Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A portfolio manager computes a relatively low price - to - book ratio for the small cap firms in the portfolio. The manager computes an

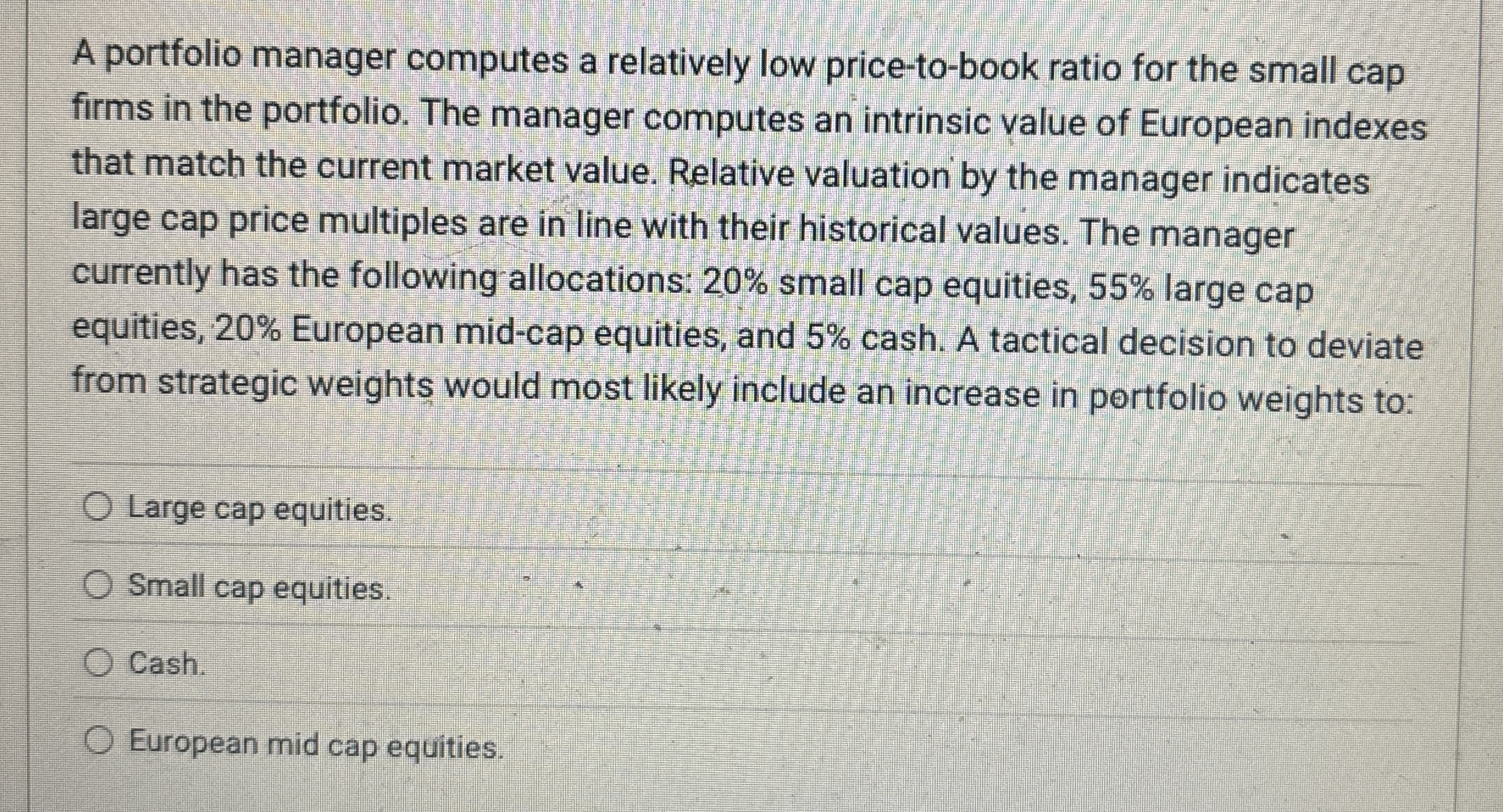

A portfolio manager computes a relatively low pricetobook ratio for the small cap

firms in the portfolio. The manager computes an intrinsic value of European indexes

that match the current market value. Relative valuation by the manager indicates

large cap price multiples are in line with their historical values. The manager

currently has the following allocations: small cap equities, large cap

equities, European midcap equities, and cash. A tactical decision to deviate

from strategic weights would most likely include an increase in pertfolio weights to:

Large cap equities.

Small cap equities.

Cash.

European mid cap equities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started