Question: Please show below with Excel calculations: Q4: Currency Swap Value On September 15th, 2013, ABC bank entered into a 2-year currency swap contract with GV

Please show below with Excel calculations:

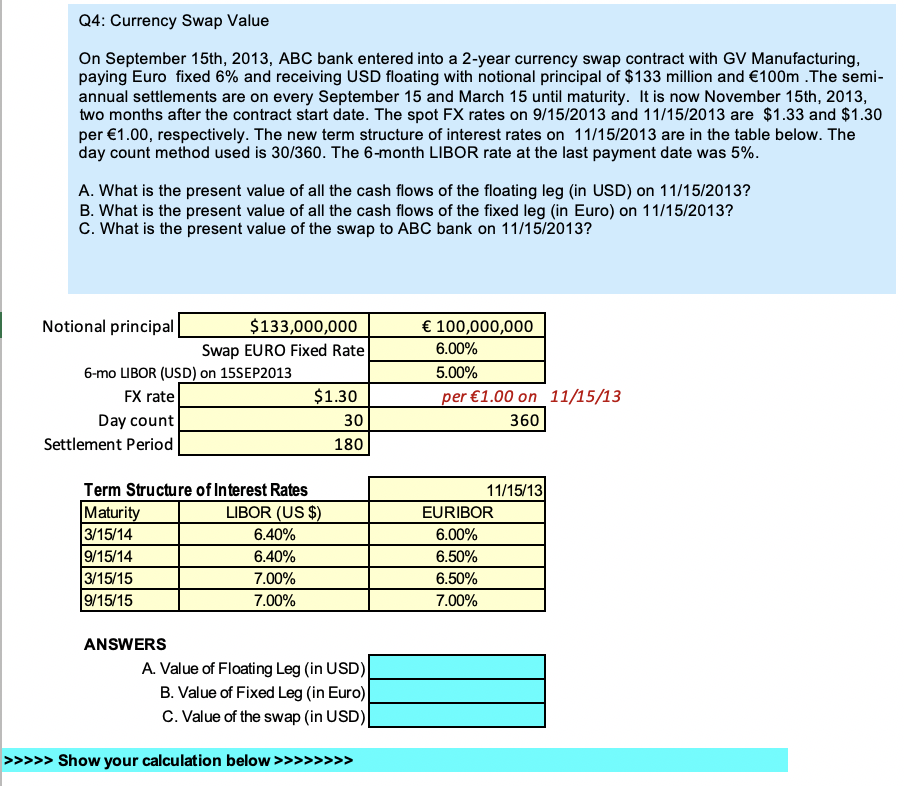

Q4: Currency Swap Value On September 15th, 2013, ABC bank entered into a 2-year currency swap contract with GV Manufacturing, paying Euro fixed 6% and receiving USD floating with notional principal of $133 million and 100m .The semi- annual settlements are on every September 15 and March 15 until maturity. It is now November 15th, 2013, two months after the contract start date. The spot FX rates on 9/15/2013 and 11/15/2013 are $1.33 and $1.30 per 1.00, respectively. The new term structure of interest rates on 11/15/2013 are in the table below. The day count method used is 30/360. The 6-month LIBOR rate at the last payment date was 5%. A. What is the present value of all the cash flows of the floating leg (in USD) on 11/15/2013? B. What is the present value of all the cash flows of the fixed leg (in Euro) on 11/15/2013? C. What is the present value of the swap to ABC bank on 11/15/2013? Notional principal $133,000,000 Swap EURO Fixed Rate 6-mo LIBOR (USD) on 15SEP2013 FX rate $1.30 Day count 30 Settlement Period 180 100,000,000 6.00% 5.00% per 1.00 on 11/15/13 360 Term Structure of Interest Rates Maturity LIBOR (US$) 3/15/14 6.40% 9/15/14 6.40% 3/15/15 7.00% 9/15/15 7.00% 11/15/13 EURIBOR 6.00% 6.50% 6.50% 7.00% ANSWERS A. Value of Floating Leg (in USD) B. Value of Fixed Leg (in Euro) C. Value of the swap (in USD) >>>>> Show your calculation below >>>>>>>>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts