Question

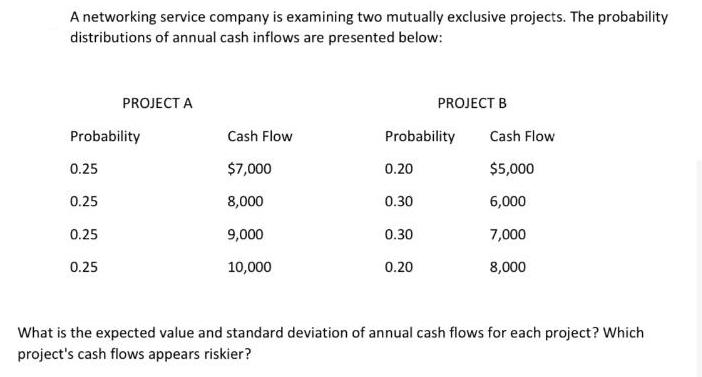

A networking service company is examining two mutually exclusive projects. The probability distributions of annual cash inflows are presented below: Probability 0.25 0.25 PROJECT

A networking service company is examining two mutually exclusive projects. The probability distributions of annual cash inflows are presented below: Probability 0.25 0.25 PROJECT A 0.25 0.25 Cash Flow $7,000 8,000 9,000 10,000 Probability 0.20 0.30 0.30 PROJECT B 0.20 Cash Flow $5,000 6,000 7,000 8,000 What is the expected value and standard deviation of annual cash flows for each project? Which project's cash flows appears riskier?

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To calculate the expected value and standard deviation of annual cash flows for each projec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F. Brigham, Phillip R. Daves

11th edition

978-1111530266

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App