Question

A new client of the bank, Ashleighs Agriculture (AA), are worried about the price of soybeans increasing. AA plan to purchase 1,000,000 bushels of soybeans

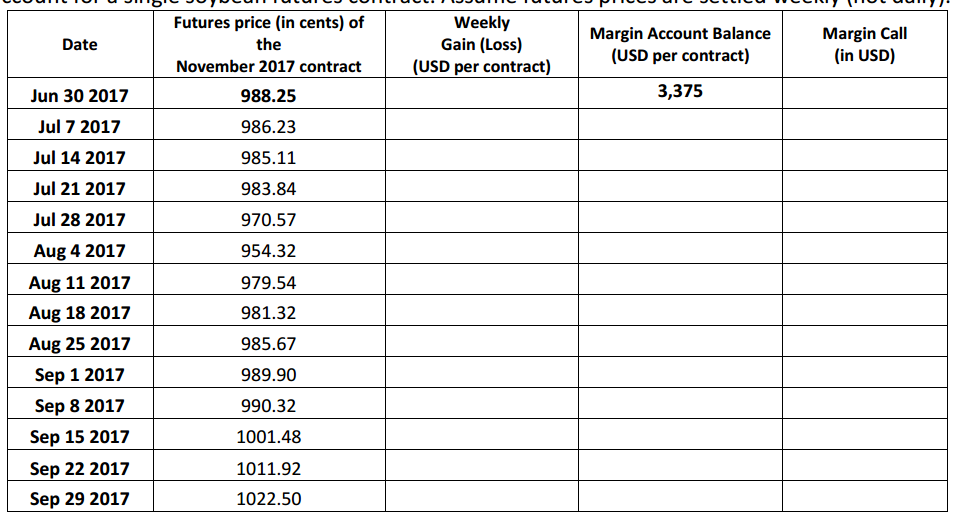

A new client of the bank, Ashleighs Agriculture (AA), are worried about the price of soybeans increasing. AA plan to purchase 1,000,000 bushels of soybeans on September 29 2017. Currently on June 30 2017, soybeans are 10.31 USD per bushel and November soybean futures contracts trade at 9882 cents. In addition, you obtain the following information from the CME: Soybeans Futures Contract Specifications

Trading Unit: 5,000 bushels

ricing Unit: US cents per bushel

Initial Margin: $3,375

Maintenance Margin: $2,500

Contract Months: January, March, May, July, August, September and November

Settlement Procedure: Physical delivery

Price quote: 9702 = 970 + 2/8 US cents

a) AA are still unsure following your explanation of margin requirements. Complete the following table (between the dates indicated) to show AA the cash flows associated with their margin account for a single soybean futures contract. Assume futures prices are settled weekly (not daily).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started