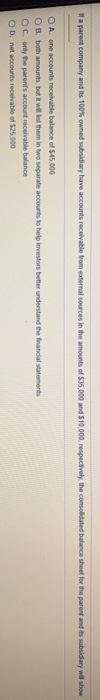

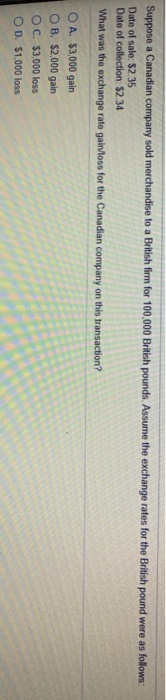

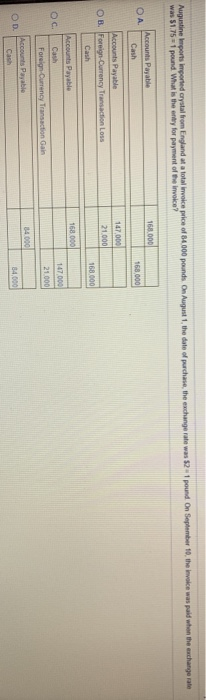

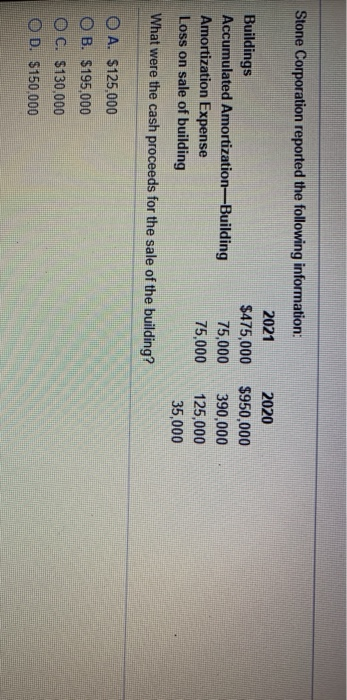

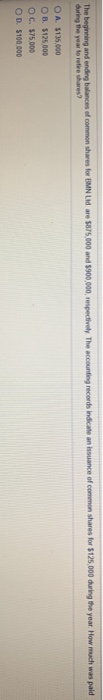

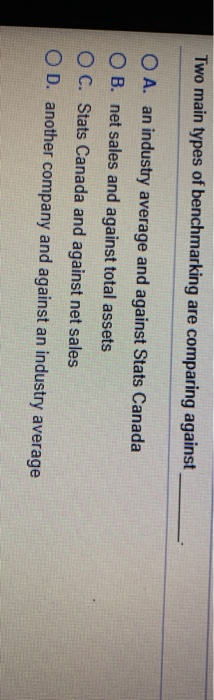

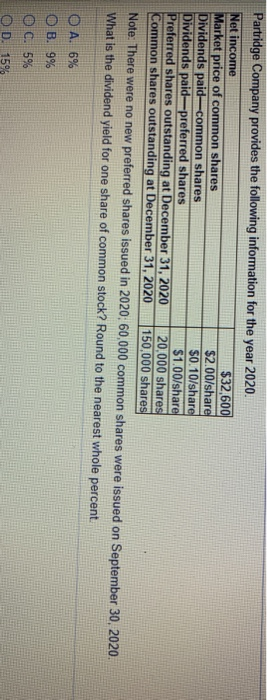

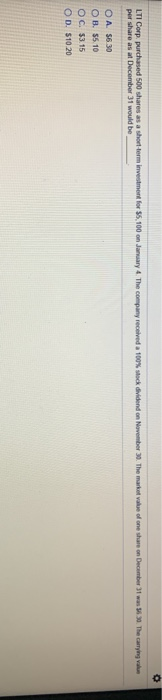

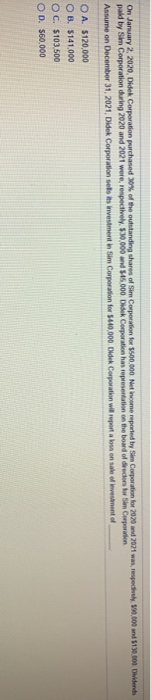

a parent company and its 100% owned subsidiary have accounts receivable from external sources in the amounts of 5.35,000 and $10.000, respectively the consolidated balance sheet for the parent and its subsidiary will show O A. one accounts receivable balance of $45.000 O B. both amounts, but I will let them in two separate accounts to help Investors better understand the financial statements OC. only the parent's account receivable balance OD not accounts receivable of $25.000 Suppose a Canadian company sold merchandise to a British firm for 100,000 British pounds. Assume the exchange rates for the British pound were as follows: Date of sale: $2.35 Date of collection: $2.34 What was the exchange rate gain/loss for the Canadian company on this transaction? O A. $3,000 gain OB. $2,000 gain O C. $3,000 loss OD. $1,000 loss Augustine Imports imported crystal from England at a total invoice price of 84.000 pounds on August 1, the date of purchase, the exchange rate was $21 pound on September 10, the invoice was paid when the exchange rate was 5175 pound. What is the entry for payment of the invoice? 168.000 . Accounts Payable Cash 168000 Accounts Payable OB. Foreign-Currency Transaction Loss Cash 147.000 21.000 168.000 Accounts Payable 168.000 OC 147,000 21000 Foreign Currency Transaction Gain 34000 OD Accounts Payable Cash 84,000 Stone Corporation reported the following information: 2021 2020 Buildings $475,000 $950,000 Accumulated Amortization-Building 75,000 390,000 Amortization Expense 75,000 125,000 Loss on sale of building 35,000 What were the cash proceeds for the sale of the building? O A. $125,000 OB. $195,000 O C. $130,000 O D. $150.000 The beginning and ending balances of common shares for BMN Mare 5875.000 and $900,000, respectively The accounting records indicate an issuance of common shares for $125,000 during the year. How much was paid during the year to retire shares? O A $135,000 OB. 5125.000 OC. $75.000 OD. $100.000 Two main types of benchmarking are comparing against O A. an industry average and against Stats Canada OB. net sales and against total assets O C. Stats Canada and against net sales OD. another company and against an industry average Partridge Company provides the following information for the year 2020. Net income $32,600 Market price of common shares $2.00/share Dividends paid-common shares $0.10/share Dividends paid-preferred shares $1.00/share Preferred shares outstanding at December 31, 2020 20,000 shares Common shares outstanding at December 31, 2020 150,000 shares Note: There were no new preferred shares issued in 2020: 60,000 common shares were issued on September 30, 2020. What is the dividend yield for one share of common stock? Round to the nearest whole percent. O A. 6% OB. 9% O c. 5% O D. 15% LTI Corp purchased 500 shares as a short-term investment for $5,100 on January 4. The company received a 100% stock dividend on November 30. The market value of one share on December 31 was 56.3 The carrying value per share as at December 31 would be O A $6.30 OB. 55 10 OC. $3.15 OD. $10.20 On January 2, 2020. Didek Corporation purchased 30% of the outstanding shares of Sim Corporation for 3.500.000 Net Income reported by Sim Corporation for 2020 and 2021 was respectively190.000 and 5130.000 Diens paid by Sim Corporation during 2020 and 2021 were respectively, 530,000 and 145.000 D Corporation has representation on the board of directors for Sim Corporion Assume on December 31, 2021, Didek Corporation sets its investment in Sim Corporation for 5440.000 Didek Corporation will report ab on sale of Investment of OA $120.000 OB. $141 000 OC. $103.500 OD. 560,000