Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new building is purchased in London, Ontario for $5,000,000, before HST. The purchaser, Total Health Inc., provides all types of health care services

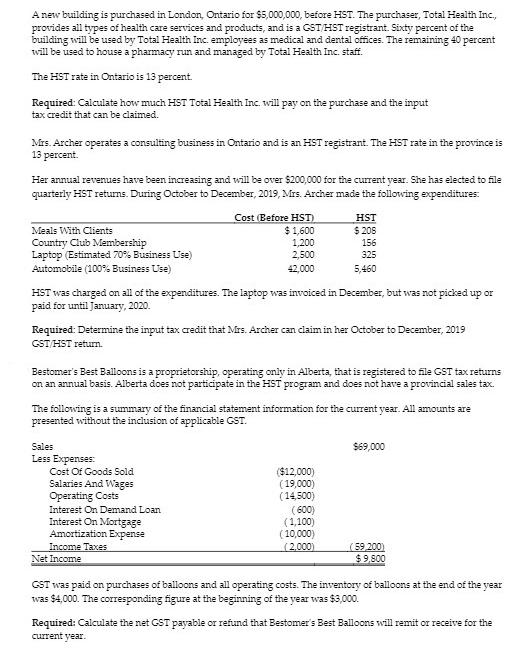

A new building is purchased in London, Ontario for $5,000,000, before HST. The purchaser, Total Health Inc., provides all types of health care services and products, and is a GST/HST registrant. Sixty percent of the building will be used by Total Health Inc. employees as medical and dental offices. The remaining 40 percent will be used to house a pharmacy run and managed by Total Health Inc. staff. The HST rate in Ontario is 13 percent. Required: Calculate how much HST Total Health Inc. will pay on the purchase and the input tax credit that can be claimed. Mrs. Archer operates a consulting business in Ontario and is an HST registrant. The HST rate in the province is 13 percent. Her annual revenues have been increasing and will be over $200,000 for the current year. She has elected to file quarterly HST returns. During October to December, 2019, Mrs. Archer made the following expenditures: Meals With Clients Country Club Membership Laptop (Estimated 70% Business Use) Automobile (100% Business Use) HST was charged on all of the expenditures. The laptop was invoiced in December, but was not picked up or paid for until January, 2020. Required: Determine the input tax credit that Mrs. Archer can claim in her October to December, 2019 GST/HST return. Bestomer's Best Balloons is a proprietorship, operating only in Alberta, that is registered to file GST tax returns on an annual basis. Alberta does not participate in the HST program and does not have a provincial sales tax. Sales Less Expenses: Cost (Before HST) $ 1,600 1,200 2,500 42,000 The following is a summary of the financial statement information for the current year. All amounts are presented without the inclusion of applicable GST. Cost Of Goods Sold Salaries And Wages Operating Costs Interest On Demand Loan Interest On Mortgage Amortization Expense Income Taxes HST $ 208 156 325 5,460 Net Income ($12,000) (19,000) (14,500) (600) (1,100) (10,000) (2.000) $69,000 (59,200) $9,800 GST was paid on purchases of balloons and all operating costs. The inventory of balloons at the end of the year was $4,000. The corresponding figure at the beginning of the year was $3,000. Required: Calculate the net GST payable or refund that Bestomer's Best Balloons will remit or receive for the current year.

Step by Step Solution

★★★★★

3.30 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the HST payable and input tax credit in the given scenarios lets break down each case separately Total Health Inc HST Calculation Purchas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started