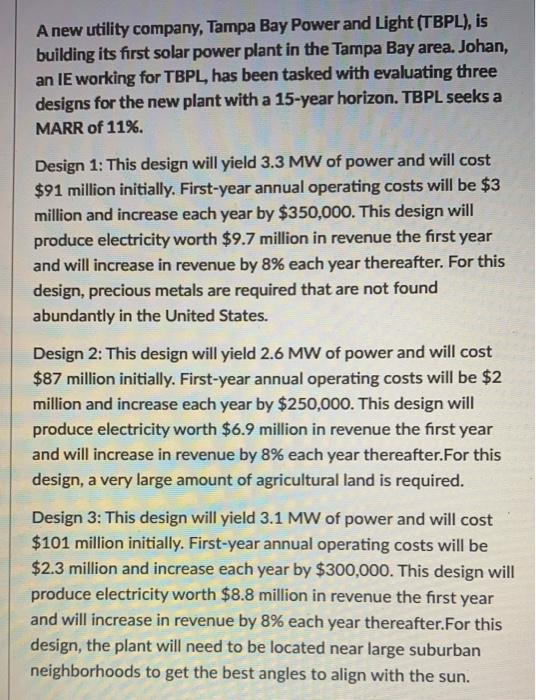

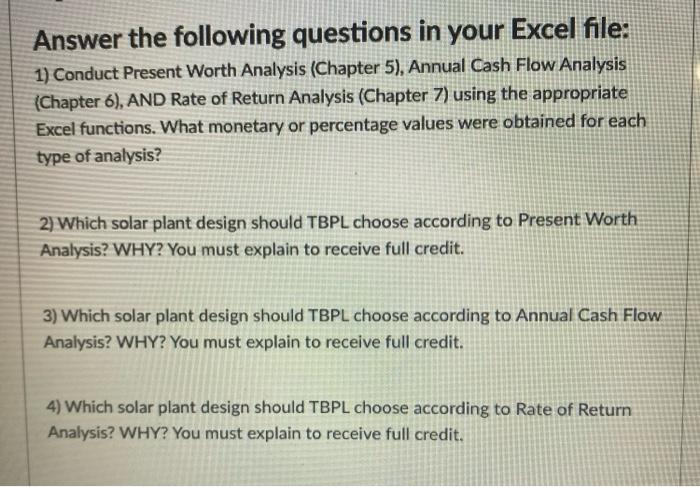

A new utility company, Tampa Bay Power and Light (TBPL), is building its first solar power plant in the Tampa Bay area. Johan, an IE working for TBPL, has been tasked with evaluating three designs for the new plant with a 15-year horizon. TBPL seeks a MARR of 11%. Design 1: This design will yield 3.3 MW of power and will cost $91 million initially. First-year annual operating costs will be $3 million and increase each year by $350,000. This design will produce electricity worth $9.7 million in revenue the first year and will increase in revenue by 8% each year thereafter. For this design, precious metals are required that are not found abundantly in the United States. Design 2: This design will yield 2.6 MW of power and will cost $87 million initially. First-year annual operating costs will be $2 million and increase each year by $250,000. This design will produce electricity worth $6.9 million in revenue the first year and will increase in revenue by 8% each year thereafter. For this design, a very large amount of agricultural land is required. Design 3: This design will yield 3.1 MW of power and will cost $101 million initially. First-year annual operating costs will be $2.3 million and increase each year by $300,000. This design will produce electricity worth $8.8 million in revenue the first year and will increase in revenue by 8% each year thereafter.For this design, the plant will need to be located near large suburban neighborhoods to get the best angles to align with the sun. Answer the following questions in your Excel file: 1) Conduct Present Worth Analysis (Chapter 5), Annual Cash Flow Analysis (Chapter 6), AND Rate of Return Analysis (Chapter 7) using the appropriate Excel functions. What monetary or percentage values were obtained for each type of analysis 2) Which solar plant design should TBPL choose according to Present Worth Analysis? WHY? You must explain to receive full credit. 3) Which solar plant design should TBPL choose according to Annual Cash Flow Analysis? WHY? You must explain to receive full credit. 4) Which solar plant design should TBPL choose according to Rate of Return Analysis? WHY? You must explain to receive full credit