3. (a) Explain the similarities and differences between being the short party of a forward contract and being the holder of an American put

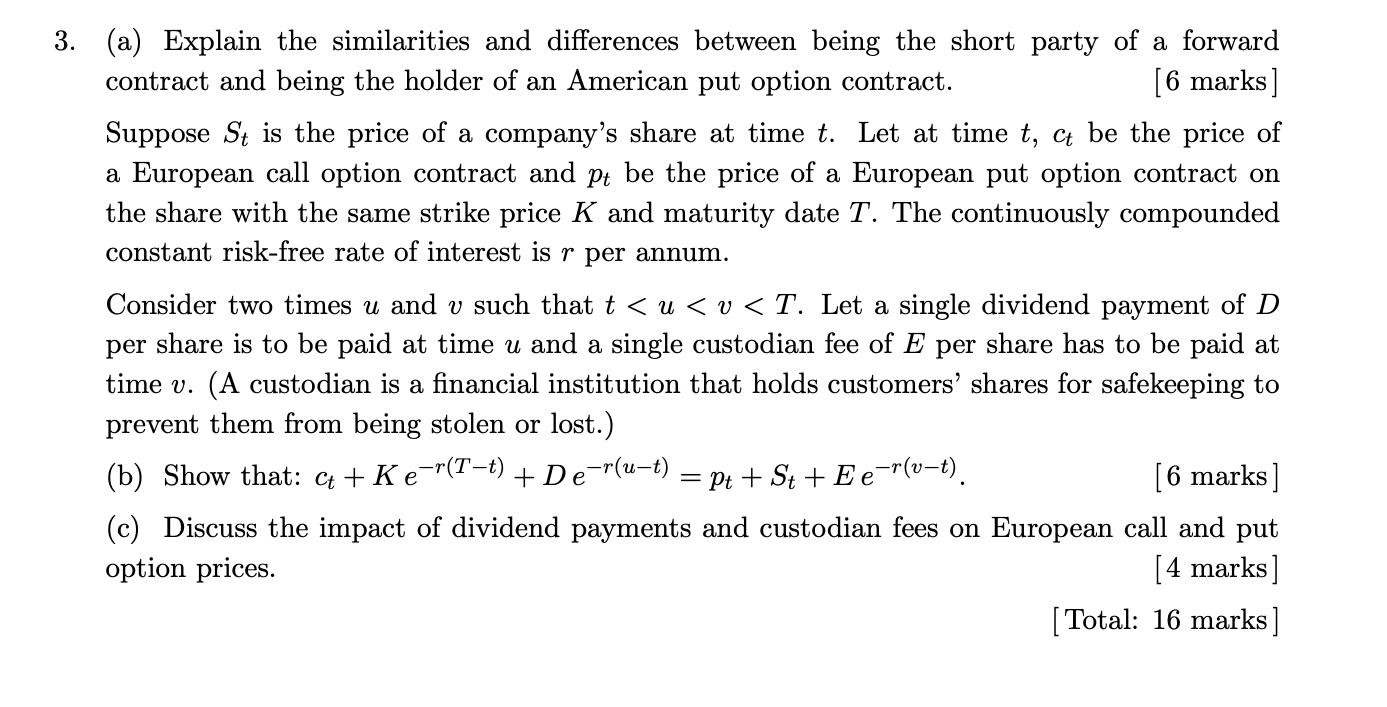

3. (a) Explain the similarities and differences between being the short party of a forward contract and being the holder of an American put option contract. [6 marks] Suppose St is the price of a company's share at time t. Let at time t, ct be the price of a European call option contract and pt be the price of a European put option contract on the share with the same strike price K and maturity date T. The continuously compounded constant risk-free rate of interest is r per annum. Consider two times u and v such that t < u

Step by Step Solution

3.54 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Ans The present value of the contract at t0 can be calculated by discounting each cash flow back to ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started