Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are valuing Research AI, a materials discovery firm. The value of the operating assets based on your analysis is $1,450 million. This estimated

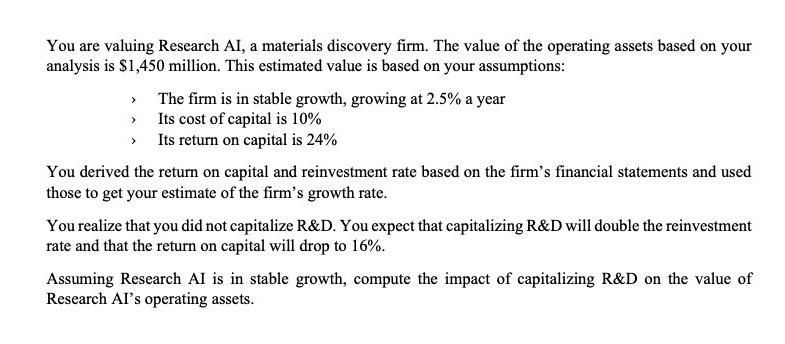

You are valuing Research AI, a materials discovery firm. The value of the operating assets based on your analysis is $1,450 million. This estimated value is based on your assumptions: > > > The firm is in stable growth, growing at 2.5% a year Its cost of capital is 10% Its return on capital is 24% You derived the return on capital and reinvestment rate based on the firm's financial statements and used those to get your estimate of the firm's growth rate. You realize that you did not capitalize R&D. You expect that capitalizing R&D will double the reinvestment rate and that the return on capital will drop to 16%. Assuming Research AI is in stable growth, compute the impact of capitalizing R&D on the value of Research Al's operating assets.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the impact of capitalizing RD on the value of Research AIs operating assets you can use t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started