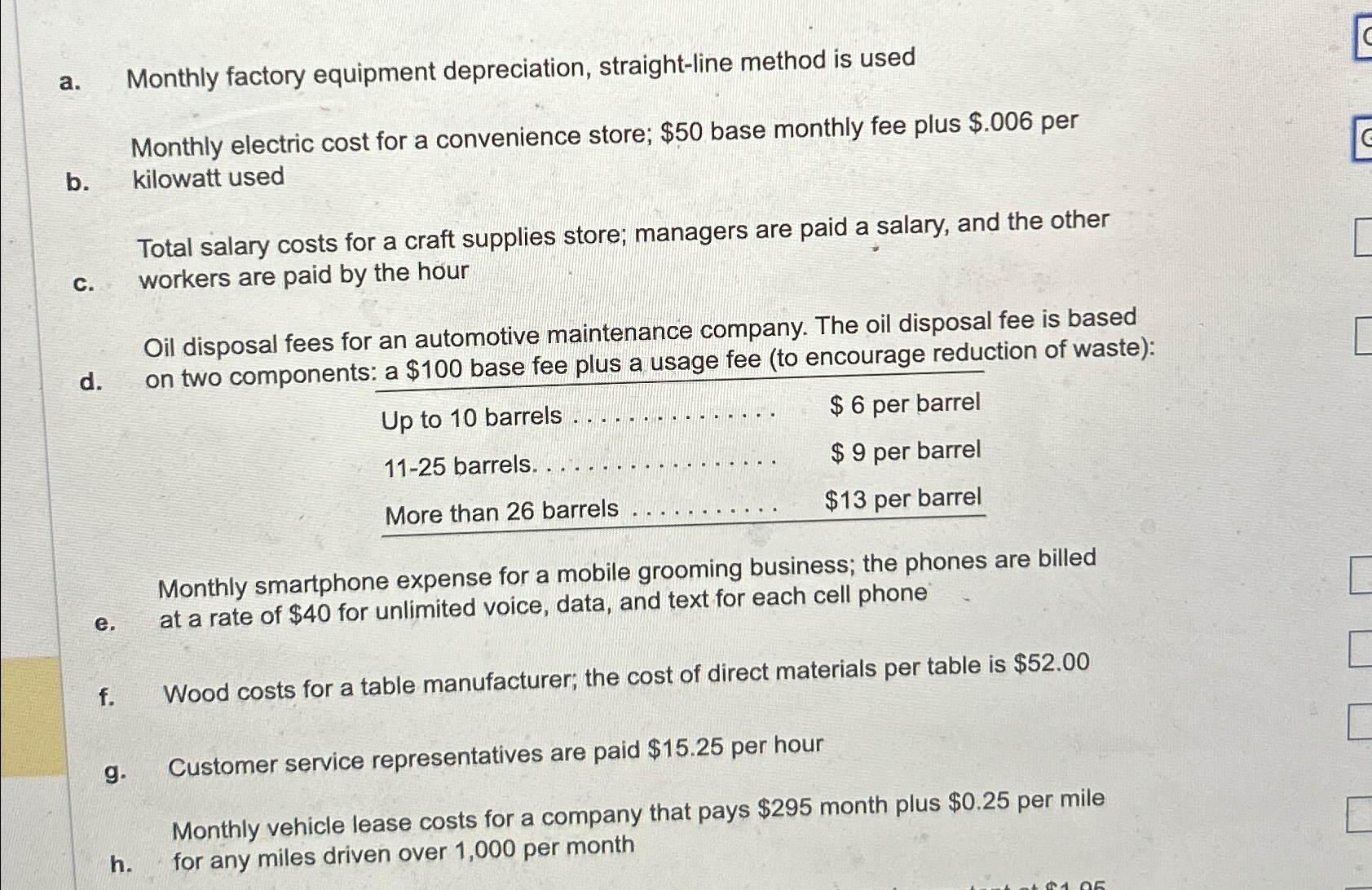

a Monthly factory equipment depreciation, straightline method is used

Monthly electric cost for a convenience store; $ base monthly fee plus $ per

b kilowatt used

Total salary costs for a craft supplies store; managers are paid a salary, and the other

c workers are paid by the hour

Oil disposal fees for an automotive maintenance company. The oil disposal fee is based

d on two components: a $ base fee plus a usage fee to encourage reduction of waste:

tableUp to barrels.,$ per barrel barrels.,$ per barrelMore than barrels,$ per barrel

Monthly smartphone expense for a mobile grooming business; the phones are billed

e at a rate of $ for unlimited voice, data, and text for each cell phone

f Wood costs for a table manufacturer; the cost of direct materials per table is $

g Customer service representatives are paid $ per hour

Monthly vehicle lease costs for a company that pays $ month plus $ per mile

h for any miles driven over per month

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started