Question

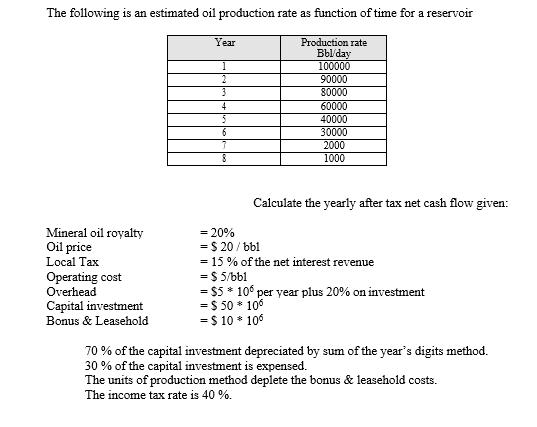

The following is an estimated oil production rate as function of time for a reservoir Production rate Bbl/day 100000 Mineral oil royalty Oil price

The following is an estimated oil production rate as function of time for a reservoir Production rate Bbl/day 100000 Mineral oil royalty Oil price Local Tax Operating cost Overhead Capital investment Bonus & Leasehold Year 3 4 5 8 90000 80000 60000 40000 30000 2000 1000 Calculate the yearly after tax net cash flow given: = 20% = $ 20/bbl = 15% of the net interest revenue = $ 5/bbl = $5 * 106 per year plus 20% on investment = $50 * 106 = $ 10 * 106 70% of the capital investment depreciated by sum of the year's digits method. 30% of the capital investment is expensed. The units of production method deplete the bonus & leasehold costs. The income tax rate is 40 %.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Mineral oid soyality oid price Local tax overhead operating cast 2 Capit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

University Physics with Modern Physics

Authors: Hugh D. Young, Roger A. Freedman, Lewis Ford

12th Edition

978-0321501479, 9780805321876, 321501470, 978-0321501219

Students also viewed these Physics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App