Question

A new financial manager at the Hansborough Company has proposed a change to the companys credit policy to lower the average collection period (ACP) of

A new financial manager at the Hansborough Company has proposed a change to the companys credit policy to lower the average collection period (ACP) of the customers who forgo the discount by ten days. The cost of the increased credit effort is $10 million, and the manager estimates that the company will lose 6% in gross sales as a result. The discount customers will not be affected.

The proposed data, including the daily data, is reflected in the following table:

| Existing Policy | Proposed Policy | |

|---|---|---|

| I. General Credit Policy Information | ||

| Credit terms | 2/10 net 30 | 2/10 net 30 |

| Average collection period (ACP) for all customers | 46.0 days | 37.0 days |

| ACP for customers who take the discount (10%) | 10.0 days | 10.0 days |

| ACP for customers who forgo the discount (90%) | 50.0 days | 40.0 days |

| II. Annual Credit Sales and Costs | ||

| Credit sales | $170,000 | $159,800 |

| Amount paid by discount customers (net discount) | $16,660 | $16,660 |

| Amount paid by nondiscount customers | $153,000.00 | $142,800 |

| Net credit sales | $169,660 | $159,460 |

| Variable operating costs (82% of net sales) | $139,121.20 | $130,757 |

| Bad debts | $0.0 | $0.0 |

| Credit evaluation and collection costs | $17,000 | $17,010 |

| III. Daily Credit Sales and Costs | ||

| Net credit sales | $465 | $437 |

| Amount paid by discount customers (net discount) | $46 | $46 |

| Amount paid by nondiscount customers | $419 | $391 |

| Variable operating costs (82% of net sales) | $381 | $358 |

| Bad debts | $0.0 | $0.0 |

| Credit evaluation and collection costs | $47 | $47 |

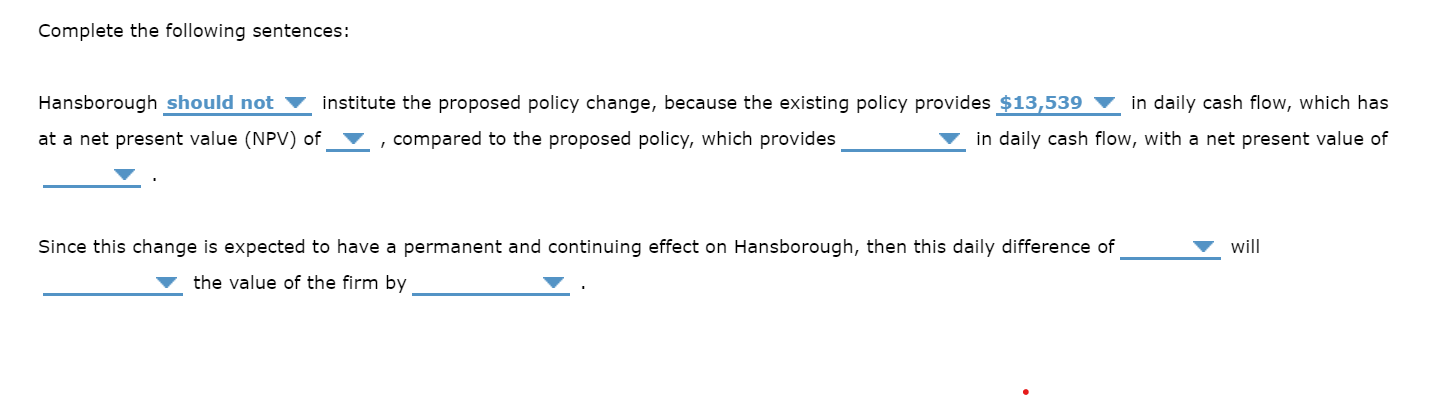

Your job is to review the proposal and make a recommendation. To simplify your analysis, assume: (1) that sales occur evenly throughout the year; (2) that the variable operating costs and the credit evaluation and collection costs are incurred at the time of sale; and (3) that a 365-day year is used to compute the daily figures. Hansboroughs cost of capital is 7.5%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started