Answered step by step

Verified Expert Solution

Question

1 Approved Answer

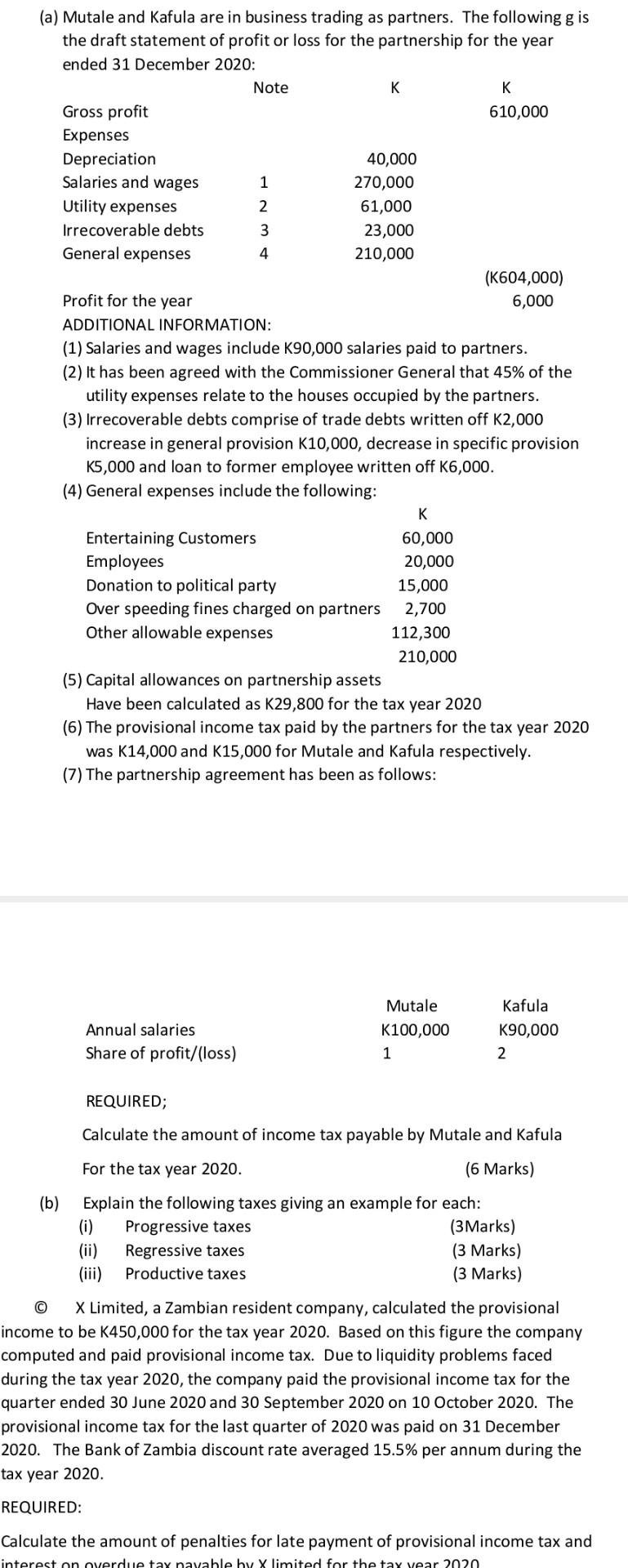

(a) Mutale and Kafula are in business trading as partners. The following g is the draft statement of profit or loss for the partnership

(a) Mutale and Kafula are in business trading as partners. The following g is the draft statement of profit or loss for the partnership for the year ended 31 December 2020: (b) Gross profit Expenses Depreciation Salaries and wages Utility expenses Irrecoverable debts General expenses Note 1 2 3 4 Entertaining Customers Employees Donation to political party Over speeding fines charged on partners Other allowable expenses Annual salaries Share of profit/(loss) K 40,000 270,000 61,000 23,000 210,000 Profit for the year ADDITIONAL INFORMATION: (1) Salaries and wages include K90,000 salaries paid to partners. (2) It has been agreed with the Commissioner General that 45% of the utility expenses relate to the houses occupied by the partners. (3) Irrecoverable debts comprise of trade debts written off K2,000 increase in general provision K10,000, decrease in specific provision K5,000 and loan to former employee written off K6,000. (4) General expenses include the following: (i) (ii) K 60,000 20,000 15,000 2,700 112,300 (5) Capital allowances on partnership assets Have been calculated as K29,800 for the tax year 2020 210,000 (6) The provisional income tax paid by the partners for the tax year 2020 was K14,000 and K15,000 for Mutale and Kafula respectively. (7) The partnership agreement has been as follows: 1 K 610,000 Mutale K100,000 (K604,000) 6,000 Kafula K90,000 2 REQUIRED; Calculate the amount of income tax payable by Mutale and Kafula For the tax year 2020. (6 Marks) Explain the following taxes giving an example for each: Progressive taxes Regressive taxes Productive taxes (3Marks) (3 Marks) (3 Marks) X Limited, a Zambian resident company, calculated the provisional income to be K450,000 for the tax year 2020. Based on this figure the company computed and paid provisional income tax. Due to liquidity problems faced during the tax year 2020, the company paid the provisional income tax for the quarter ended 30 June 2020 and 30 September 2020 on 10 October 2020. The provisional income tax for the last quarter of 2020 was paid on 31 December 2020. The Bank of Zambia discount rate averaged 15.5% per annum during the tax year 2020. REQUIRED: Calculate the amount of penalties for late payment of provisional income tax and interest on overdue tax payable by X limited for the tax year 2020

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a i Calculate salaries income for Mutale and Kafula based on partnership agreement Mutale Annual salary K100000 Kafula Annual salary K90000 ii Calcula...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started