Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Petros Berhad is involved in exploring, producing and developing oil and gas resources business. The company just paid a dividend of RM1.20 per

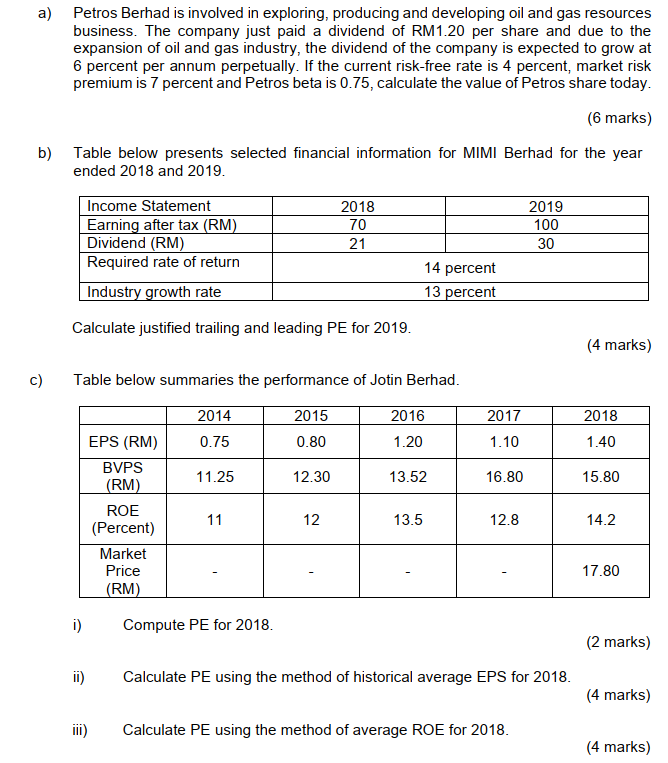

a) Petros Berhad is involved in exploring, producing and developing oil and gas resources business. The company just paid a dividend of RM1.20 per share and due to the expansion of oil and gas industry, the dividend of the company is expected to grow at 6 percent per annum perpetually. If the current risk-free rate is 4 percent, market risk premium is 7 percent and Petros beta is 0.75, calculate the value of Petros share today. (6 marks) b) Table below presents selected financial information for MIMI Berhad for the year ended 2018 and 2019. Income Statement Earning after tax (RM) 2018 70 2019 100 Dividend (RM) 21 30 Required rate of return 14 percent Industry growth rate 13 percent Calculate justified trailing and leading PE for 2019. (4 marks) c) Table below summaries the performance of Jotin Berhad. 2014 2015 2016 2017 2018 EPS (RM) 0.75 0.80 1.20 1.10 1.40 BVPS 11.25 12.30 13.52 16.80 15.80 (RM) ROE 11 12 13.5 12.8 14.2 (Percent) Market Price 17.80 (RM) i) Compute PE for 2018. (2 marks) ii) Calculate PE using the method of historical average EPS for 2018. (4 marks) Calculate PE using the method of average ROE for 2018. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the value of Petros Berhads share today we can use the Gordon Growth Model formula P0 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started