Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new cash management system is expected to add 2 days to the firm's disbursement schedule. If average daily remittances are $7 million and

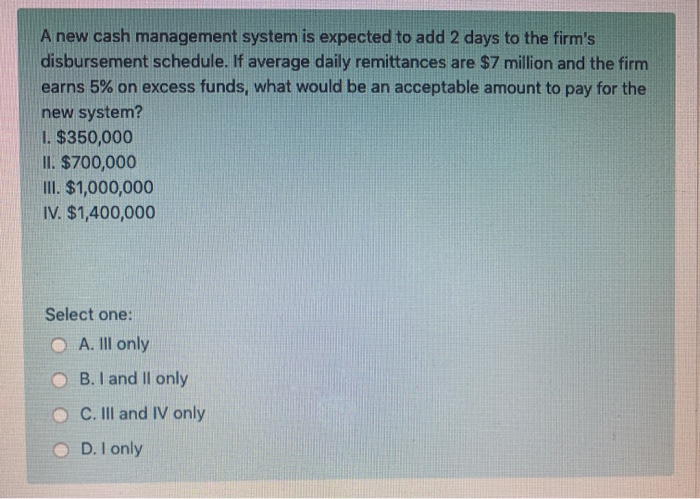

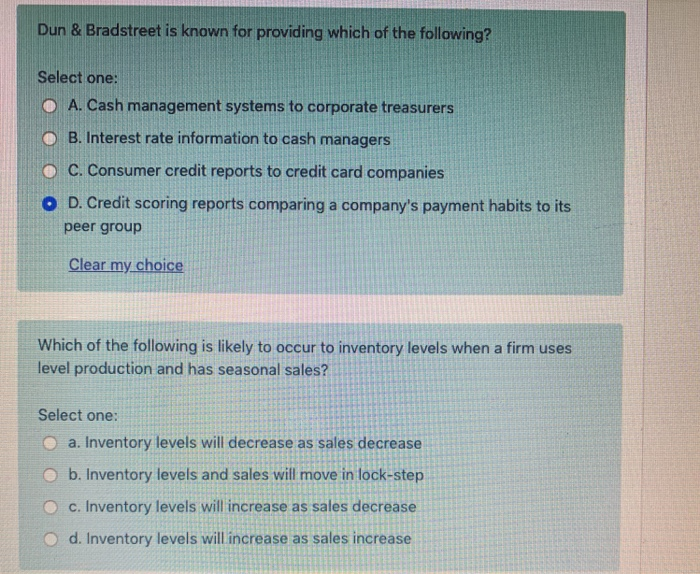

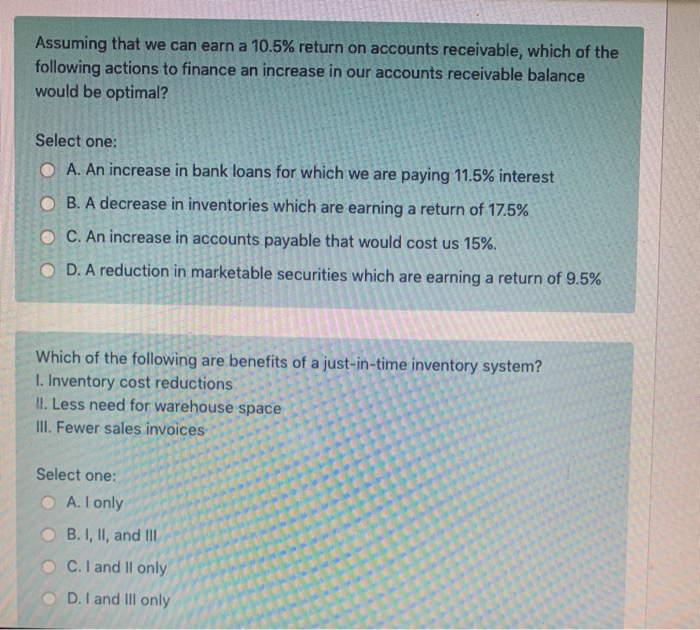

A new cash management system is expected to add 2 days to the firm's disbursement schedule. If average daily remittances are $7 million and the firm earns 5% on excess funds, what would be an acceptable amount to pay for the new system? 1. $350,000 II. $700,000 III. $1,000,000 IV. $1,400,000 Select one: OA. Ill only OB. I and II only C. III and IV only OD. I only Dun & Bradstreet is known for providing which of the following? Select one: OA. Cash management systems to corporate treasurers OB. Interest rate information to cash managers OC. Consumer credit reports to credit card companies OD. Credit scoring reports comparing a company's payment habits to its peer group Clear my choice Which of the following is likely to occur to inventory levels when a firm uses level production and has seasonal sales? Select one: a. Inventory levels will decrease as sales decrease Ob. Inventory levels and sales will move in lock-step O c. Inventory levels will increase as sales decrease d. Inventory levels will increase as sales increase Assuming that we can earn a 10.5% return on accounts receivable, which of the following actions to finance an increase in our accounts receivable balance would be optimal? Select one: O A. An increase in bank loans for which we are paying 11.5% interest OB. A decrease in inventories which are earning a return of 17.5% OC. An increase in accounts payable that would cost us 15%. D. A reduction in marketable securities which are earning a return of 9.5% Which of the following are benefits of a just-in-time inventory system? I. Inventory cost reductions II. Less need for warehouse space III. Fewer sales invoices Select one: OA. I only OB. I, II, and III OC. I and II only OD. I and III only

Step by Step Solution

★★★★★

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Question 1 To determine the cost for th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started