Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A plant manager wants to know, based on investing in market research, what is overall payout would be. Currently there are two alternatives facing his

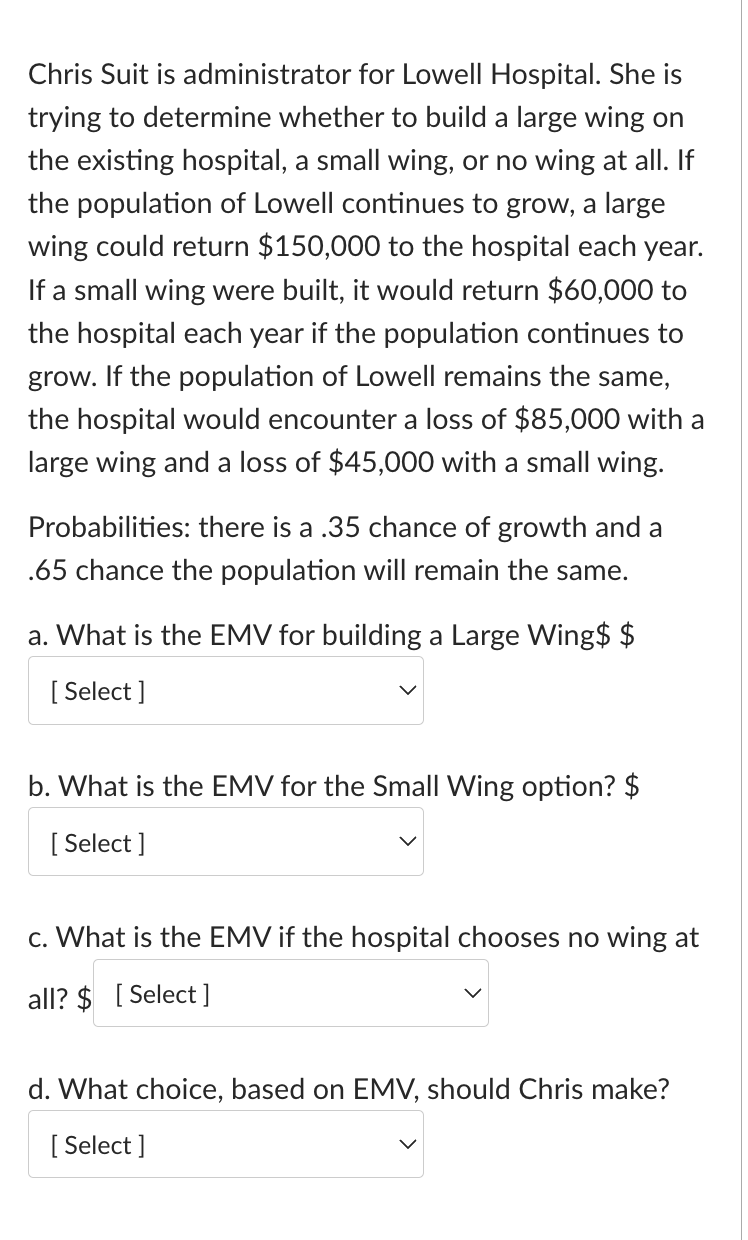

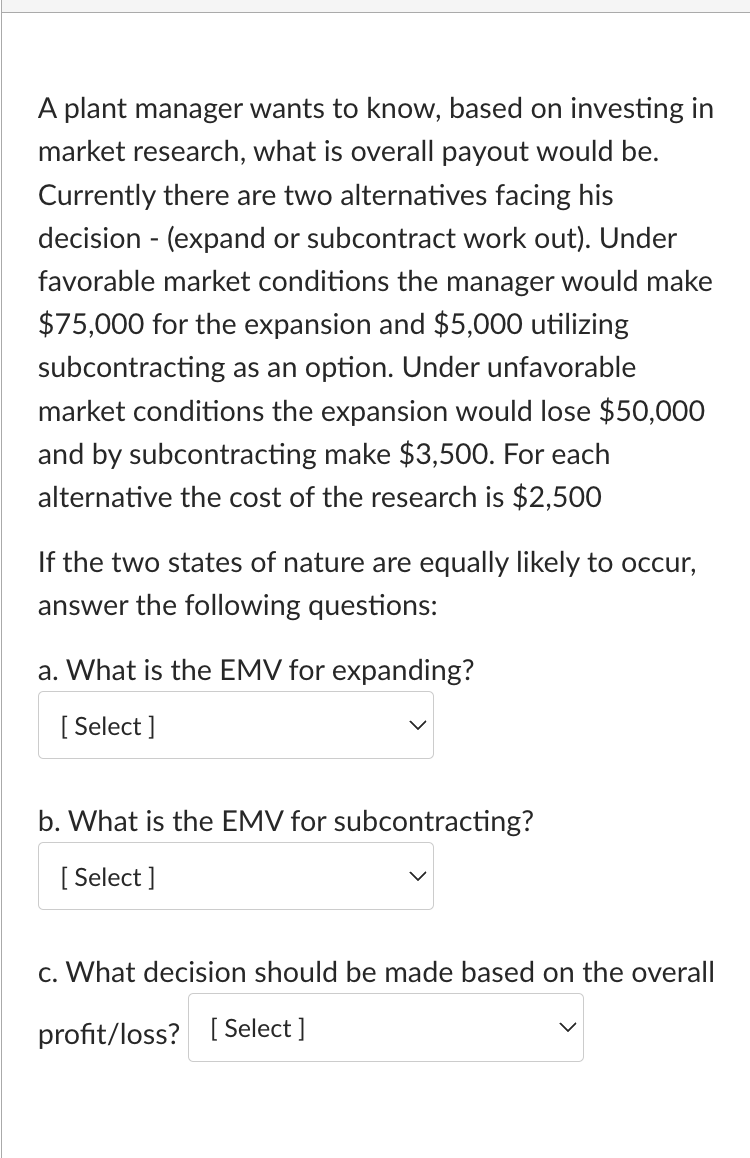

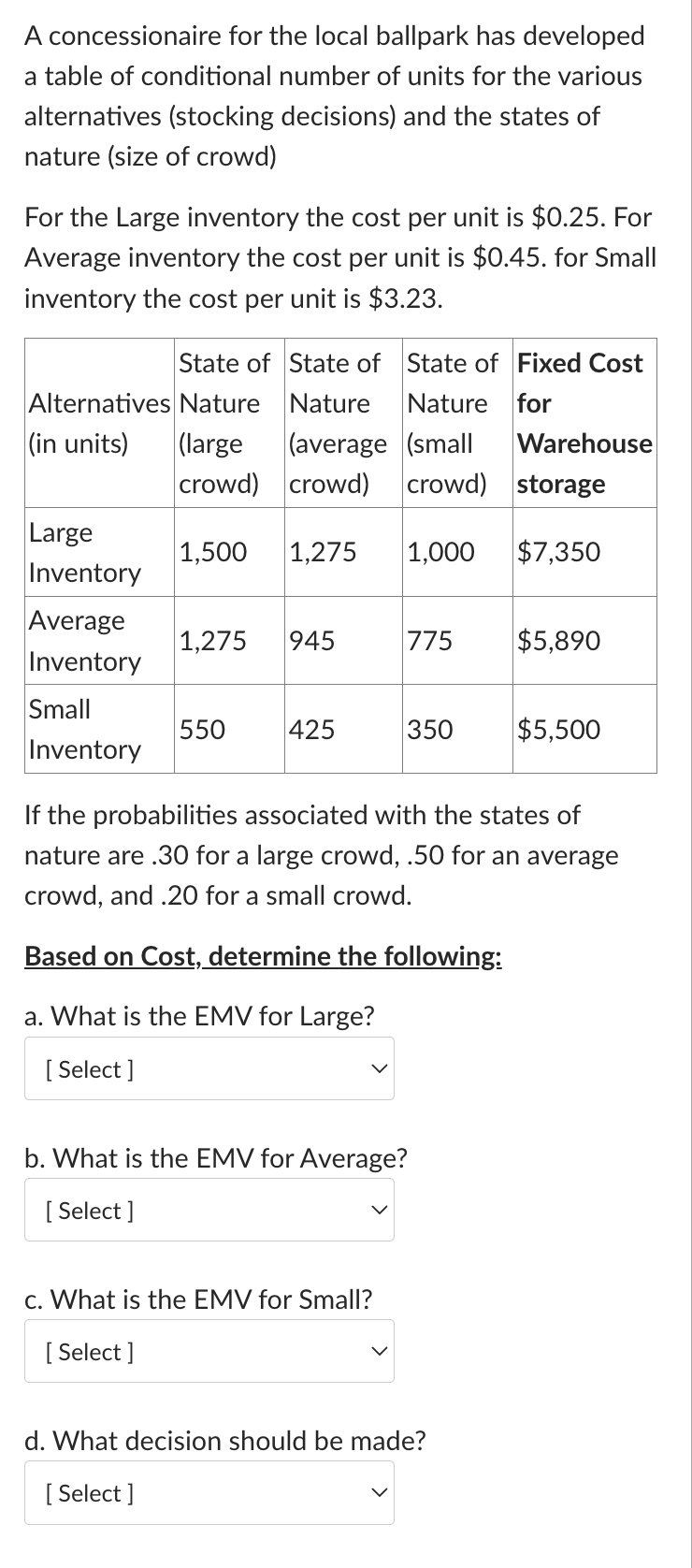

A plant manager wants to know, based on investing in market research, what is overall payout would be. Currently there are two alternatives facing his decision - (expand or subcontract work out). Under favorable market conditions the manager would make $75,000 for the expansion and $5,000 utilizing subcontracting as an option. Under unfavorable market conditions the expansion would lose $50,000 and by subcontracting make $3,500. For each alternative the cost of the research is $2,500 If the two states of nature are equally likely to occur, answer the following questions: a. What is the EMV for expanding? b. What is the EMV for subcontracting? c. What decision should be made based on the overall profit/loss? A concessionaire for the local ballpark has developed a table of conditional number of units for the various alternatives (stocking decisions) and the states of nature (size of crowd) For the Large inventory the cost per unit is $0.25. For Average inventory the cost per unit is $0.45. for Small inventory the cost per unit is $3.23. If the probabilities associated with the states of nature are .30 for a large crowd, .50 for an average crowd, and .20 for a small crowd. Based on Cost, determine the following: a. What is the EMV for Large? b. What is the EMV for Average? c. What is the EMV for Small? d. What decision should be made? Chris Suit is administrator for Lowell Hospital. She is trying to determine whether to build a large wing on the existing hospital, a small wing, or no wing at all. If the population of Lowell continues to grow, a large wing could return $150,000 to the hospital each year. If a small wing were built, it would return $60,000 to the hospital each year if the population continues to grow. If the population of Lowell remains the same, the hospital would encounter a loss of $85,000 with a large wing and a loss of $45,000 with a small wing. Probabilities: there is a .35 chance of growth and a .65 chance the population will remain the same. a. What is the EMV for building a Large Wing \$ \$ b. What is the EMV for the Small Wing option? \$ c. What is the EMV if the hospital chooses no wing at all? \$ d. What choice, based on EMV, should Chris make

A plant manager wants to know, based on investing in market research, what is overall payout would be. Currently there are two alternatives facing his decision - (expand or subcontract work out). Under favorable market conditions the manager would make $75,000 for the expansion and $5,000 utilizing subcontracting as an option. Under unfavorable market conditions the expansion would lose $50,000 and by subcontracting make $3,500. For each alternative the cost of the research is $2,500 If the two states of nature are equally likely to occur, answer the following questions: a. What is the EMV for expanding? b. What is the EMV for subcontracting? c. What decision should be made based on the overall profit/loss? A concessionaire for the local ballpark has developed a table of conditional number of units for the various alternatives (stocking decisions) and the states of nature (size of crowd) For the Large inventory the cost per unit is $0.25. For Average inventory the cost per unit is $0.45. for Small inventory the cost per unit is $3.23. If the probabilities associated with the states of nature are .30 for a large crowd, .50 for an average crowd, and .20 for a small crowd. Based on Cost, determine the following: a. What is the EMV for Large? b. What is the EMV for Average? c. What is the EMV for Small? d. What decision should be made? Chris Suit is administrator for Lowell Hospital. She is trying to determine whether to build a large wing on the existing hospital, a small wing, or no wing at all. If the population of Lowell continues to grow, a large wing could return $150,000 to the hospital each year. If a small wing were built, it would return $60,000 to the hospital each year if the population continues to grow. If the population of Lowell remains the same, the hospital would encounter a loss of $85,000 with a large wing and a loss of $45,000 with a small wing. Probabilities: there is a .35 chance of growth and a .65 chance the population will remain the same. a. What is the EMV for building a Large Wing \$ \$ b. What is the EMV for the Small Wing option? \$ c. What is the EMV if the hospital chooses no wing at all? \$ d. What choice, based on EMV, should Chris make Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started