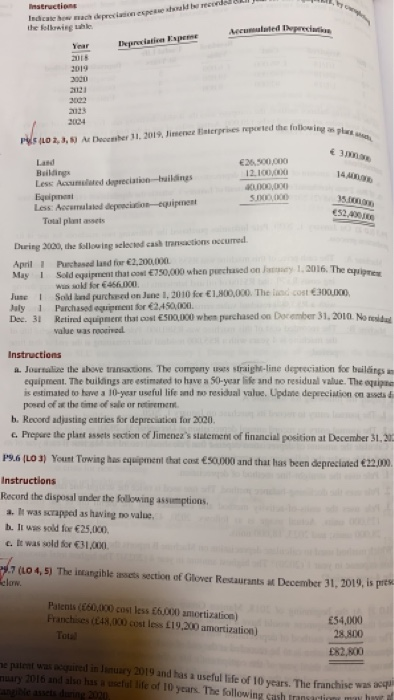

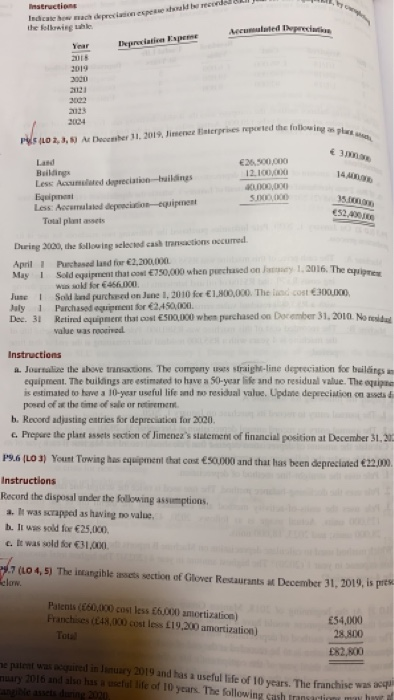

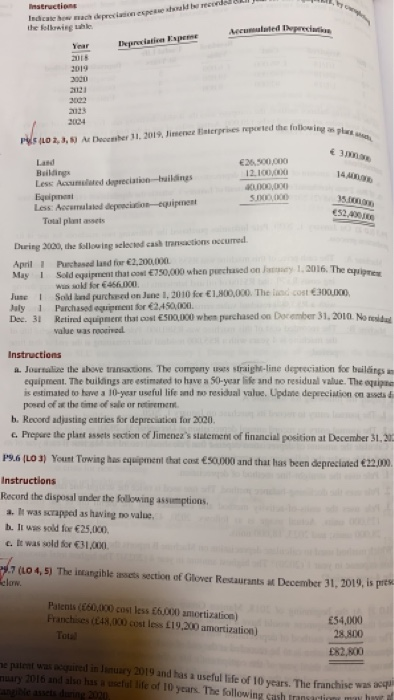

P9.5(lo 2,3,5)

Depreciativa peme PYLO 2, 3, Amer 112012, Jimene preported the following Instruction Idente was depreciation spesielle del the following the Acculated precise Year 23 2004 Land Building Less Accumulated depreciation-buildings Equipment Less: Accumulated conquipment 2.500.000 12.100.000 0.000 SO 35 Total plantas During 2000, the following selected cash transactions recurred. April Perchased land for 2,200,000 Sold equipment that cout 750,000 when purchased on my 1, 2016. The apex Wind for 466100 June 1 Sold ind purchased on June 1, 2010 for E 1.800,000. The cost ECO 1 Purchased equipment for 2.450,000 Dec. 31 Retiral quines that ca 500,000 when purchased on December 31, 2010. No reside value as mooriad Instructions a. Jourtalize the above transactions. The company straight-line depreciation for bailngs a equipment. The buildings are estimated to have a 50-year life and to residual value. The app is estimated to have a 10-year useful life and no residual value. Update depreciation pound of the time of sale or rement b. Record adjusting entries for depreciation for 2000 c. Prepare the plant assets section of Jimenez's statement of financial position at December 31, 2 P9.6 (L03) Yount Tuwing has equipment that cost toux and that has been depreciated 22.000 Instructions Record the disposal under the following assumptions, a. It was scrappal as having no value. b. It was sold for 25,000 c. It was sold for 31,000 7 (LO 4, 5) The intangible assets section of Glover Restaurants at December 31, 2019, is prese clow Patents (60,000 cost less 6.000 amortization) Franchises (C48,000 costs 19.200 amortization) Tour 54,000 28.800 82.800 ne palet was in dimuary 2019 and has a useful life of 10 years. The franchise was a nuary 2016 and also has a well life of 10 years. The following sash transaction Depreciativa peme PYLO 2, 3, Amer 112012, Jimene preported the following Instruction Idente was depreciation spesielle del the following the Acculated precise Year 23 2004 Land Building Less Accumulated depreciation-buildings Equipment Less: Accumulated conquipment 2.500.000 12.100.000 0.000 SO 35 Total plantas During 2000, the following selected cash transactions recurred. April Perchased land for 2,200,000 Sold equipment that cout 750,000 when purchased on my 1, 2016. The apex Wind for 466100 June 1 Sold ind purchased on June 1, 2010 for E 1.800,000. The cost ECO 1 Purchased equipment for 2.450,000 Dec. 31 Retiral quines that ca 500,000 when purchased on December 31, 2010. No reside value as mooriad Instructions a. Jourtalize the above transactions. The company straight-line depreciation for bailngs a equipment. The buildings are estimated to have a 50-year life and to residual value. The app is estimated to have a 10-year useful life and no residual value. Update depreciation pound of the time of sale or rement b. Record adjusting entries for depreciation for 2000 c. Prepare the plant assets section of Jimenez's statement of financial position at December 31, 2 P9.6 (L03) Yount Tuwing has equipment that cost toux and that has been depreciated 22.000 Instructions Record the disposal under the following assumptions, a. It was scrappal as having no value. b. It was sold for 25,000 c. It was sold for 31,000 7 (LO 4, 5) The intangible assets section of Glover Restaurants at December 31, 2019, is prese clow Patents (60,000 cost less 6.000 amortization) Franchises (C48,000 costs 19.200 amortization) Tour 54,000 28.800 82.800 ne palet was in dimuary 2019 and has a useful life of 10 years. The franchise was a nuary 2016 and also has a well life of 10 years. The following sash transaction