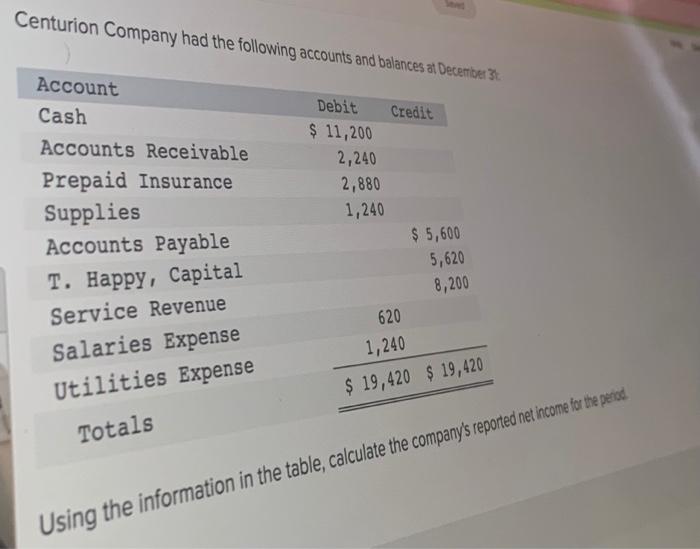

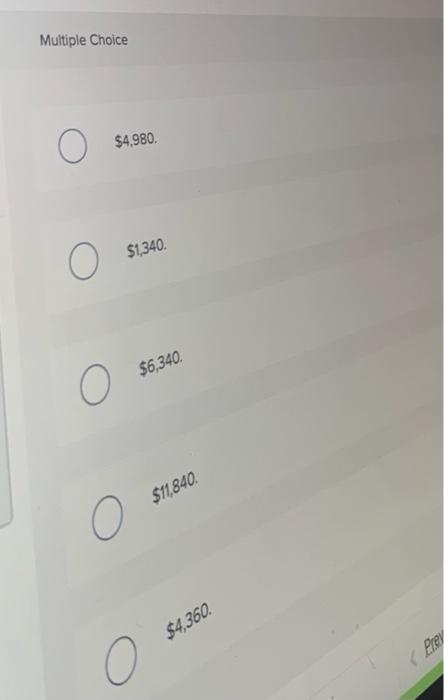

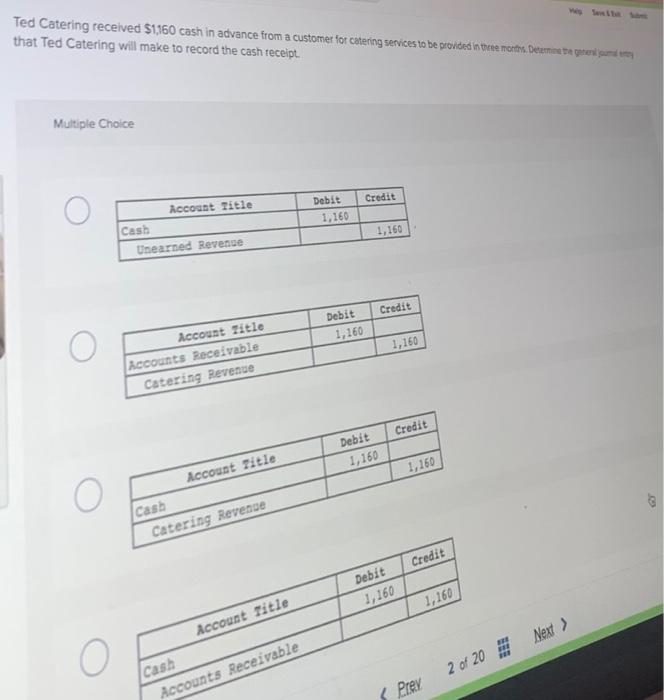

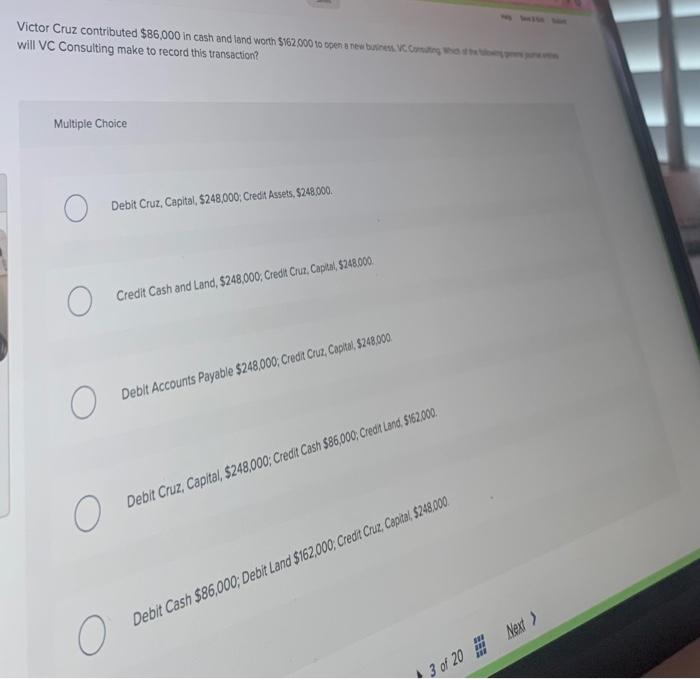

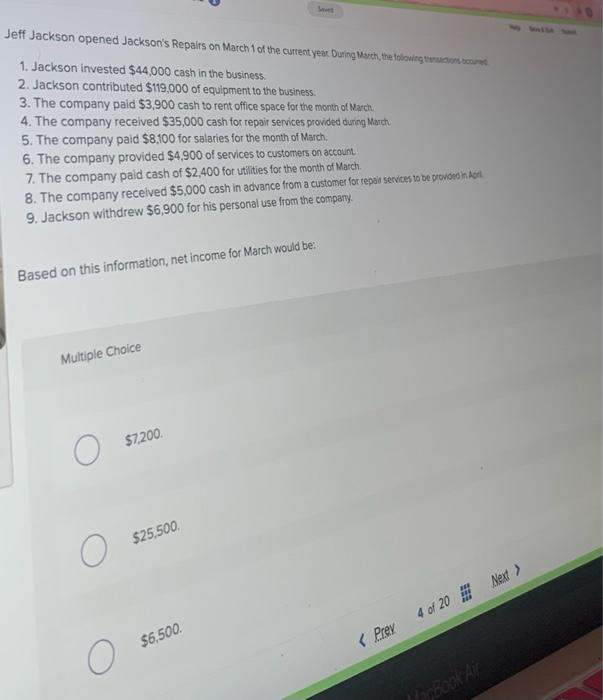

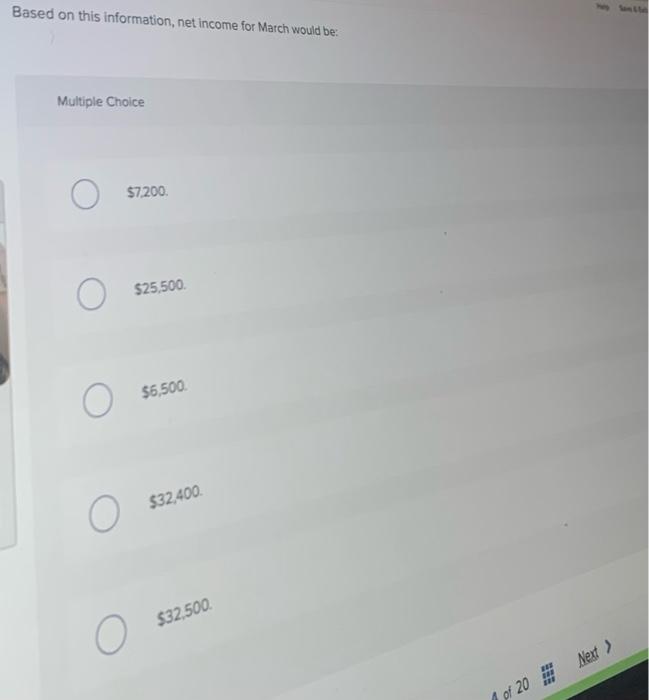

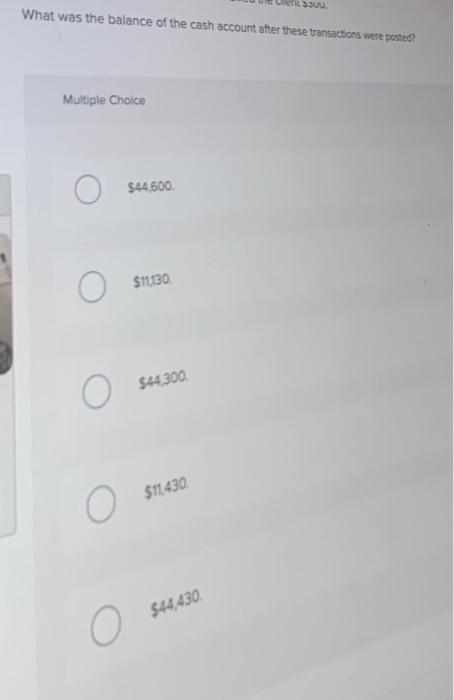

Centurion Company had the following accounts and balances at December 31 Account Cash Accounts Receivable Prepaid Insurance Debit Credit $ 11,200 2,240 2,880 1,240 Supplies Accounts Payable T. Happy, Capital Service Revenue Salaries Expense $ 5,600 5,620 8,200 620 1,240 Utilities Expense $ 19,420 $ 19,420 Totals Using the information in the table, calculate the company's reported net income for the period Multiple Choice O $4,980. O $1,340. $6,340. O $11.840. O $4,360 o Pley Ted Catering received $1,150 cash in advance from a customer for catering services to be provided in three montira. Determine Begeri Sardere that Ted Catering will make to record the cash receipt. Multiple Choice Debit Credit 1,160 Account Title Cash Unearned Revenge 1,160 Credit Debit 1,160 1,160 Account Title Accounts Receivable Catering Revenue Credit Debit 1,160 1,160 Account Title Cash Catering Revenue Credit Debit 1,160 1,160 Next > O Account Title Cash Accounts Receivable 2 of 20 Prey Victor Cruz contributed $86,000 in cash and land worth $162,000 to open a new business will VC Consulting make to record this transaction? Multiple Choice Debit Cruz, Capital, $248,000; Credit Assets, 5248.000. Credit Cash and Land, $248,000, Credit Cruz, Captai, 5248.000 Debit Accounts Payable $248,000, Credit Cruz, Capital, $248,000. Debit Cruz, Capital, $248,000 Credit Cash $86,000, Credit Land, S162,000. Debit Cash $86,000, Debit Land $162,000, Credit Cruz, Capital, $248.000 a O 3 of 20 Next > Jeff Jackson opened Jackson's Repairs on March 1 of the current yen. During March, the telowing con 1. Jackson invested $44,000 cash in the business. 2. Jackson contributed $119,000 of equipment to the business. 3. The company paid $3,900 cash to rent office space for the month of March. 4. The company received $35,000 cash for repair services provided during March 5. The company paid $8,100 for salaries for the month of March, 6. The company provided $4,900 of services to customers on account 7. The company paid cash of $2,400 for utilities for the month of March. 8. The company received $5,000 cash in advance from a customer for repair services to be provided in her 9. Jackson withdrew $6,900 for his personal use from the company, Based on this information, net income for March would be: Multiple Choice $7,200 $25,500 O Next > 4 of 20 $6,500 of 20 What was the balance of the cash account after these transactions were pested? Multiple Choice $44.600 $11.30 $44 300 $11.430 $44,430 O