Question

A new highway is to be constructed. Design A calls for a concrete pavement costing $85 per foot with a 16-year life; three paved ditches

A new highway is to be constructed. Design A calls for a concrete pavement costing $85 per foot with a 16-year life; three paved ditches costing $5 per foot each; and four box culverts every mile, each costing $8,000 and having a 16-year life. Annual maintenance will cost $1,800 per mile; the culverts must be cleaned every four years at a cost of $300 each per mile. Design B calls for a bituminous pavement costing $45 per foot with a 8-year life; two sodded ditches costing $1.35 per foot each; and four pipe culverts every mile, each costing $2,150 and having a 8-year life. The replacement culverts will cost $2,350 each. Annual maintenance will cost $2,900 per mile; the culverts must be cleaned yearly at a cost of $215 each per mile; and the annual ditch maintenance will cost $1.60 per foot per ditch. Compare the two designs on the basis of equivalent worth per mile for a16-year period. Find the most economical design on the basis of AW and PW if the MARR is 6% per year.

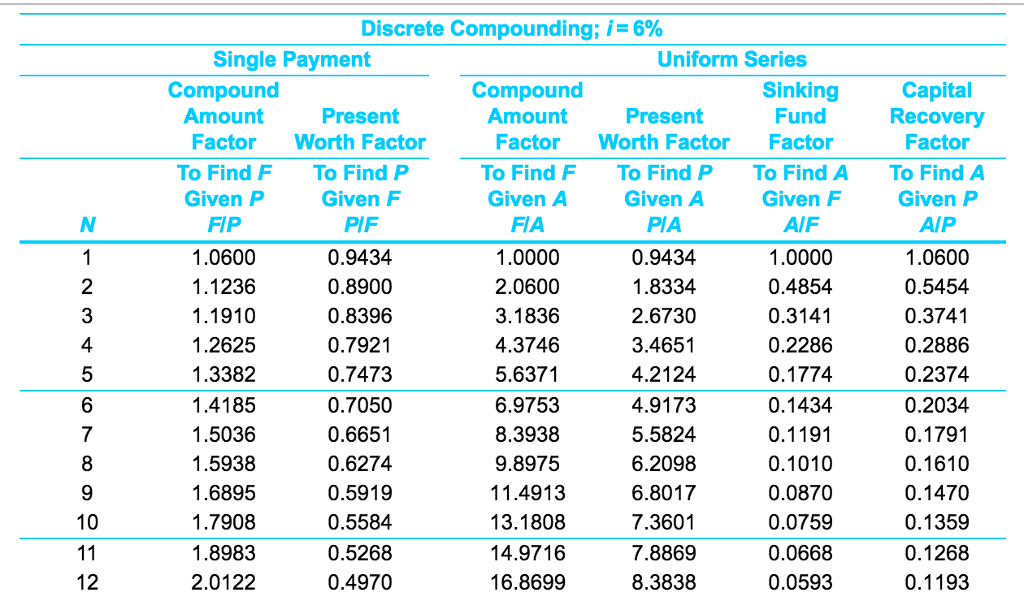

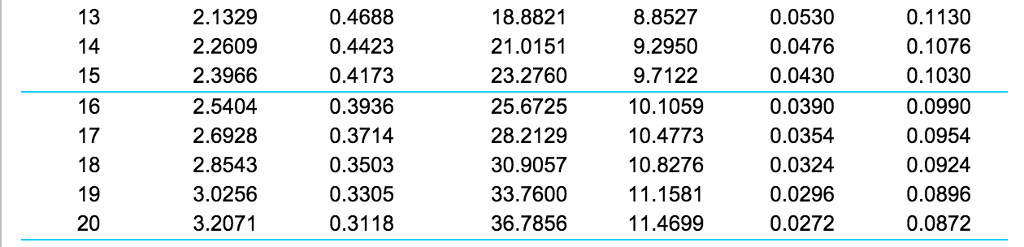

the interest and annuity table for discrete compounding when the MARR is 6% per year.

The AW value for Design A is $......./mi. (Round to the nearest hundreds.)

10 11 12 Discrete Compounding; i 6% Single Payment Uniform Series Compound Compound Sinking Capita Present Amount Amount Present Fund Recovery Factor Worth Factor Factor Worth Factor Factor Factor To Find F To Find P To Find F To Find P To Find A To Find A Given A Given A Given P Given F Given F Given P FIP PIF FIA PIA AIF AIP 1.0600 0.9434 1.0000 0.9434 1.0000 1.0600 0.8900 1.1236 2.0600 1.8334 0.4854 0.5454 0.8396 1.1910 3.1836 2.6730 0.3141 0.3741 1.2625 4.3746 0.2286 0.2886 0.7921 3.4651 0.2374 1.3382 0.7473 5.6371 4.2124 0.1774 0.7050 0.2034 1.4185 6.9753 4.9173 0.1434 8.3938 5.5824 1.5036 0.6651 0.1191 0.1791 1.5938 9.8975 0.6274 6.2098 0.1010 0.1610 1.6895 0.5919 0.0870 0.1470 6.8017 11.4913 0.5584 1.7908 13.1808 7.3601 0.0759 0.1359 0.5268 0.1268 14.9716 1.8983 7.8869 0.0668 0.0593 0.4970 16.8699 2.0122 8.3838 0.1193Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started