Answered step by step

Verified Expert Solution

Question

1 Approved Answer

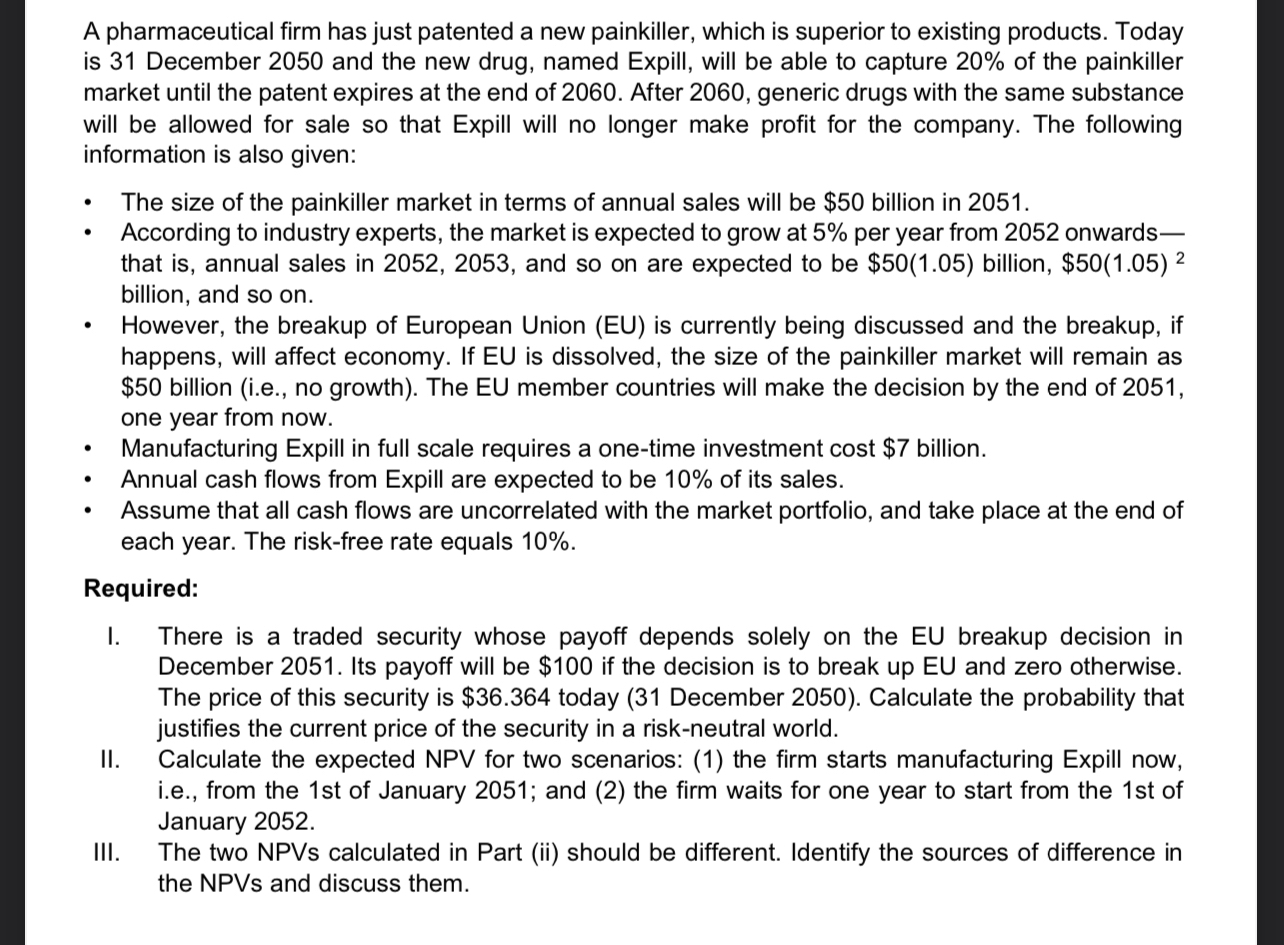

A pharmaceutical firm has just patented a new painkiller, which is superior to existing products. Today is 3 1 December 2 0 5 0 and

A pharmaceutical firm has just patented a new painkiller, which is superior to existing products. Today is December and the new drug, named Expill, will be able to capture of the painkiller market until the patent expires at the end of After generic drugs with the same substance will be allowed for sale so that Expill will no longer make profit for the company. The following information is also given:

The size of the painkiller market in terms of annual sales will be $ billion in

According to industry experts, the market is expected to grow at per year from onwards that is annual sales in and so on are expected to be $ billion, $ billion, and so on

However, the breakup of European Union EU is currently being discussed and the breakup, if happens, will affect economy. If EU is dissolved, the size of the painkiller market will remain as $ billion ie no growth The EU member countries will make the decision by the end of one year from now.

Manufacturing Expill in full scale requires a onetime investment cost $ billion.

Annual cash flows from Expill are expected to be of its sales.

Assume that all cash flows are uncorrelated with the market portfolio, and take place at the end of each year. The riskfree rate equals

Required:

I. There is a traded security whose payoff depends solely on the EU breakup decision in December Its payoff will be $ if the decision is to break up EU and zero otherwise. The price of this security is $ today December Calculate the probability that justifies the current price of the security in a riskneutral world.

II Calculate the expected NPV for two scenarios: the firm starts manufacturing Expill now, ie from the st of January ; and the firm waits for one year to start from the st of January

III. The two NPVs calculated in Part ii should be different. Identify the sources of difference in the NPVs and discuss them.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started