Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A new well is proposed to be drilled in an oil reservoir, as an engineer you are requested to perform an economical evaluation of

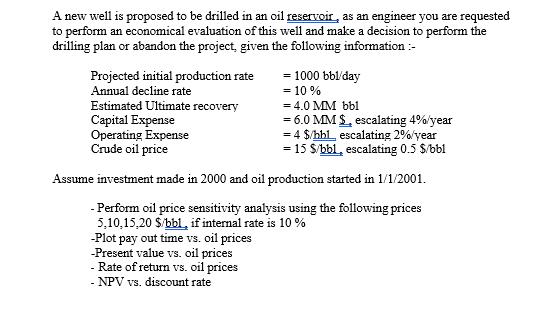

A new well is proposed to be drilled in an oil reservoir, as an engineer you are requested to perform an economical evaluation of this well and make a decision to perform the drilling plan or abandon the project, given the following information :- Projected initial production rate Annual decline rate = 1000 bbl/day = 10% = 4.0 MM bbl Estimated Ultimate recovery Capital Expense Operating Expense Crude oil price = 6.0 MM $, escalating 4%/year = 4 $/hhl, escalating 2%/year = 15 S/bbl, escalating 0.5 $/bbl Assume investment made in 2000 and oil production started in 1/1/2001. - Perform oil price sensitivity analysis using the following prices 5,10,15,20 $/bbl, if internal rate is 10% -Plot pay out time vs. oil prices -Present value vs. oil prices - Rate of return vs. oil prices NPV vs. discount rate

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To perform the economical evaluation we can use several financial metrics such as the Internal Rate of Return IRR PayOut Time POT Present Value PV and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started