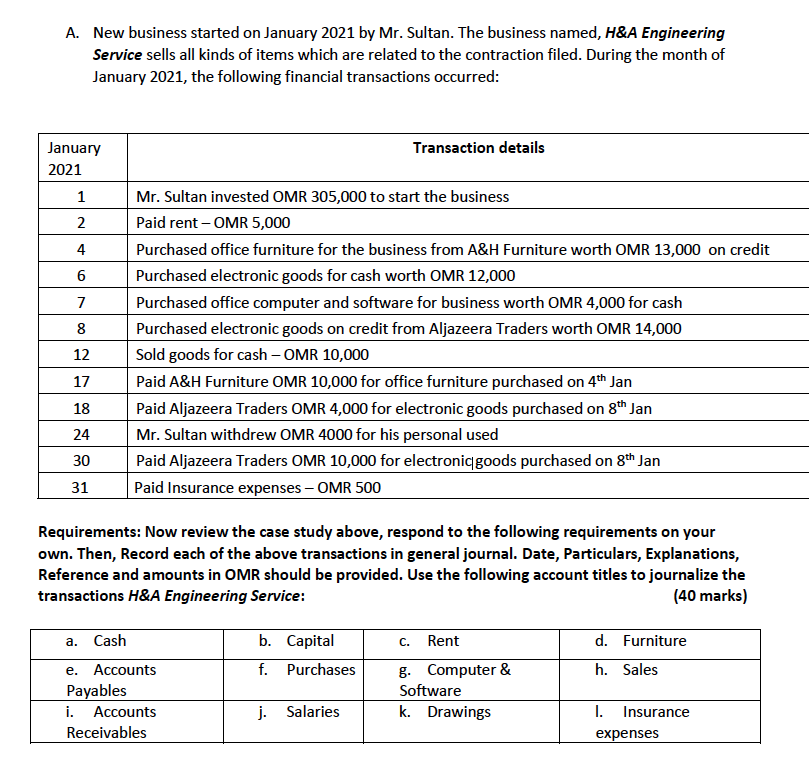

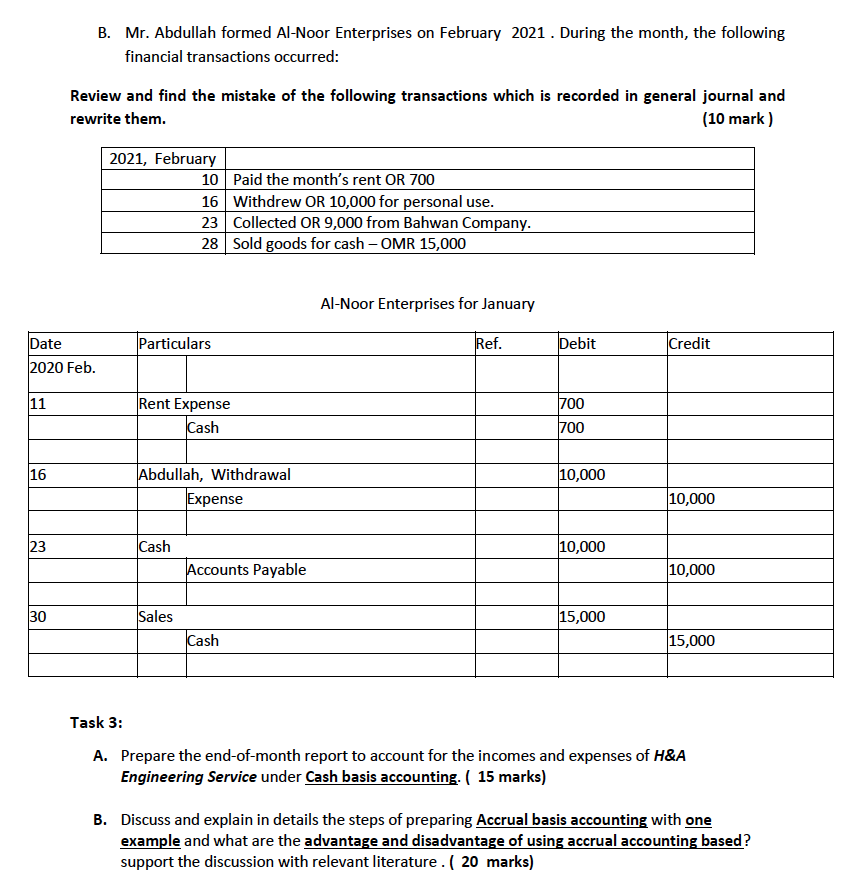

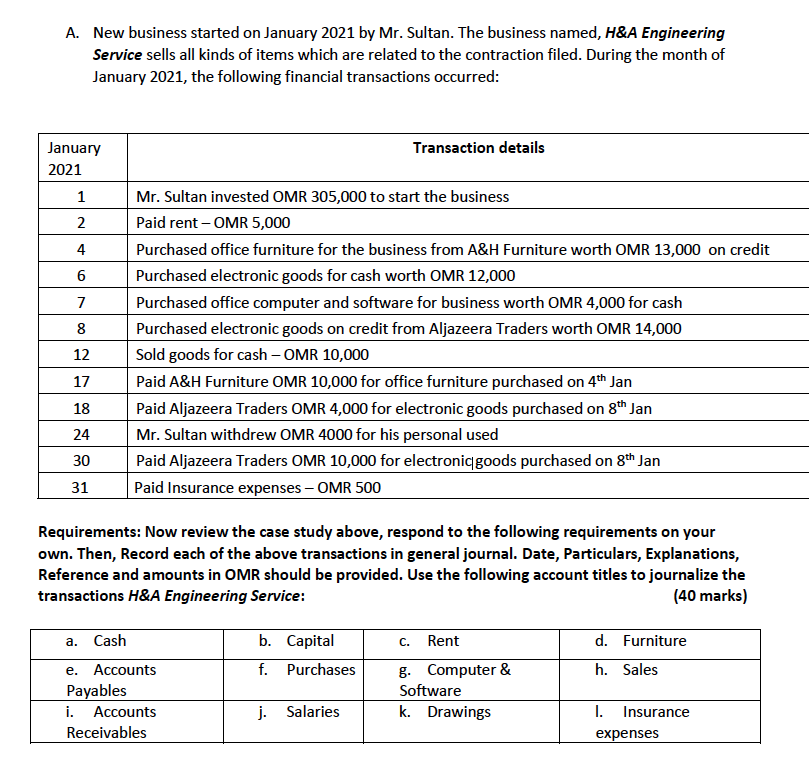

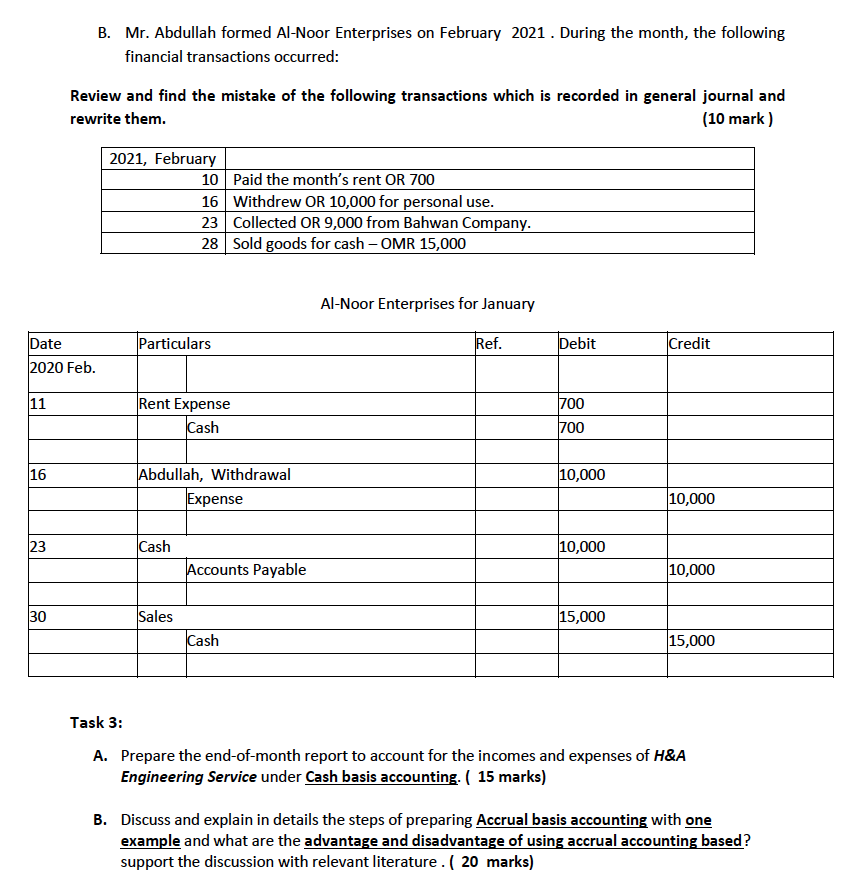

A. New business started on January 2021 by Mr. Sultan. The business named, H&A Engineering Service sells all kinds of items which are related to the contraction filed. During the month of January 2021, the following financial transactions occurred: Transaction details January 2021 1 2 4 6 7 8 Mr. Sultan invested OMR 305,000 to start the business Paid rent - OMR 5,000 Purchased office furniture for the business from A&H Furniture worth OMR 13,000 on credit Purchased electronic goods for cash worth OMR 12,000 Purchased office computer and software for business worth OMR 4,000 for cash Purchased electronic goods on credit from Aljazeera Traders worth OMR 14,000 Sold goods for cash - OMR 10,000 Paid A&H Furniture OMR 10,000 for office furniture purchased on 4th Jan Paid Aljazeera Traders OMR 4,000 for electronic goods purchased on 8th Jan Mr. Sultan withdrew OMR 4000 for his personal used Paid Aljazeera Traders OMR 10,000 for electronic goods purchased on 8th Jan Paid Insurance expenses - OMR 500 12 17 18 24 30 31 Requirements: Now review the case study above, respond to the following requirements on your own. Then, Record each of the above transactions in general journal. Date, Particulars, Explanations, Reference and amounts in OMR should be provided. Use the following account titles to journalize the transactions H&A Engineering Service: (40 marks) a. Cash C. b. Capital f. Purchases d. Furniture h. Sales e. Accounts Payables i. Accounts Receivables Rent g. Computer & Software k. Drawings j. Salaries 1. Insurance expenses B. Mr. Abdullah formed Al-Noor Enterprises on February 2021. During the month, the following financial transactions occurred: Review and find the mistake of the following transactions which is recorded in general journal and rewrite them. (10 mark) 2021, February 10 Paid the month's rent OR 700 16 Withdrew OR 10,000 for personal use. 23 Collected OR 9,000 from Bahwan Company. 28 Sold goods for cash - OMR 15,000 Al-Noor Enterprises for January Particulars Ref. Debit Credit Date 2020 Feb. 11 700 Rent Expense Cash 700 16 10,000 Abdullah, Withdrawal Expense 10,000 23 Cash 10,000 Accounts Payable 10,000 30 Sales 15,000 Cash 15,000 Task 3: A. Prepare the end-of-month report to account for the incomes and expenses of H&A Engineering Service under Cash basis accounting ( 15 marks) B. Discuss and explain in details the steps of preparing Accrual basis accounting with one example and what are the advantage and disadvantage of using accrual accounting based? support the discussion with relevant literature. ( 20 marks)