Question

A portfolio consists of cash and 5 risky assets, S1, S2, S3,S4 and S5 stocks. Initial investment of $10 million is available on the 1

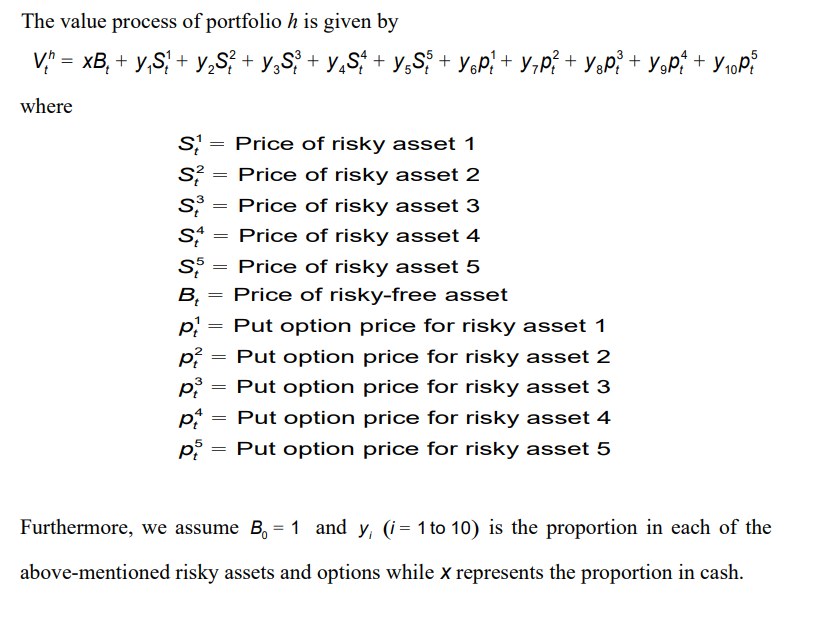

A portfolio consists of cash and 5 risky assets, S1, S2, S3,S4 and S5 stocks. Initial investment of $10 million is available on the 1 st of May 2022; 60% of it can be used to buy the stocks and 10% can be retained in cash and the rest can be used for hedging the portfolio using 4-month European Put Options that will expire on the 31st of August 2022. The value process of portfolio h is given by

For each risky asset, construct and draw an 8-period Binomial tree for the put option using VBA . Allocate funds for each asset listed above, including cash. Automatically, determine the current value of the portfolio in your code using the formula for h.

The value process of portfolio h is given by 5 V" xB + yS + yS? + YS + VS + yS + y + YP? + YP + y + where = S = Price of risky asset 1 S = Price of risky asset 2 S = Price of risky asset 3 St= Price of risky asset 4 S5 = Price of risky asset 5 B = Price of risky-free asset p = Put option price for risky asset 1 p 3 p Put option price for risky asset 2 Put option price for risky asset 3 Put option price for risky asset 4 Put option price for risky asset 5 pt p = = = Furthermore, we assume B = 1 and y, (i= 1 to 10) is the proportion in each of the above-mentioned risky assets and options while X represents the proportion in cash. The value process of portfolio h is given by 5 V" xB + yS + yS? + YS + VS + yS + y + YP? + YP + y + where = S = Price of risky asset 1 S = Price of risky asset 2 S = Price of risky asset 3 St= Price of risky asset 4 S5 = Price of risky asset 5 B = Price of risky-free asset p = Put option price for risky asset 1 p 3 p Put option price for risky asset 2 Put option price for risky asset 3 Put option price for risky asset 4 Put option price for risky asset 5 pt p = = = Furthermore, we assume B = 1 and y, (i= 1 to 10) is the proportion in each of the above-mentioned risky assets and options while X represents the proportion in cashStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started