Question

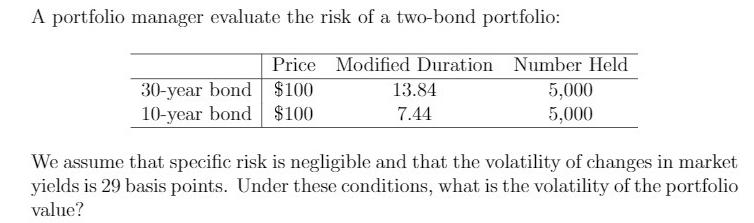

A portfolio manager evaluate the risk of a two-bond portfolio: Price Modified Duration Number Held $100 30-year bond 10-year bond $100 13.84 7.44 5,000

A portfolio manager evaluate the risk of a two-bond portfolio: Price Modified Duration Number Held $100 30-year bond 10-year bond $100 13.84 7.44 5,000 5,000 We assume that specific risk is negligible and that the volatility of changes in market yields is 29 basis points. Under these conditions, what is the volatility of the portfolio value?

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Portfolio volatility Variance aS 1 bS 2 12 Where a the portfolio weight of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance

Authors: Jonathan Berk and Peter DeMarzo

3rd edition

978-0132992473, 132992477, 978-0133097894

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App