Question

A new piece of equipment is expected to produce 330 widgets per year, which will sell for $1,000 each. Variable costs are 40% of sales

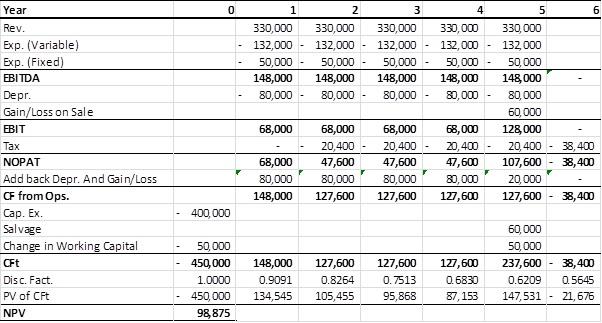

A new piece of equipment is expected to produce 330 widgets per year, which will sell for $1,000 each. Variable costs are 40% of sales and fixed costs are $50,000 per year. The investment has a capital expenditure of $400,000 and will require additional working capital of $50,000 which will be recovered in the last year of operations. The new investment will be depreciated prime cost over its 5 year life and is expected to have a salvage value of $60,000 at the end of its life. Company tax is 30% and is paid the year after income. The required rate of return on such an investment is 10%.

a.Should the company purchase the new piece of equipment?

b. What is the approximate breakeven price on the widgets?

Year Rev. Exp. (Variable) Exp. (Fixed) EBITDA Depr. Gain/Loss on Sale EBIT Tax NOPAT Add back Depr. And Gain/Loss CF from Ops. Cap. Ex. Salvage Change in Working Capital CFt Disc. Fact. PV of CFt NPV 0 400,000 1 330,000 330,000 330,000 132,000 132,000 132,000 80,000 - 2 50,000 - 50,000 - 148,000 68,000 68,000 80,000 148,000 50,000 148,000 148,000 80,000- 80,000 3 80,000 127,600 50,000 450,000 148,000 127,600 1.0000 0.9091 0.8264 450,000 134,545 105,455 98,875 4 50,000 50,000 148,000 148,000 80,000 80,000 60,000 68,000 68,000 68,000 128,000 20,400 20,400 20,400 20,400 38,400 47,600 47,600 47,600 107,600 38,400 80,000 80,000 20,000 127,600 127,600 127,600 5 330,000 330,000 132,000 132,000 127,600 127,600 0.7513 0.6830 95,868 87,153 - 38,400 60,000 50,000 237,600 38,400 0.6209 0.5645 147,531 21,676

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started