Answered step by step

Verified Expert Solution

Question

1 Approved Answer

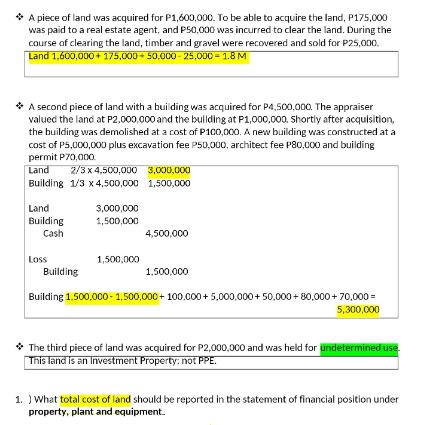

* A piece of land was acquired for P1,600,000. To be able to acquire the land, P175,000 was paid to a real estate agent,

* A piece of land was acquired for P1,600,000. To be able to acquire the land, P175,000 was paid to a real estate agent, and P50,000 was incurred to clear the land. During the course of clearing the land, timber and gravel were recovered and sold for P25,000. Land 1,600,000+ 175,000+50.000-25,000 = 1.8 M * A second piece of land with a building was acquired for P4,500,000. The appraiser valued the land at P2,000,000 and the building at P1,000,000. Shortly after acquisition, the building was demolished at a cost of P100,000. A new building was constructed at a cost of P5,000,000 plus excavation fee P50,000, architect fee P80,000 and building permit P70,000. Land Building Land Building Cash Loss 2/3 x 4,500,000 3,000,000 1/3 x 4,500,000 1,500,000 Building 3,000,000 1,500,000 1,500,000 4,500,000 1,500,000 Building 1,500,000-1,500,000+ 100.000+ 5,000,000+50,000+80,000+70,000 = 5,300,000 The third piece of land was acquired for P2,000,000 and was held for undetermined use. This land is an Investment Property: not PPE. 1.) What total cost of land should be reported in the statement of financial position under property, plant and equipment.

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To determine the total cost of land that should be reported in the statement of financial position u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started