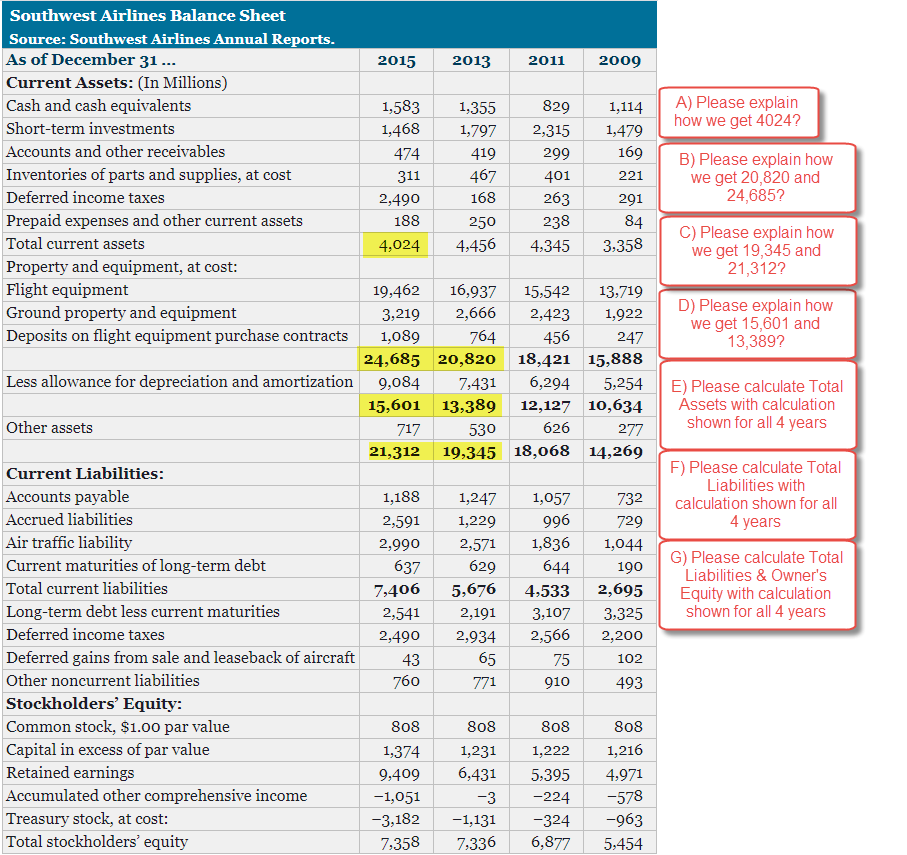

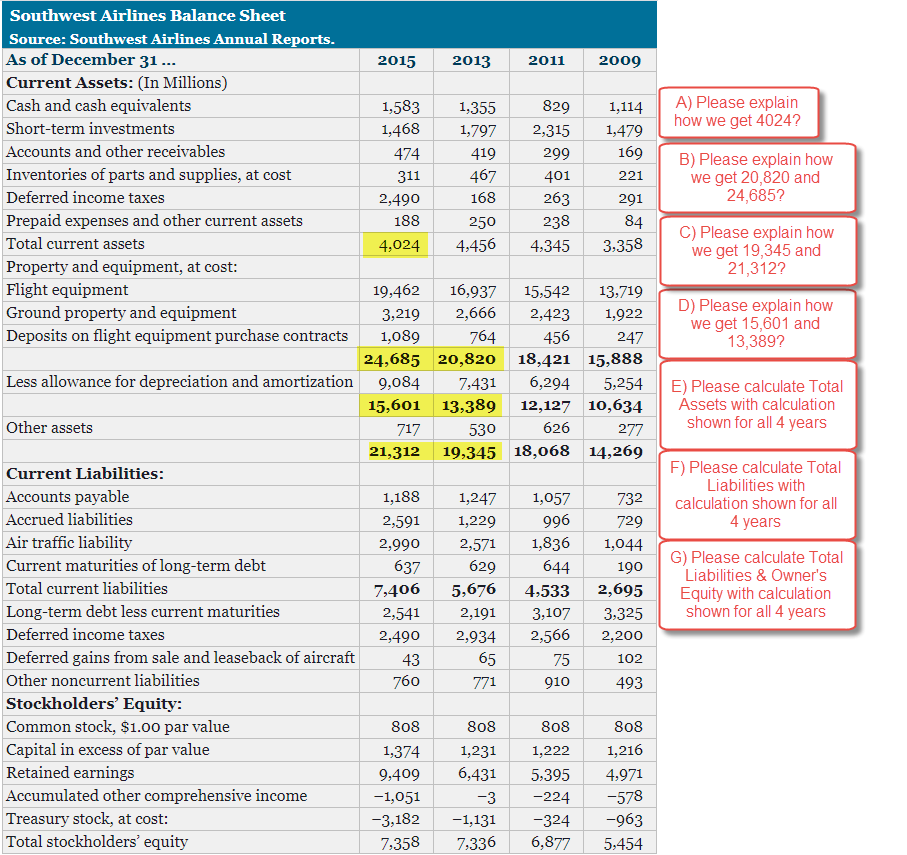

A) Please explain how we get 4024? 311 B) Please explain how we get 20,820 and 24,685? C) Please explain how we get 19,345 and 21,312? D) Please explain how we get 15,601 and 13,389? Southwest Airlines Balance Sheet Source: Southwest Airlines Annual Reports. As of December 31 ... 2015 2013 2011 2009 Current Assets: (In Millions) Cash and cash equivalents 1,583 1,355 829 1,114 Short-term investments 1,468 1,797 2,315 1,479 Accounts and other receivables 474 419 299 169 Inventories of parts and supplies, at cost 467 401 221 Deferred income taxes 2,490 168 263 291 Prepaid expenses and other current assets 188 250 238 84 Total current assets 4,024 4,456 4,345 3,358 Property and equipment, at cost: Flight equipment 19,462 16,937 15,542 13,719 Ground property and equipment 3,219 2,666 2,423 1,922 Deposits on flight equipment purchase contracts 1,089 764 456 247 24,685 20,820 18,421 15,888 Less allowance for depreciation and amortization 9,084 7,431 6,294 5,254 15,601 13,389 12,127 10,634 Other assets 717 530 626 277 21,312 19,345 18,068 14,269 Current Liabilities: Accounts payable 1,188 1,247 1,057 732 Accrued liabilities 2,591 1,229 996 729 Air traffic liability 2,990 2,571 1,836 1,044 Current maturities of long-term debt 637 629 644 190 Total current liabilities 7,406 5,676 4,533 2,695 Long-term debt less current maturities 2,541 2,191 3,107 3,325 Deferred income taxes 2,490 2,934 2,566 2,200 Deferred gains from sale and leaseback of aircraft 43 75 102 Other noncurrent liabilities 760 771 910 493 Stockholders' Equity: Common stock, $1.00 par value 808 808 808 808 Capital in excess of par value 1,374 1,231 1,222 1,216 Retained earnings 9,409 6,431 5,395 4,971 Accumulated other comprehensive income -1,051 -3 -224 -578 Treasury stock, at cost: -3,182 -1,131 -324 -963 Total stockholders' equity 7,358 7,336 6,877 5,454 E) Please calculate Total Assets with calculation shown for all 4 years F) Please calculate Total Liabilities with calculation shown for all 4 years G) Please calculate Total Liabilities & Owner's Equity with calculation shown for all 4 years 65 A) Please explain how we get 4024? 311 B) Please explain how we get 20,820 and 24,685? C) Please explain how we get 19,345 and 21,312? D) Please explain how we get 15,601 and 13,389? Southwest Airlines Balance Sheet Source: Southwest Airlines Annual Reports. As of December 31 ... 2015 2013 2011 2009 Current Assets: (In Millions) Cash and cash equivalents 1,583 1,355 829 1,114 Short-term investments 1,468 1,797 2,315 1,479 Accounts and other receivables 474 419 299 169 Inventories of parts and supplies, at cost 467 401 221 Deferred income taxes 2,490 168 263 291 Prepaid expenses and other current assets 188 250 238 84 Total current assets 4,024 4,456 4,345 3,358 Property and equipment, at cost: Flight equipment 19,462 16,937 15,542 13,719 Ground property and equipment 3,219 2,666 2,423 1,922 Deposits on flight equipment purchase contracts 1,089 764 456 247 24,685 20,820 18,421 15,888 Less allowance for depreciation and amortization 9,084 7,431 6,294 5,254 15,601 13,389 12,127 10,634 Other assets 717 530 626 277 21,312 19,345 18,068 14,269 Current Liabilities: Accounts payable 1,188 1,247 1,057 732 Accrued liabilities 2,591 1,229 996 729 Air traffic liability 2,990 2,571 1,836 1,044 Current maturities of long-term debt 637 629 644 190 Total current liabilities 7,406 5,676 4,533 2,695 Long-term debt less current maturities 2,541 2,191 3,107 3,325 Deferred income taxes 2,490 2,934 2,566 2,200 Deferred gains from sale and leaseback of aircraft 43 75 102 Other noncurrent liabilities 760 771 910 493 Stockholders' Equity: Common stock, $1.00 par value 808 808 808 808 Capital in excess of par value 1,374 1,231 1,222 1,216 Retained earnings 9,409 6,431 5,395 4,971 Accumulated other comprehensive income -1,051 -3 -224 -578 Treasury stock, at cost: -3,182 -1,131 -324 -963 Total stockholders' equity 7,358 7,336 6,877 5,454 E) Please calculate Total Assets with calculation shown for all 4 years F) Please calculate Total Liabilities with calculation shown for all 4 years G) Please calculate Total Liabilities & Owner's Equity with calculation shown for all 4 years 65