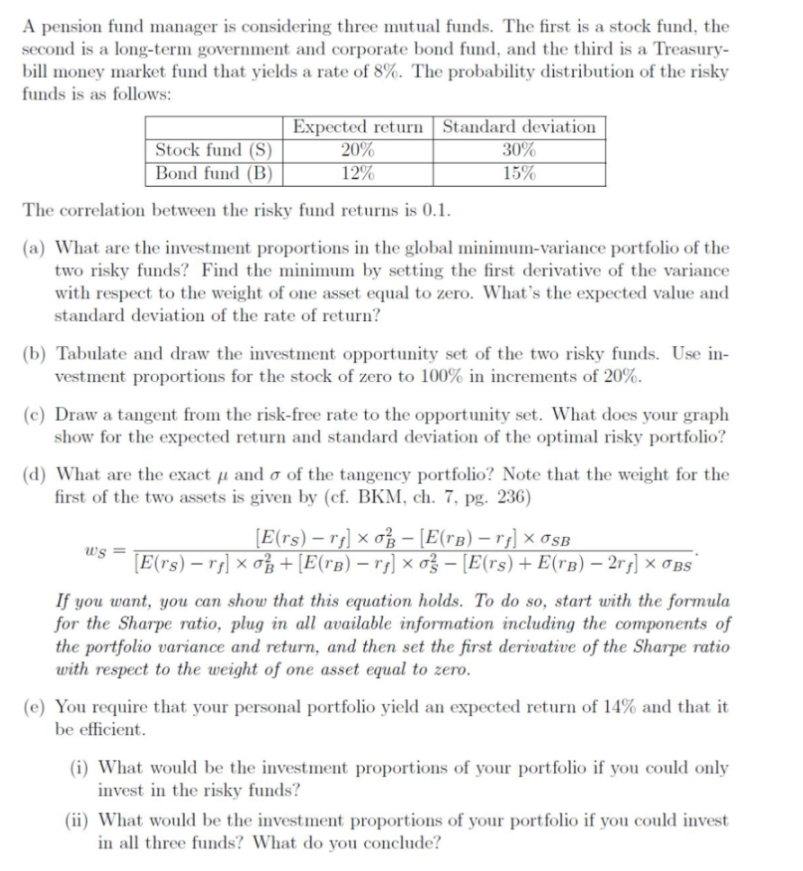

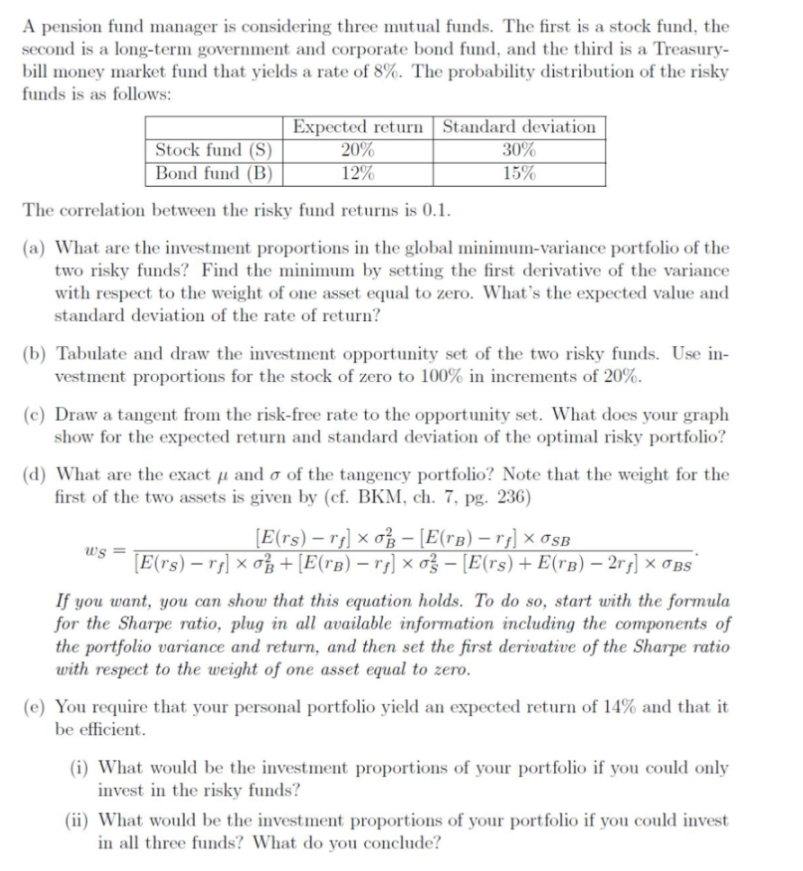

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a Treasury- bill money market fund that yields a rate of 8%. The probability distribution of the risky funds is as follows: Expected return Standard deviation Stock fund (S) 20% 30% Bond fund (B) 12% 15% The correlation between the risky fund returns is 0.1. (a) What are the investment proportions in the global minimum-variance portfolio of the two risky funds? Find the minimum by setting the first derivative of the variance with respect to the weight of one asset equal to zero. What's the expected value and standard deviation of the rate of return? (b) Tabulate and draw the investment opportunity set of the two risky funds. Use in- vestment proportions for the stock of zero to 100% in increments of 20%. (c) Draw a tangent from the risk-free rate to the opportunity set. What does your graph show for the expected return and standard deviation of the optimal risky portfolio? (d) What are the exact u and o of the tangency portfolio? Note that the weight for the first of the two assets is given by (cf. BKM, ch. 7, pg. 236) [E(rs) rj] o- [E(TB) rf] x OSB Ws = [E(rs) rp] x o + [E(+B) ry] Xo [E(rs) + E(TB) 2r;] X OBS If you want, you can show that this equation holds. To do so, start with the formula for the Sharpe ratio, plug in all available information including the components of the portfolio variance and return, and then set the first derivative of the Sharpe ratio with respect to the weight of one asset equal to zero. (e) You require that your personal portfolio yield an expected return of 14% and that it be efficient (i) What would be the investment proportions of your portfolio if you could only invest in the risky funds? (ii) What would be the investment proportions of your portfolio if you could invest in all three funds? What do you conclude? A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term government and corporate bond fund, and the third is a Treasury- bill money market fund that yields a rate of 8%. The probability distribution of the risky funds is as follows: Expected return Standard deviation Stock fund (S) 20% 30% Bond fund (B) 12% 15% The correlation between the risky fund returns is 0.1. (a) What are the investment proportions in the global minimum-variance portfolio of the two risky funds? Find the minimum by setting the first derivative of the variance with respect to the weight of one asset equal to zero. What's the expected value and standard deviation of the rate of return? (b) Tabulate and draw the investment opportunity set of the two risky funds. Use in- vestment proportions for the stock of zero to 100% in increments of 20%. (c) Draw a tangent from the risk-free rate to the opportunity set. What does your graph show for the expected return and standard deviation of the optimal risky portfolio? (d) What are the exact u and o of the tangency portfolio? Note that the weight for the first of the two assets is given by (cf. BKM, ch. 7, pg. 236) [E(rs) rj] o- [E(TB) rf] x OSB Ws = [E(rs) rp] x o + [E(+B) ry] Xo [E(rs) + E(TB) 2r;] X OBS If you want, you can show that this equation holds. To do so, start with the formula for the Sharpe ratio, plug in all available information including the components of the portfolio variance and return, and then set the first derivative of the Sharpe ratio with respect to the weight of one asset equal to zero. (e) You require that your personal portfolio yield an expected return of 14% and that it be efficient (i) What would be the investment proportions of your portfolio if you could only invest in the risky funds? (ii) What would be the investment proportions of your portfolio if you could invest in all three funds? What do you conclude