Answered step by step

Verified Expert Solution

Question

1 Approved Answer

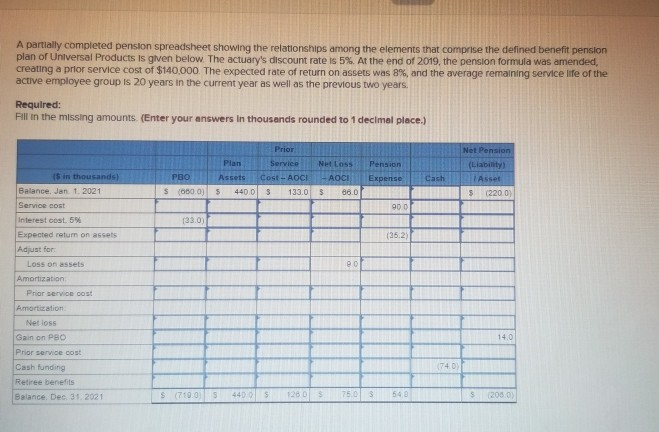

A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The

A partially completed pension spreadsheet showing the relationships among the elements that comprise the defined benefit pension plan of Universal Products is given below. The actuary's discount rate is 5%. At the end of 2019, the pension formula was amended, creating a prior service cost of $140,000. The expected rate of return on assets was 8%, and the average remaining service life of the active employee group is 20 years in the current year as well as the previous two years, Required: Fill in the missing amounts (Enter your answers in thousands rounded to 1 decimal place.) Prior Plan Service Assets Cost - AOCI $ 440.0 133.0 PBO S (0800) Net Loss AOCI 3 860 Pension Expense Cash Net Pension (Liability Asset $ 1220.0) 90.0 15 in thousands Balance, Jan. 1. 2021 Service cost Interest cost. 5% Expected retum on assets Adjust for: Loss on assets 133.0 (25.2 20 Amortization Prior service cost Amortization Net loss Gain on PSO 14.0 Prior service cost 174.0) Cash funding Retiree benefits Balance, Dec. 31. 2021 $710.05 440 S 1260 7503 548 (205.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started