Answered step by step

Verified Expert Solution

Question

1 Approved Answer

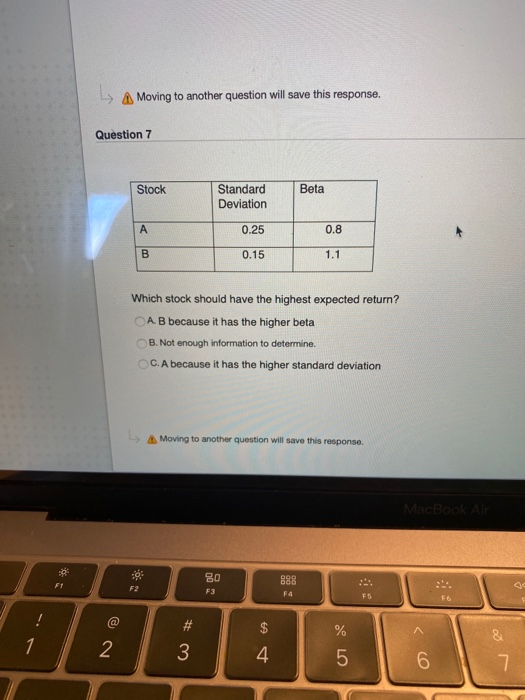

A Moving to another question will save this response. Question 7 Stock Beta Standard Deviation 0.25 0.8 B 0.15 1.1 Which stock should have the

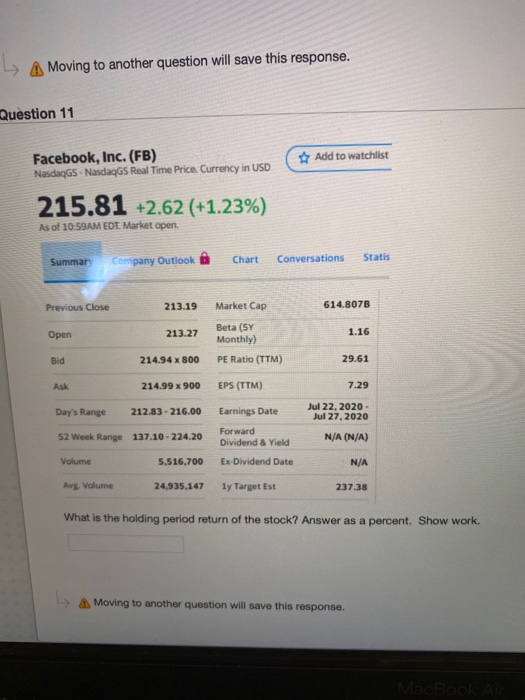

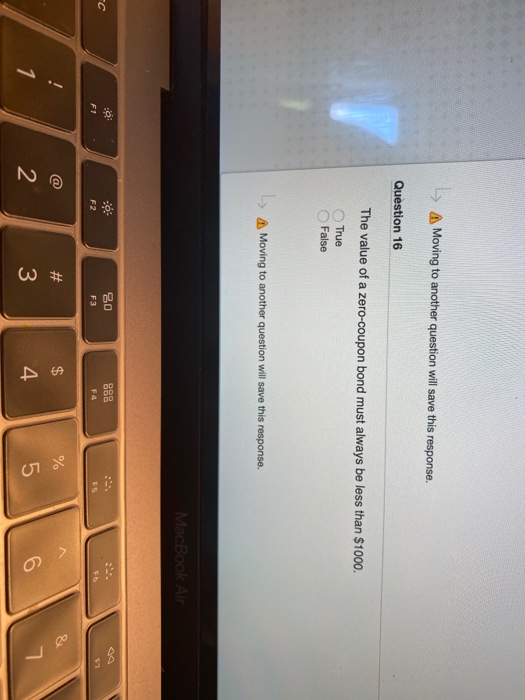

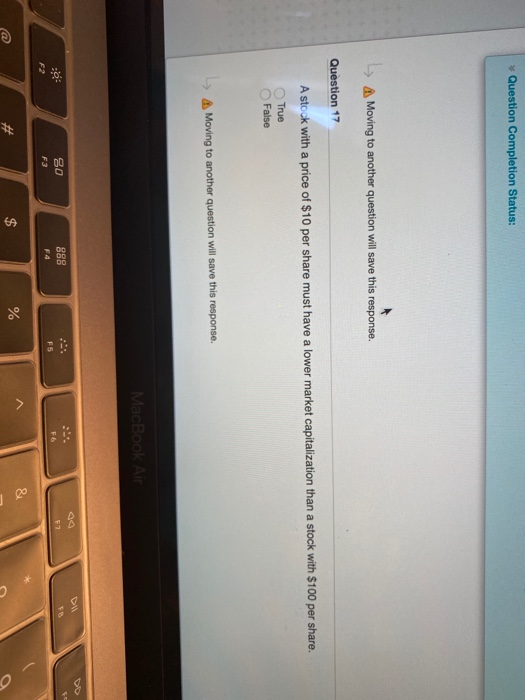

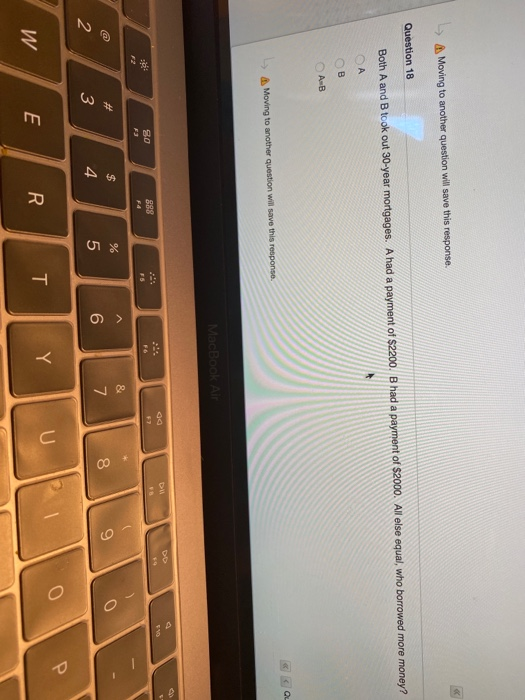

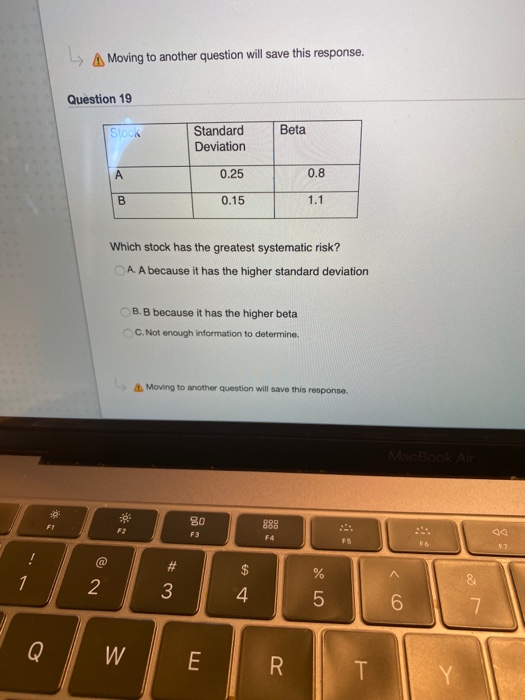

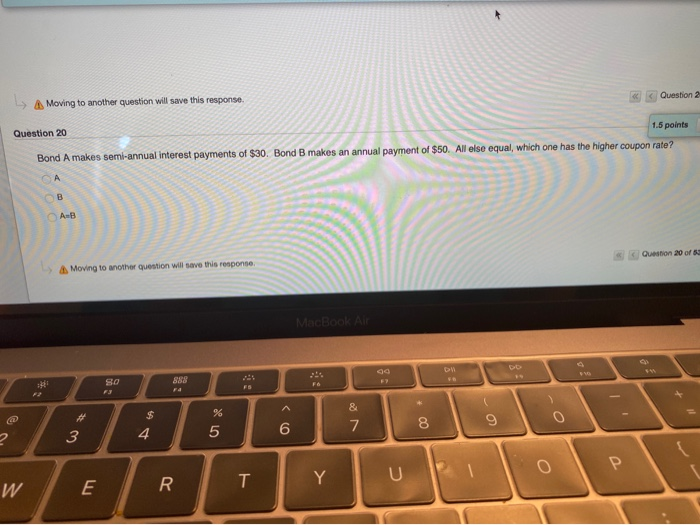

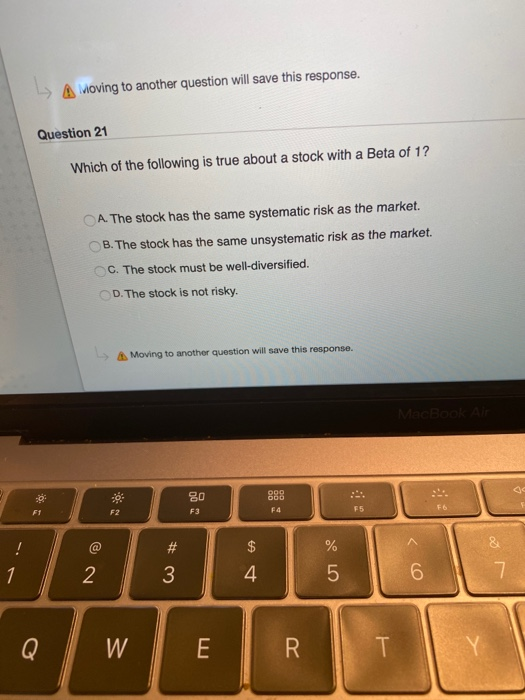

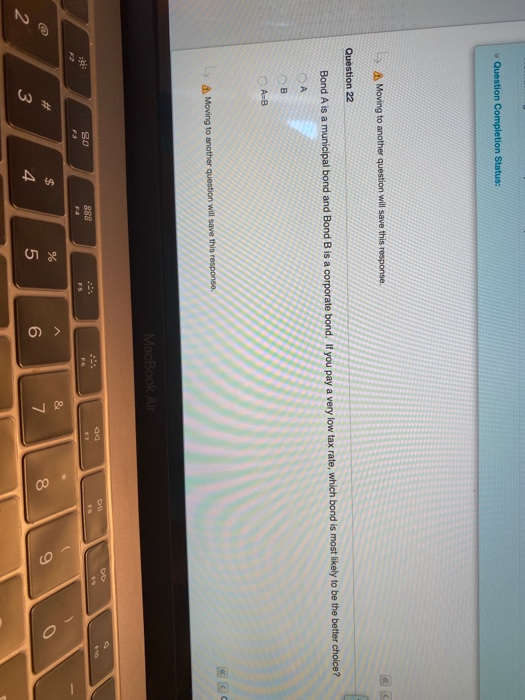

A Moving to another question will save this response. Question 7 Stock Beta Standard Deviation 0.25 0.8 B 0.15 1.1 Which stock should have the highest expected return? A B because it has the higher beta B. Not enough information to determine. C. A because it has the higher standard deviation Moving to another question will save this response. MacBook Air 80 F2 F3 F4 FS F6 % 1 2 # 3 $ 4 5 6 7 A Moving to another question will save this response. Question 11 Add to watchlist Facebook, Inc. (FB) NasdaqGs NasdaqGs Real Time Price Currency in USD 215.81 +2.62 (+1.23%) As of 10:59AM EDT. Market open Summar Company Outlook Chart Conversations Statis Previous Close 213.19 Market Cap 614.807B Open 213.27 Beta (SY Monthly) 1.16 Bid 214.94 x 800 PE Ratio (TTM) 29.61 Ask 214.99 x 900 EPS (TTM) 7.29 Day's Range 212.83-216.00 Earnings Date Jul 22, 2020 Jul 27, 2020 52 Week Range 137.10-224.20 Forward Dividend & Yield N/A (N/A) Volume 5,516,700 Ex-Dividend Date N/A Avg. Volume 24,935,147 1y Target Est 237.38 What is the holding period return of the stock? Answer as a percent. Show work. Moving to another question will save this response. MacBook AS 5 A Moving to another question will save this response. Question 16 The value of a zero-coupon bond must always be less than $1000. True False A Moving to another question will save this response. MacBook Air Bo F1 F2 F3 F4 F5 % & # 3 $ 4 1 2 5 6. 7 Question Completion Status: A Moving to another question will save this response. Question 17 A stock with a price of $10 per share must have a lower market capitalization than a stock with $100 per share. True False Moving to another question will save this response. MacBook Air 80 F3 888 fa 57 F6 F5 F2 $ % # L A Moving to another question will save this response. Question 18 Both A and B took out 30-year mortgages. A had a payment of $2200. B had a payment of 2000. All else equal, who borrowed more money? CA B Q L A Moving to another question will save this response. MacBook Air Du FE 80 F3 - & $ 4 0 % 5 # 3 9 8 7 6 2 U T Y E R W L A Moving to another question will save this response. Question 19 Stock Beta Standard Deviation 0.25 0.8 0.15 1.1 Which stock has the greatest systematic risk? A. A because it has the higher standard deviation B. B because it has the higher beta C. Not enough information to determine. A Moving to another question will save this response. 20 F1 F2 F3 F4 FS 57 $ N 1 # 3 % 4 5 6 7 Q W E R T Y Question 2 A Moving to another question will save this response. Question 20 1.5 points Bond A makes semi-annual interest payments of $30. Bond B makes an annual payment of $50. All else equal, which one has the higher coupon rate? Question 20 of Moving to another question will save this response. MacBook Air DW 80 888 F6 % & 7 8 9 0 6 3 4 5 0 P. U Y T E R W A Moving to another question will save this response. Question 21 Which of the following is true about a stock with a Beta of 1? A. The stock has the same systematic risk as the market. B. The stock has the same unsystematic risk as the market. C. The stock must be well-diversified. D. The stock is not risky. Moving to another question will save this response. 988 80 F3 F2 F4 F1 F5 A # $ & % 5 1 2 3 4 6 7 Q W E R T Question Completion Status: A Moving to another question will save this response. Question 22 Bond A is a municipal bond and Bond B is a corporate bond. If you pay a very low tax rate, which bond is most likely to be the better choice? B Moving to another question will save this response. MacBook Air 888 SO F3 F6 F5 & $ % 5 9 8 0 7 6 2 4 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started