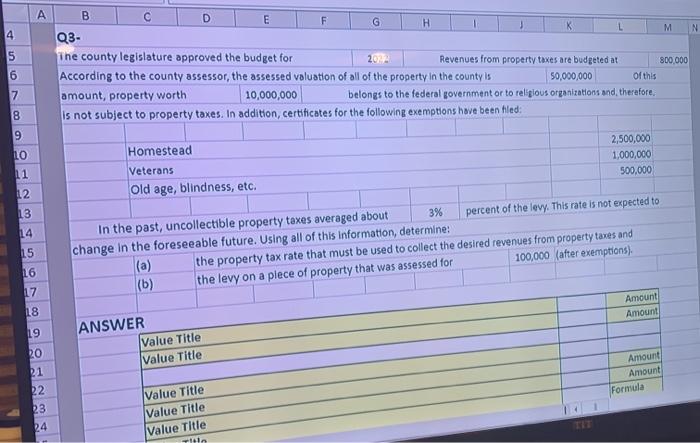

N 4 5 B E F G H L M Q3- The county legislature approved the budget for 2014 Revenues from property taxes are budgeted at 800,000 According to the county assessor, the assessed valuation of all of the property in the county is 50,000,000 Of this amount, property worth 10,000,000 belongs to the federal government or to religious organizations and therefore, is not subject to property taxes. In addition, certificates for the following exemptions have been fled: 6 7 8 9 10 11 Homestead Veterans Old age, blindness, etc. 2,500,000 1,000,000 500,000 12 13 14 15 16 In the past, uncollectible property taxes averaged about 3% percent of the levy. This rate is not expected to change in the foreseeable future. Using all of this information, determine: (a) the property tax rate that must be used to collect the desired revenues from property taxes and (b) the levy on a piece of property that was assessed for 100,000 (after exemptions). 17 18 Amount Amount 19 ANSWER Value Title Value Title RO Amount Amount Formula 21 22 23 24 Value Title Value Title Value Title Q1- Identify the significant differences between US government budgetary systems and Saudi Arabia government budgetary systems. You are required to make detalled comparisons between the two countries difference in term of: a. Budgetary process b. Implementation process C. Monitoring and evaluation process d. Give at least two reasons why do think each country may have their own practice in term of reporting the government accounting and budgetary system. Q2- Compare and contrast the Saudi Arabia Government budgets for the years 2019 and 2020. Q3. Explain the role and responsibilities of Ministry of Finance (MOF), General Auditing Bureau (GAB), and Saudi Arabian Monetary Agency (SAMA) and their involvement in budgetary process. 04- Explain the reason for the budget allocation and how the government will finance this expenditure for 2021. 25- The government has recently increased value added tax (VAT) from 5% to 15%. Explain possible reasons why the government has increased the VAT rates and explain the impact of VAT to consumer spending and business Required: 1. The answer must type out using Arial 12. justified and proper heading to all your answer. Make sure you include Page 1 and 2 of the question together with your answers. 2. Quote suitable reference for the information used in the assignment and attach all the relevant documents to support your answers. Page 2 of 3 NOTE: 1. Progress report 1-07th February. 2- Progress report 2 - 01 March 3- Progress report 3 - 18th March. 1). Please use your college email only 1). Please enter the following information in SUBJECT while mailing your progress report ID Number: ACCEST N 4 5 B E F G H L M Q3- The county legislature approved the budget for 2014 Revenues from property taxes are budgeted at 800,000 According to the county assessor, the assessed valuation of all of the property in the county is 50,000,000 Of this amount, property worth 10,000,000 belongs to the federal government or to religious organizations and therefore, is not subject to property taxes. In addition, certificates for the following exemptions have been fled: 6 7 8 9 10 11 Homestead Veterans Old age, blindness, etc. 2,500,000 1,000,000 500,000 12 13 14 15 16 In the past, uncollectible property taxes averaged about 3% percent of the levy. This rate is not expected to change in the foreseeable future. Using all of this information, determine: (a) the property tax rate that must be used to collect the desired revenues from property taxes and (b) the levy on a piece of property that was assessed for 100,000 (after exemptions). 17 18 Amount Amount 19 ANSWER Value Title Value Title RO Amount Amount Formula 21 22 23 24 Value Title Value Title Value Title Q1- Identify the significant differences between US government budgetary systems and Saudi Arabia government budgetary systems. You are required to make detalled comparisons between the two countries difference in term of: a. Budgetary process b. Implementation process C. Monitoring and evaluation process d. Give at least two reasons why do think each country may have their own practice in term of reporting the government accounting and budgetary system. Q2- Compare and contrast the Saudi Arabia Government budgets for the years 2019 and 2020. Q3. Explain the role and responsibilities of Ministry of Finance (MOF), General Auditing Bureau (GAB), and Saudi Arabian Monetary Agency (SAMA) and their involvement in budgetary process. 04- Explain the reason for the budget allocation and how the government will finance this expenditure for 2021. 25- The government has recently increased value added tax (VAT) from 5% to 15%. Explain possible reasons why the government has increased the VAT rates and explain the impact of VAT to consumer spending and business Required: 1. The answer must type out using Arial 12. justified and proper heading to all your answer. Make sure you include Page 1 and 2 of the question together with your answers. 2. Quote suitable reference for the information used in the assignment and attach all the relevant documents to support your answers. Page 2 of 3 NOTE: 1. Progress report 1-07th February. 2- Progress report 2 - 01 March 3- Progress report 3 - 18th March. 1). Please use your college email only 1). Please enter the following information in SUBJECT while mailing your progress report ID Number: ACCEST