Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a- Ms Miriam is working as an interior designer with Well Decoration Sdn Bhd. For the whole year of 2017, she receives the following

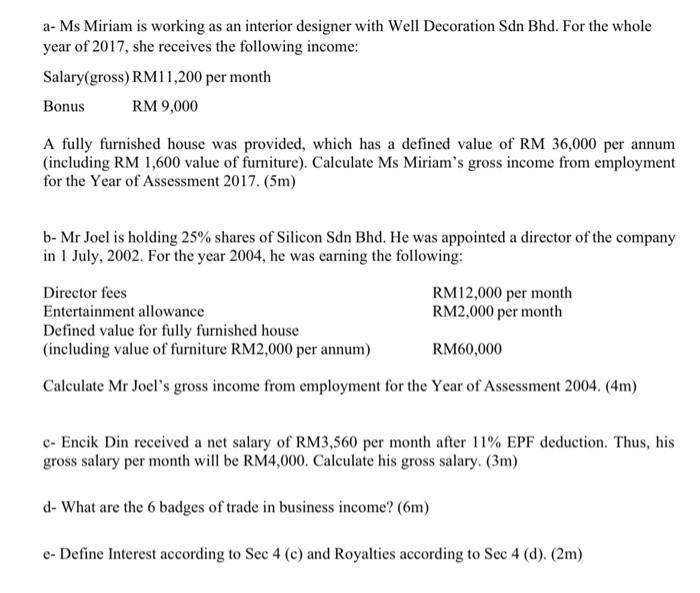

a- Ms Miriam is working as an interior designer with Well Decoration Sdn Bhd. For the whole year of 2017, she receives the following income: Salary(gross) RM11,200 per month Bonus RM 9,000 A fully furnished house was provided, which has a defined value of RM 36,000 per annum (including RM 1,600 value of furniture). Calculate Ms Miriam's gross income from employment for the Year of Assessment 2017. (5m) b- Mr Joel is holding 25% shares of Silicon Sdn Bhd. He was appointed a director of the company in 1 July, 2002. For the year 2004, he was earning the following: Director fees RM12,000 per month RM2,000 per month Entertainment allowance Defined value for fully furnished house (including value of furniture RM2,000 per annum) RM60,000 Calculate Mr Joel's gross income from employment for the Year of Assessment 2004. (4m) c- Encik Din received a net salary of RM3,560 per month after 11% EPF deduction. Thus, his gross salary per month will be RM4,000. Calculate his gross salary. (3m) d- What are the 6 badges of trade in business income? (6m) e-Define Interest according to Sec 4 (c) and Royalties according to Sec 4 (d). (2m)

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Ms Miriams gross income from employment for the Year of Assessment 2017 is RM152800 This is calcul...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started