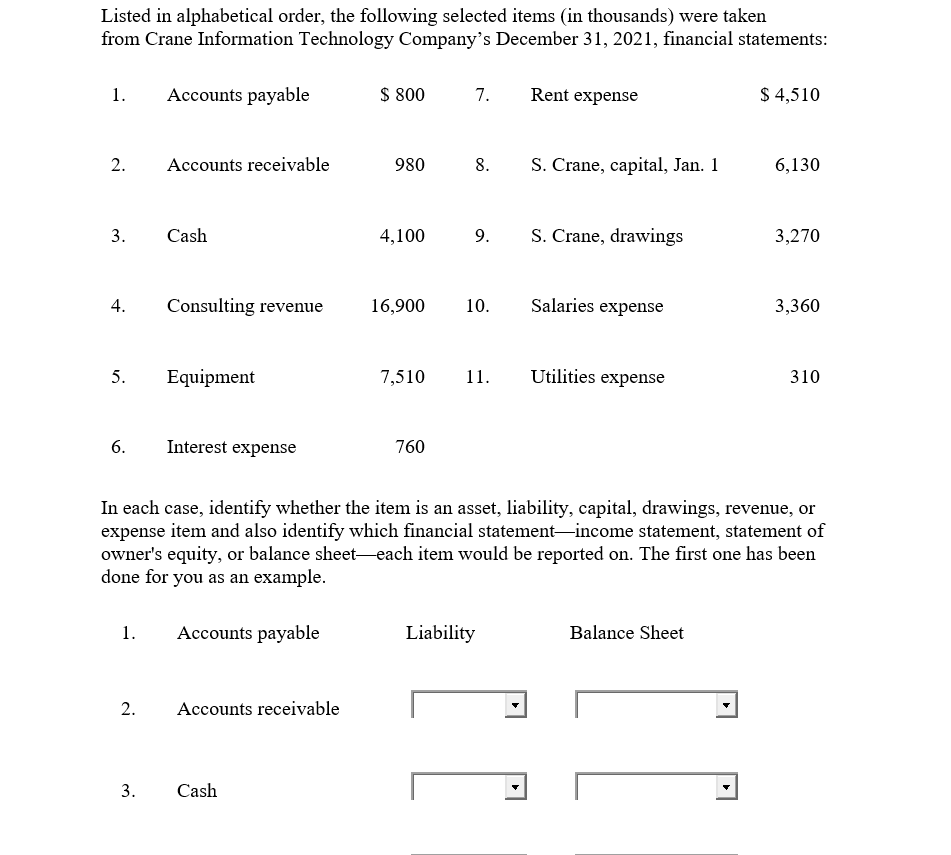

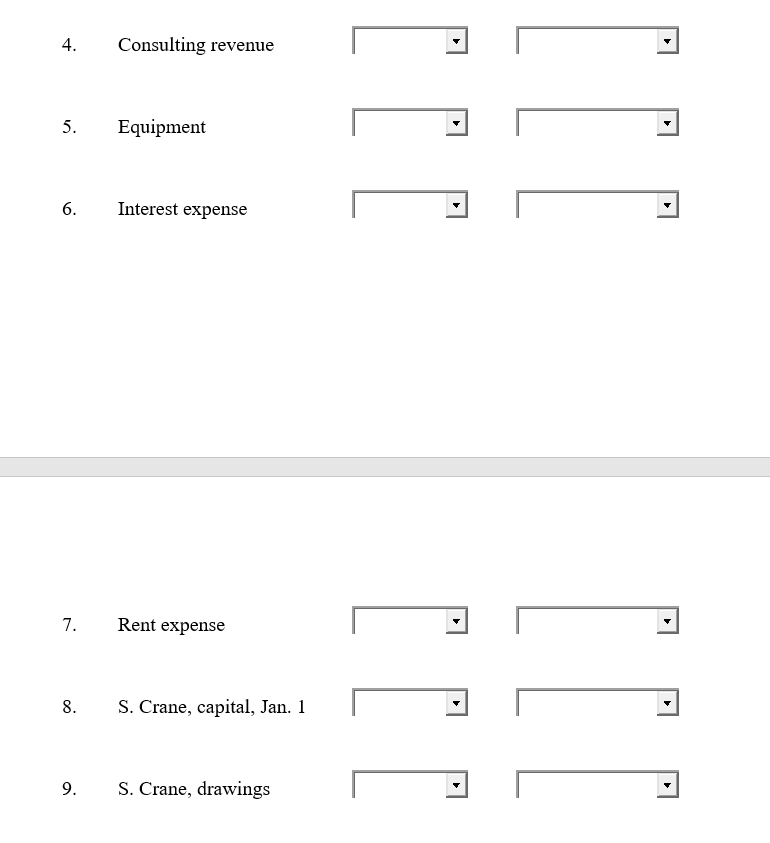

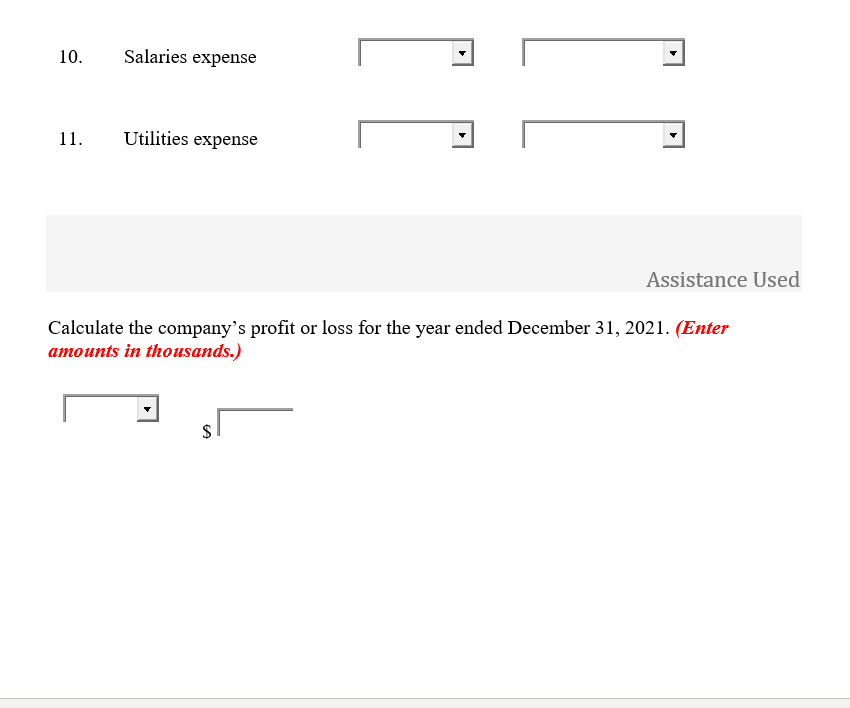

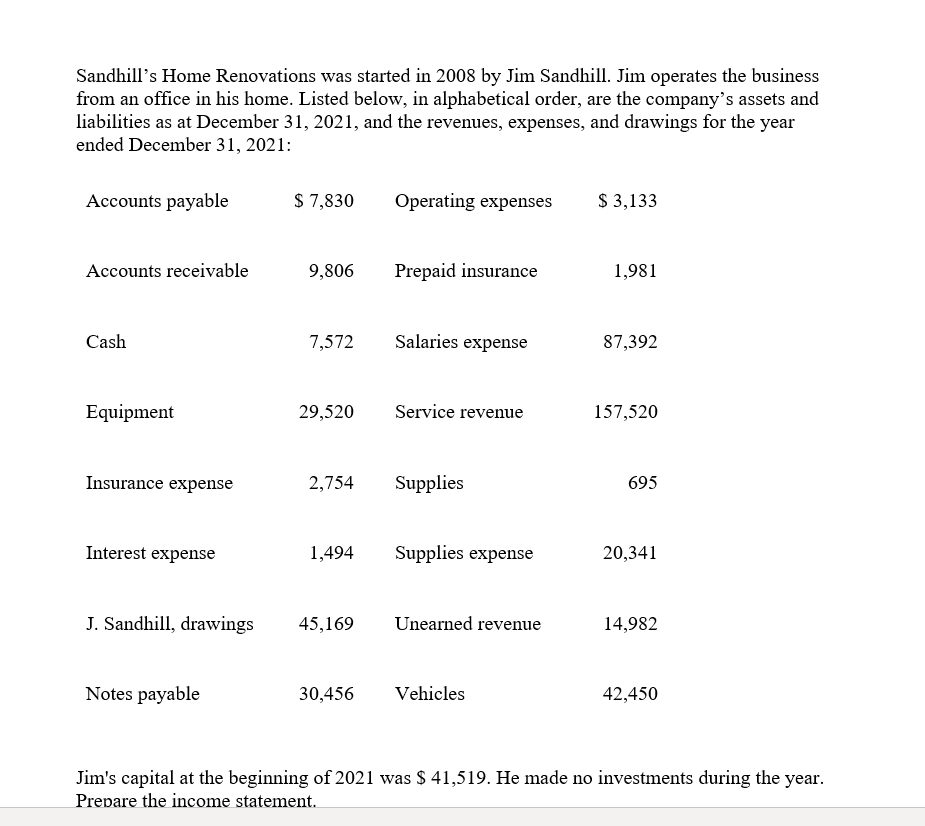

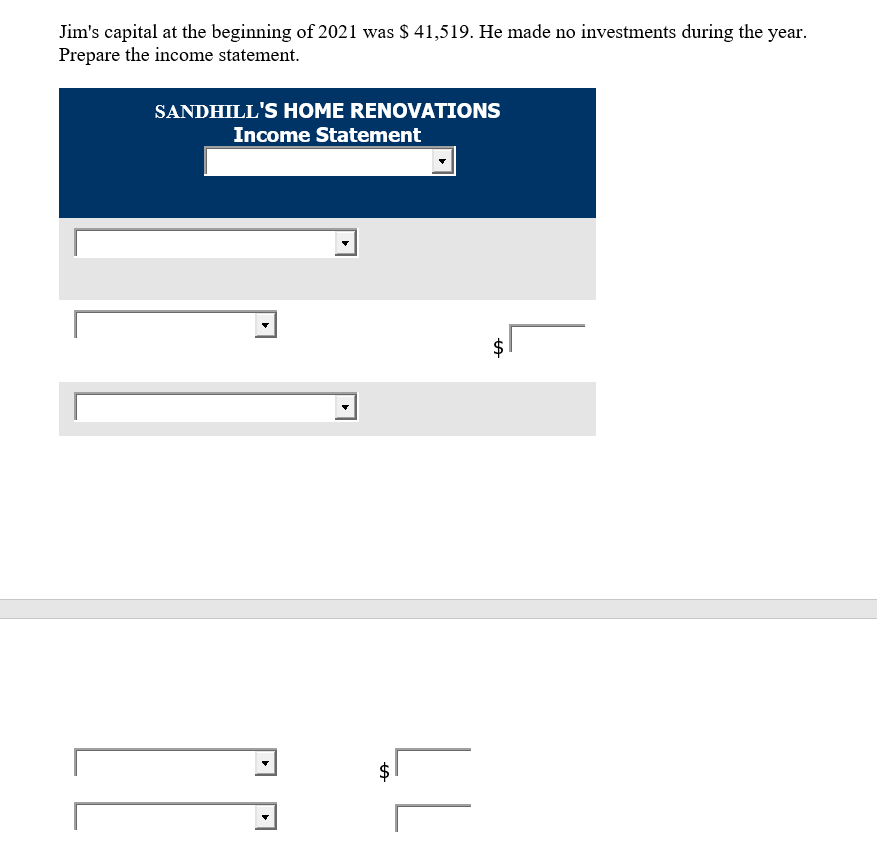

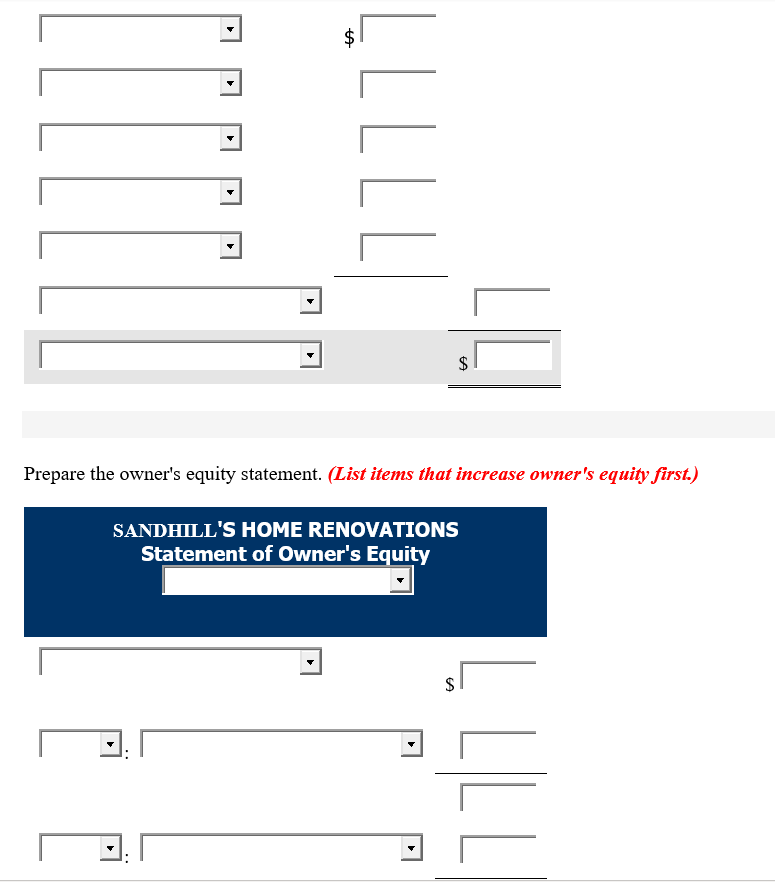

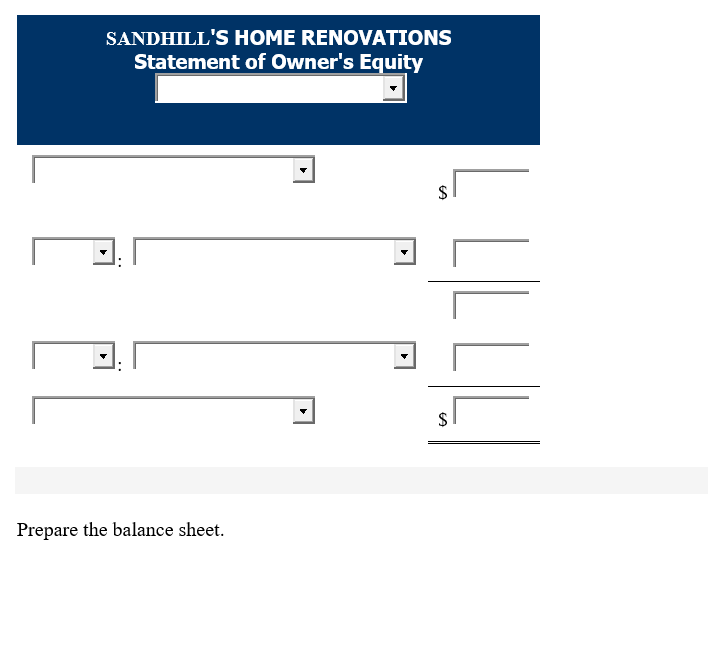

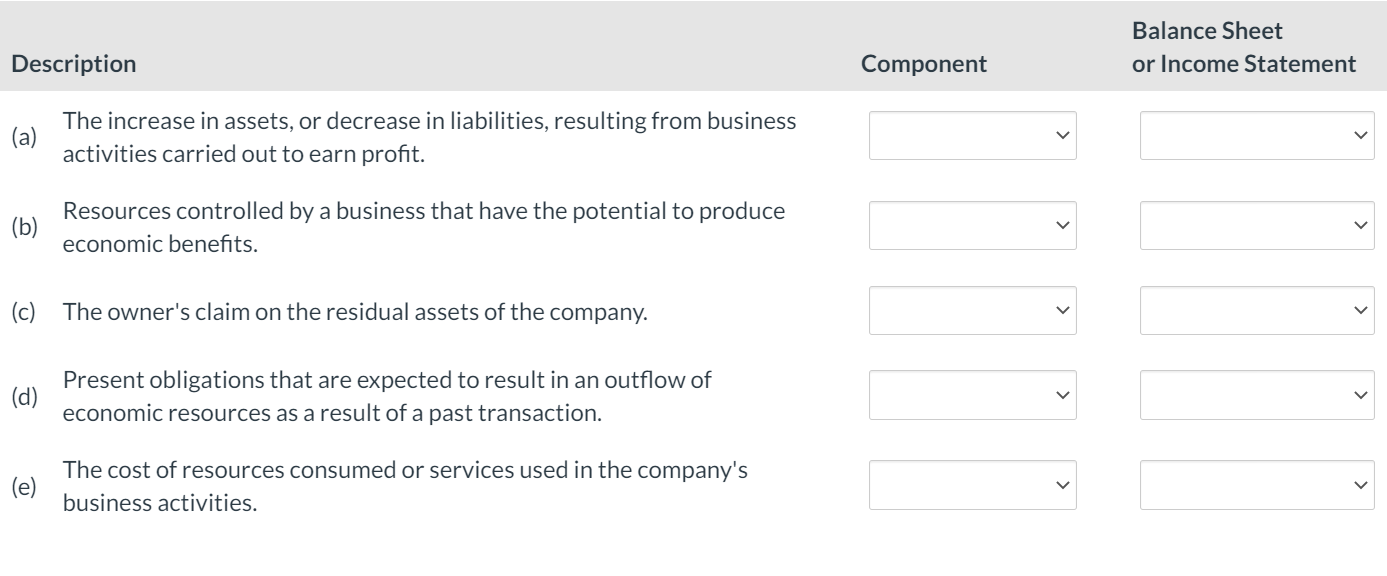

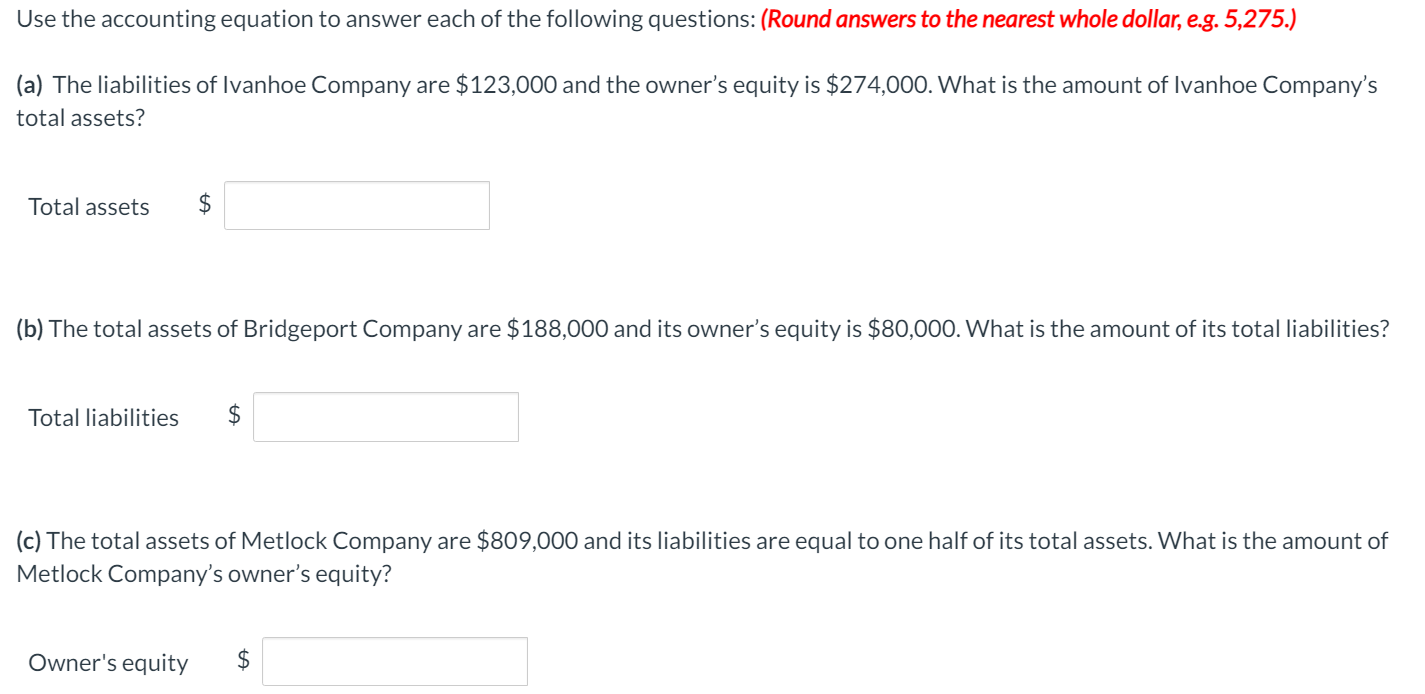

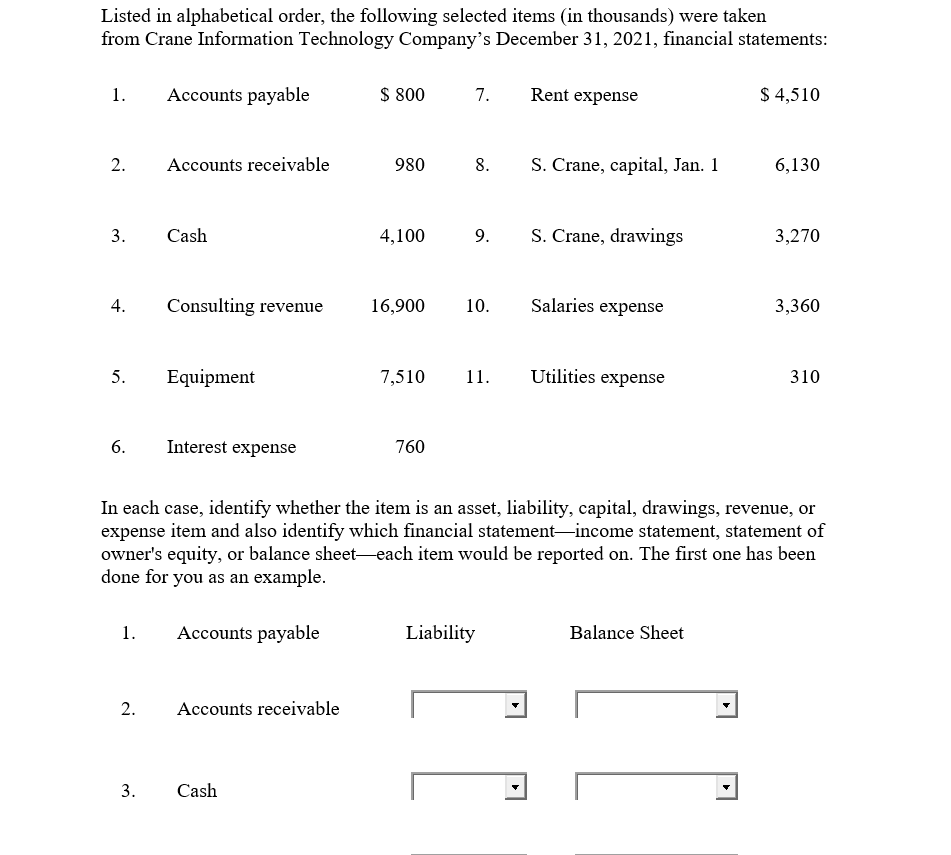

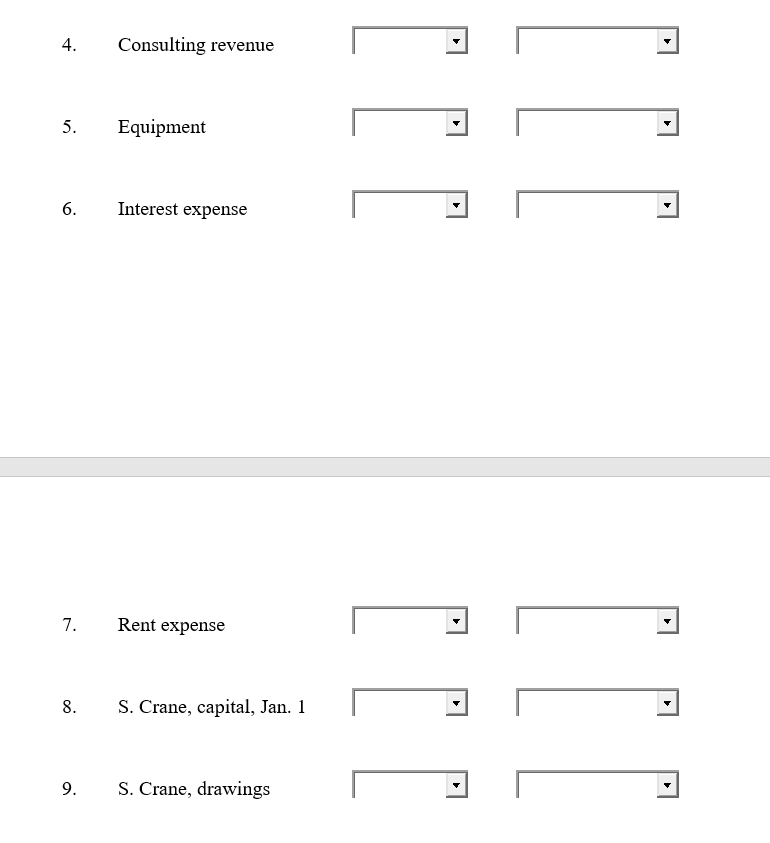

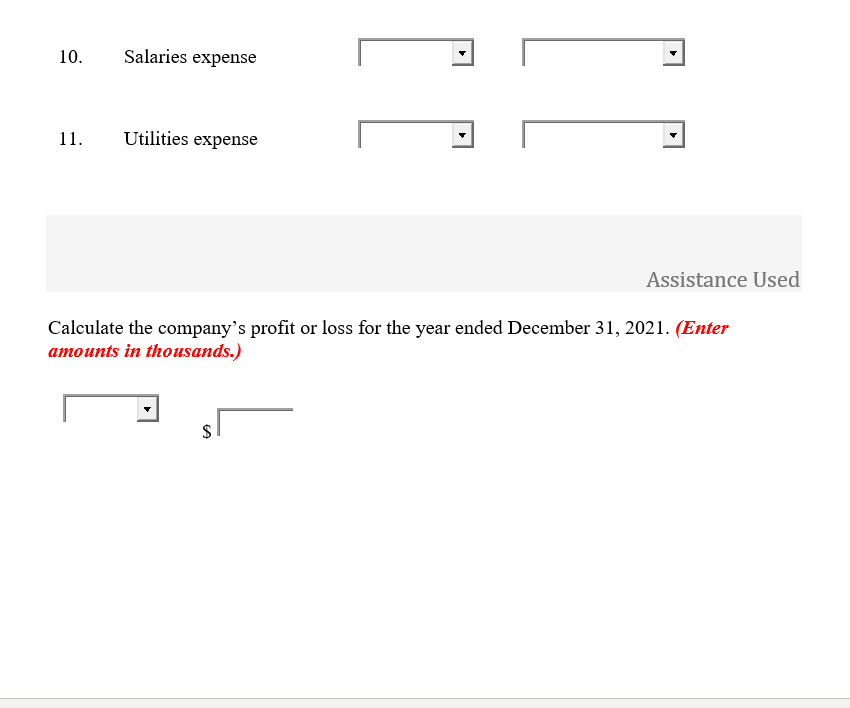

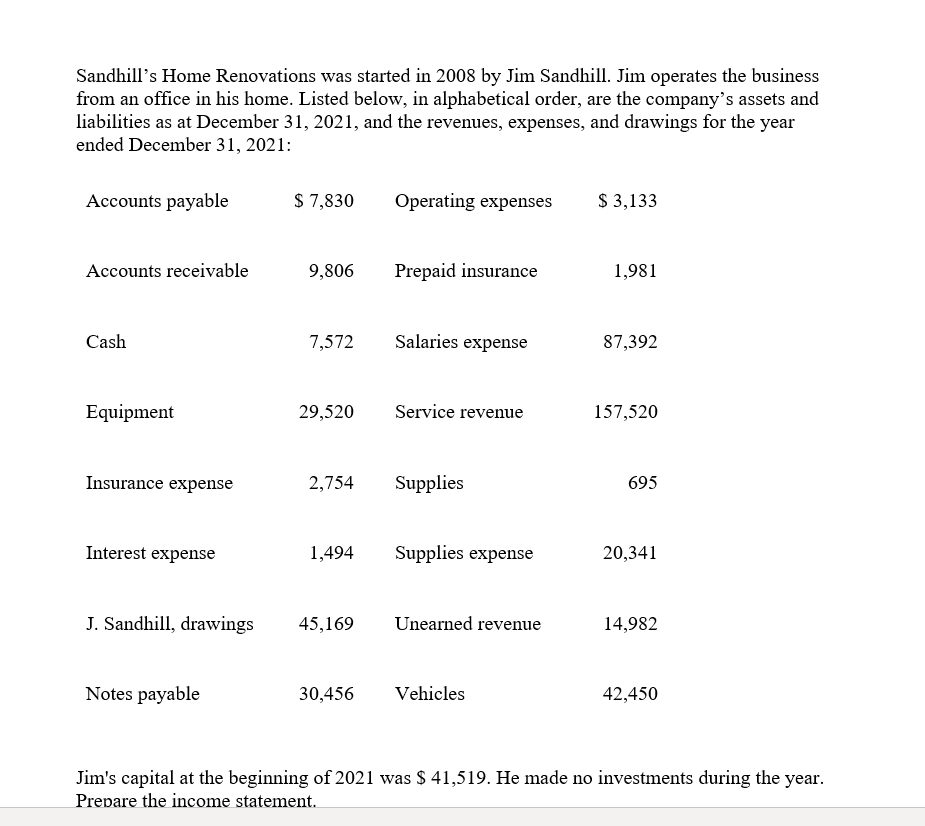

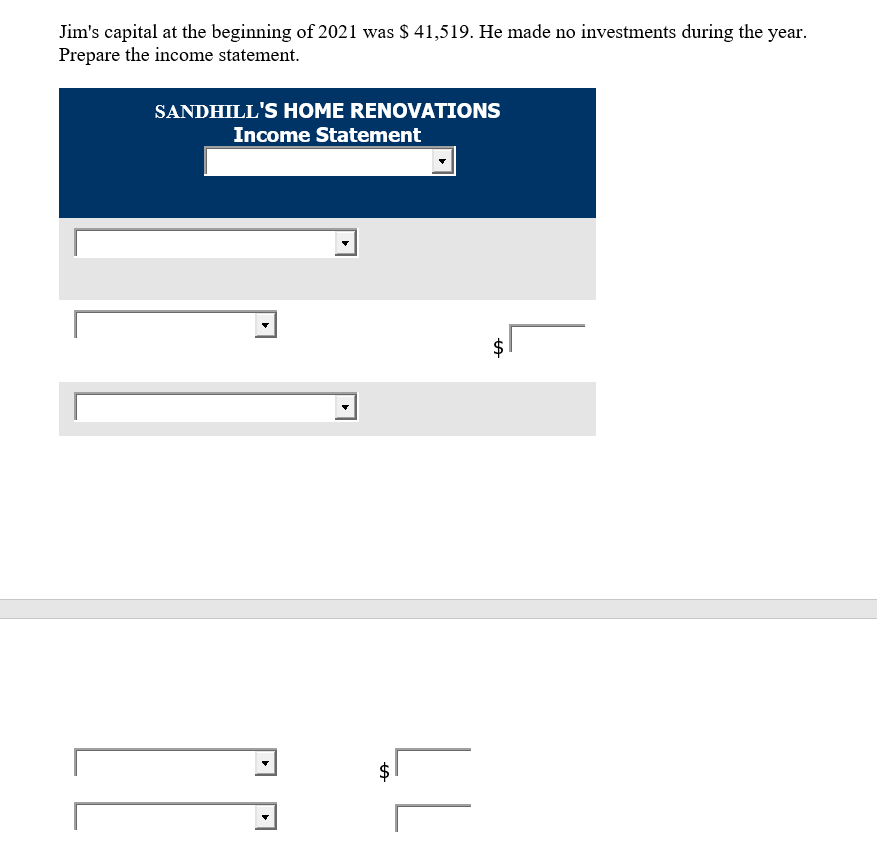

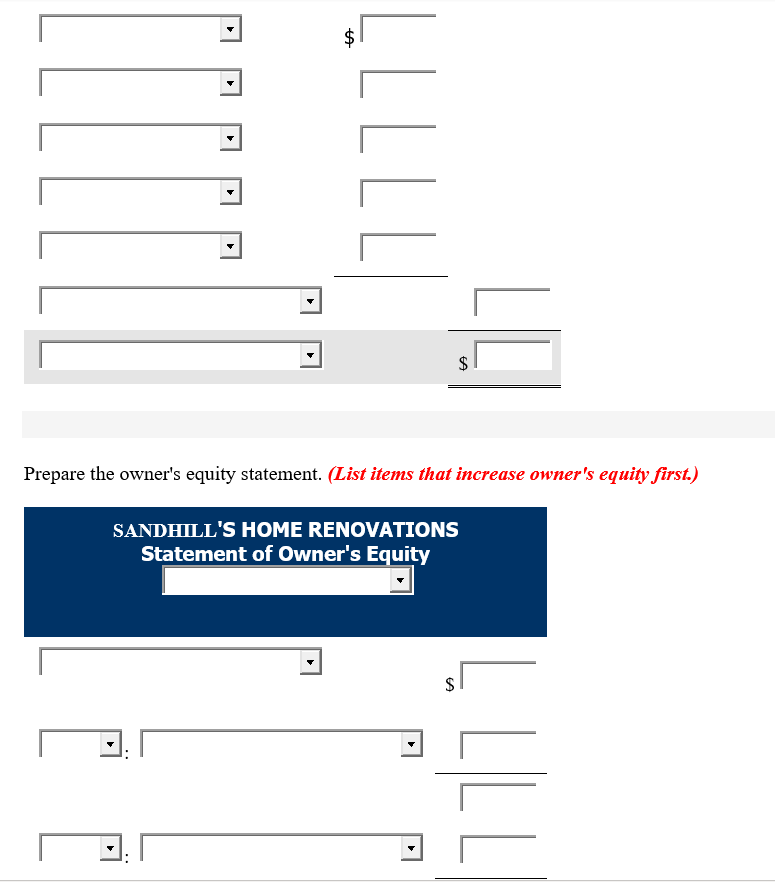

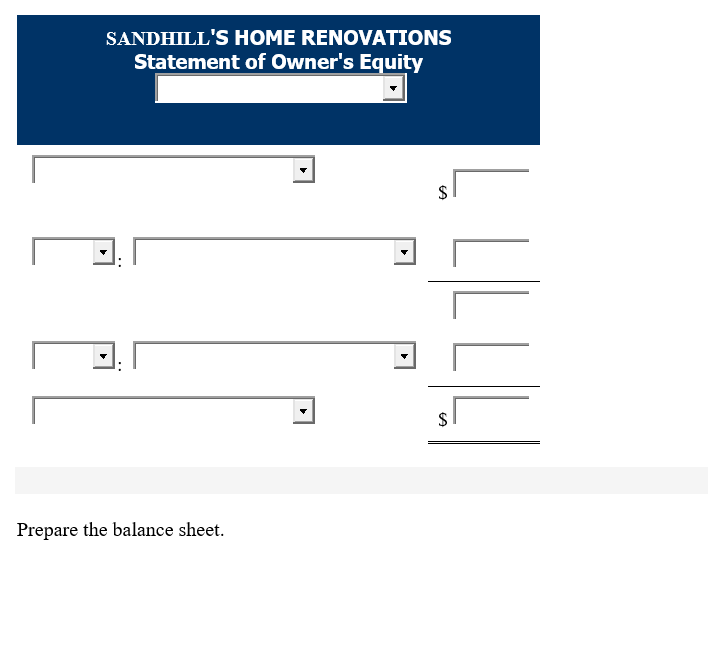

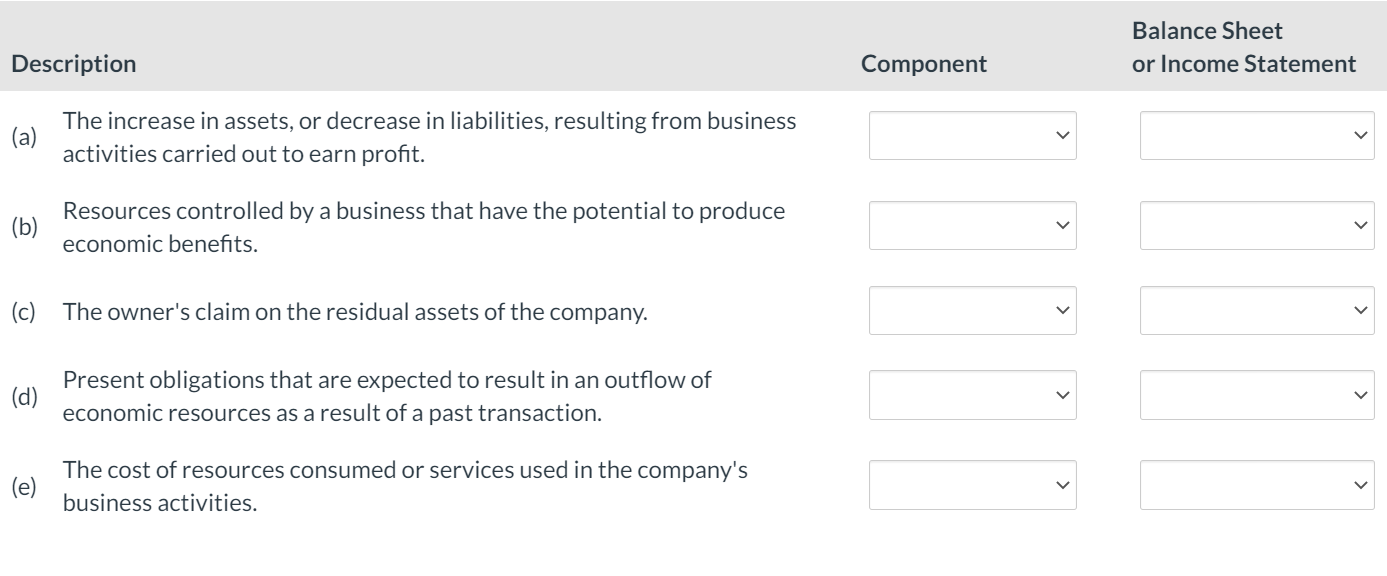

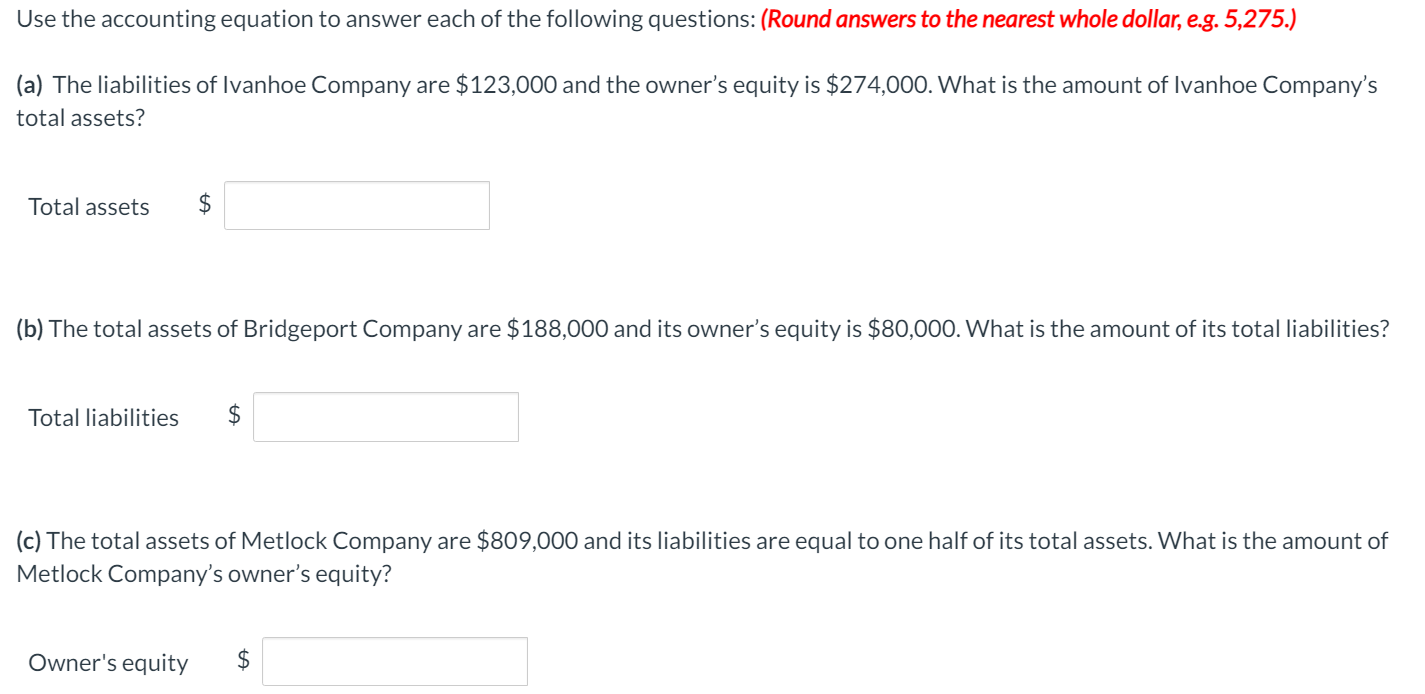

Listed in alphabetical order, the following selected items (in thousands) were taken from Crane Information Technology Company's December 31, 2021, financial statements: 1. Accounts payable $ 800 7. Rent expense $ 4,510 2. Accounts receivable 980 8. S. Crane, capital, Jan. 1 6,130 3. Cash 4,100 9. S. Crane, drawings 3,270 4. Consulting revenue 16,900 10. Salaries expense 3,360 5. Equipment 7,510 11. Utilities expense 310 6. Interest expense 760 In each case, identify whether the item is an asset, liability, capital, drawings, revenue, or expense item and also identify which financial statement-income statement, statement of owner's equity, or balance sheeteach item would be reported on. The first one has been done for you as an example. 1. Accounts payable Liability Balance Sheet 2. Accounts receivable 3. Cash 4. Consulting revenue 5. Equipment J. 6. Interest expense 7. Rent expense 8. S. Crane, capital, Jan. 1 III 9. S. Crane, drawings 10. Salaries expense 11. Utilities expense Assistance Used Calculate the company's profit or loss for the year ended December 31, 2021. (Enter amounts in thousands.) $ Sandhill's Home Renovations was started in 2008 by Jim Sandhill. Jim operates the business from an office in his home. Listed below, in alphabetical order, are the company's assets and liabilities as at December 31, 2021, and the revenues, expenses, and drawings for the year ended December 31, 2021: Accounts payable $ 7,830 Operating expenses $ 3,133 Accounts receivable 9,806 Prepaid insurance 1,981 Cash 7,572 Salaries expense 87,392 Equipment 29,520 Service revenue 157,520 Insurance expense 2,754 Supplies 695 Interest expense 1,494 Supplies expense 20,341 J. Sandhill, drawings 45,169 Unearned revenue 14,982 Notes payable 30,456 Vehicles 42,450 Jim's capital at the beginning of 2021 was $ 41,519. He made no investments during the year. Prepare the income statement. Jim's capital at the beginning of 2021 was $ 41,519. He made no investments during the year. Prepare the income statement. SANDHILL'S HOME RENOVATIONS Income Statement $ $ LI A LLLLL LL $ Prepare the owner's equity statement. (List items that increase owner's equity first.) SANDHILL'S HOME RENOVATIONS Statement of Owner's Equity $ LLL SANDHILL'S HOME RENOVATIONS Statement of Owner's Equity $ 1111 Prepare the balance sheet. Balance Sheet or Income Statement Description Component (a) The increase in assets, or decrease in liabilities, resulting from business activities carried out to earn profit. (b) Resources controlled by a business that have the potential to produce economic benefits. (c) The owner's claim on the residual assets of the company. Use the accounting equation to answer each of the following questions: (Round answers to the nearest whole dollar, e.g. 5,275.) (a) The liabilities of Ivanhoe Company are $123,000 and the owner's equity is $274,000. What is the amount of Ivanhoe Company's total assets? Total assets $ (b) The total assets of Bridgeport Company are $188,000 and its owner's equity is $80,000. What is the amount of its total liabilities? Total liabilities $ (c) The total assets of Metlock Company are $809,000 and its liabilities are equal to one half of its total assets. What is the amount of Metlock Company's owner's equity? Owner's equity $