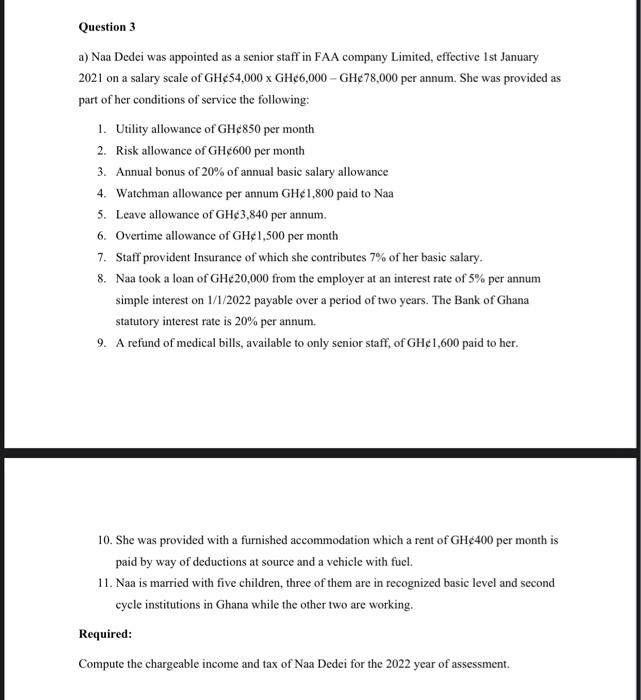

a) Naa Dedei was appointed as a senior staff in FAA company Limited, effective 1st January 2021 on a salary scale of GHe 54,000GHe6,000 - GHe78,000 per annum. She was provided as part of her conditions of service the following: 1. Utility allowance of GHe850 per month 2. Risk allowance of GH600 per month 3. Annual bonus of 20% of annual basic salary allowance 4. Watchman allowance per annum GHe1,800 paid to Naa 5. Leave allowance of GH3,840 per annum. 6. Overtime allowance of GHl,500 per month 7. Staff provident Insurance of which she contributes 7% of her basic salary. 8. Naa took a loan of GHe20,000 from the employer at an interest rate of 5% per annum simple interest on 1/1/2022 payable over a period of two years. The Bank of Ghana statutory interest rate is 20% per annum. 9. A refund of medical bills, available to only senior staff, of GHe1,600 paid to her. 10. She was provided with a furnished accommodation which a rent of GHe400 per month is paid by way of deductions at source and a vehicle with fuel. 11. Naa is married with five children, three of them are in recognized basic level and second cycle institutions in Ghana while the other two are working. Required: Compute the chargeable income and tax of Naa Dedei for the 2022 year of assessment. a) Naa Dedei was appointed as a senior staff in FAA company Limited, effective 1st January 2021 on a salary scale of GHe 54,000GHe6,000 - GHe78,000 per annum. She was provided as part of her conditions of service the following: 1. Utility allowance of GHe850 per month 2. Risk allowance of GH600 per month 3. Annual bonus of 20% of annual basic salary allowance 4. Watchman allowance per annum GHe1,800 paid to Naa 5. Leave allowance of GH3,840 per annum. 6. Overtime allowance of GHl,500 per month 7. Staff provident Insurance of which she contributes 7% of her basic salary. 8. Naa took a loan of GHe20,000 from the employer at an interest rate of 5% per annum simple interest on 1/1/2022 payable over a period of two years. The Bank of Ghana statutory interest rate is 20% per annum. 9. A refund of medical bills, available to only senior staff, of GHe1,600 paid to her. 10. She was provided with a furnished accommodation which a rent of GHe400 per month is paid by way of deductions at source and a vehicle with fuel. 11. Naa is married with five children, three of them are in recognized basic level and second cycle institutions in Ghana while the other two are working. Required: Compute the chargeable income and tax of Naa Dedei for the 2022 year of assessment