Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A potential pitfall to the NPV method might be: O It doesn't take into account the salvage value of old equipment. It doesn't take into

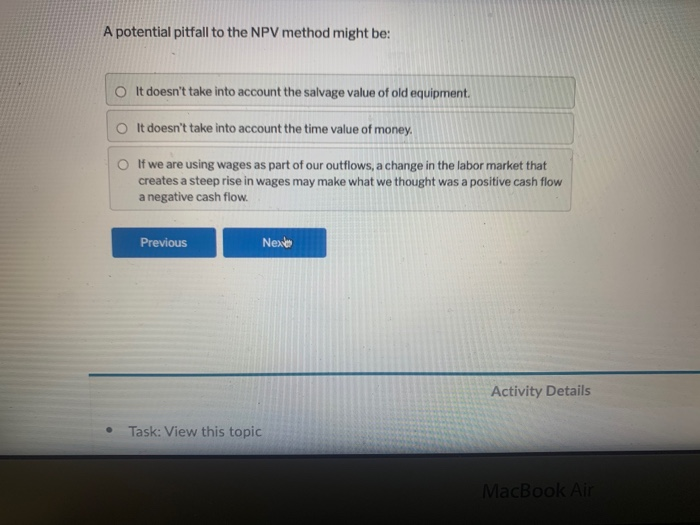

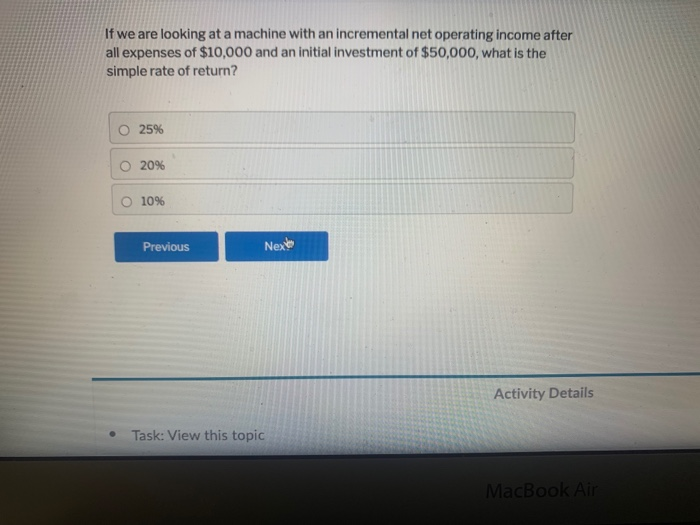

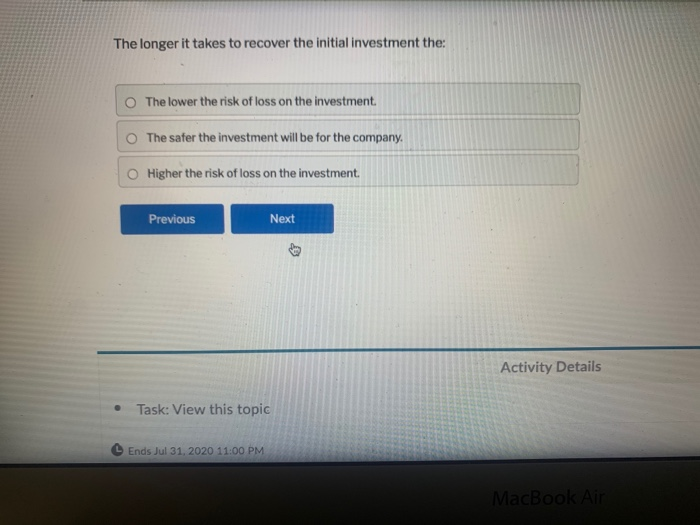

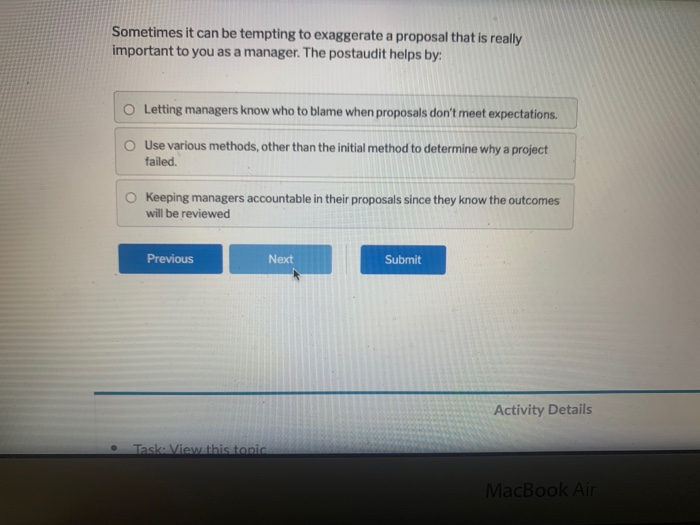

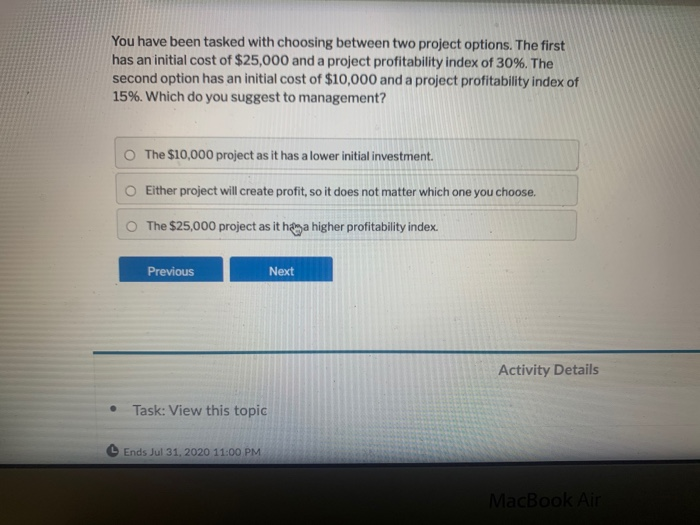

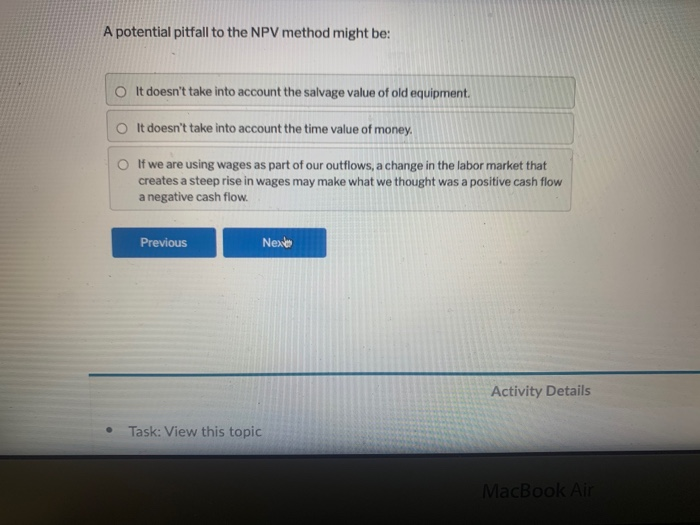

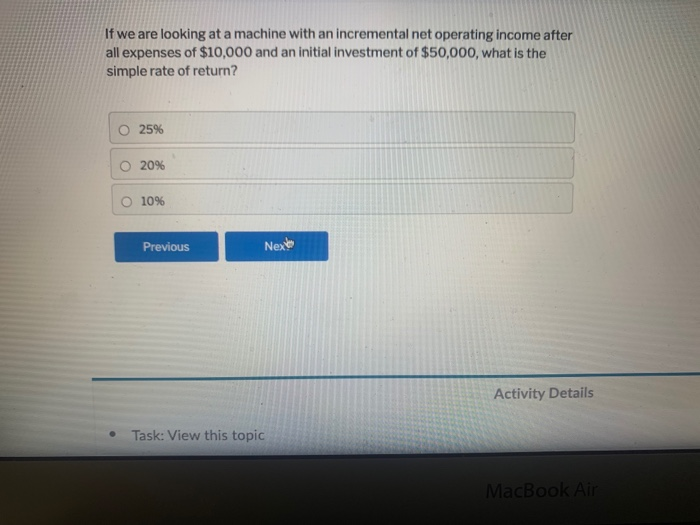

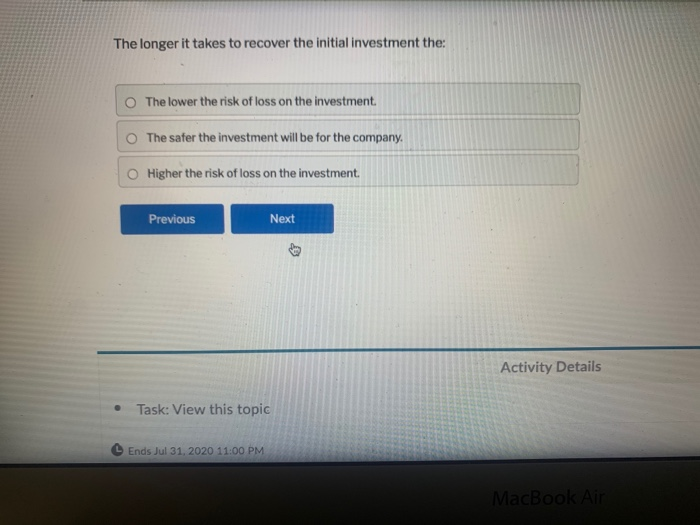

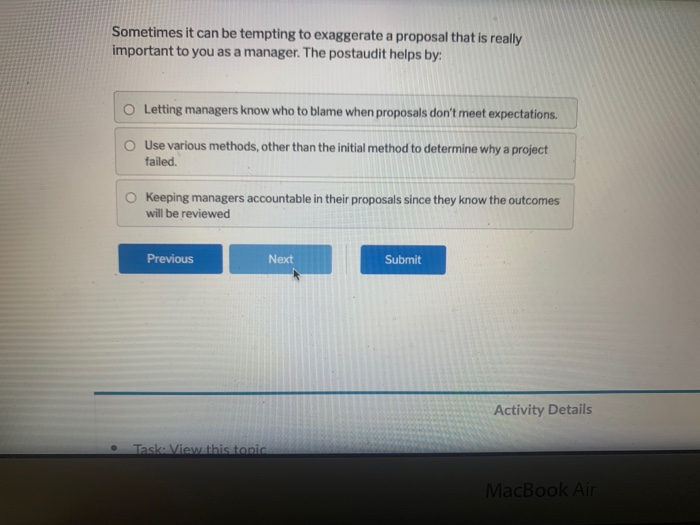

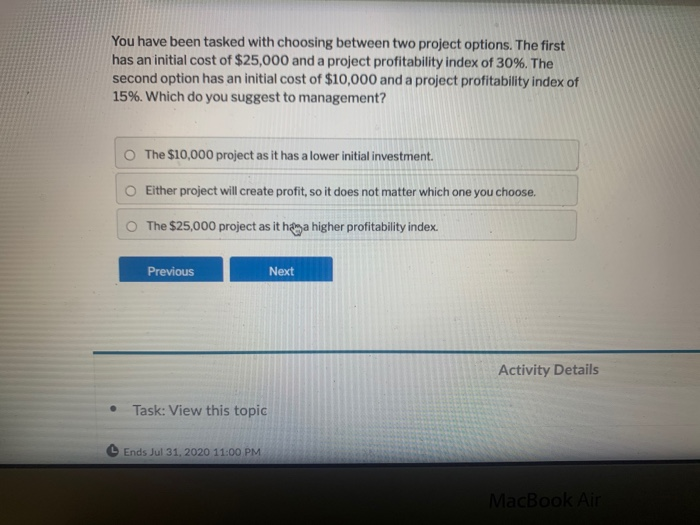

A potential pitfall to the NPV method might be: O It doesn't take into account the salvage value of old equipment. It doesn't take into account the time value of money. If we are using wages as part of our outflows, a change in the labor market that creates a steep rise in wages may make what we thought was a positive cash flow a negative cash flow. Previous Next Activity Details Task: View this topic MacBook Air If we are looking at a machine with an incremental net operating income after all expenses of $10,000 and an initial investment of $50,000, what is the simple rate of return? 25% O 20% O 10% Previous Next Activity Details Task: View this topic MacBook Air The longer it takes to recover the initial investment the: The lower the risk of loss on the investment The safer the investment will be for the company. O Higher the risk of loss on the investment Previous Next Activity Details Task: View this topic Ends Jul 31, 2020 11:00 PM MacBook Air Sometimes it can be tempting to exaggerate a proposal that is really important to you as a manager. The postaudit helps by: O Letting managers know who to blame when proposals don't meet expectations. Use various methods, other than the initial method to determine why a project failed. Keeping managers accountable in their proposals since they know the outcomes will be reviewed Previous Next Submit Activity Details Task: View this tonic MacBook Air You have been tasked with choosing between two project options. The first has an initial cost of $25,000 and a project profitability index of 30%. The second option has an initial cost of $10,000 and a project profitability index of 15%. Which do you suggest to management? The $10,000 project as it has a lower initial investment. Either project will create profit, so it does not matter which one you choose. The $25,000 project as it haga higher profitability index. Previous Next Activity Details . Task: View this topic Ends Jul 31, 2020 11:00 PM MacBook Air

A potential pitfall to the NPV method might be: O It doesn't take into account the salvage value of old equipment. It doesn't take into account the time value of money. If we are using wages as part of our outflows, a change in the labor market that creates a steep rise in wages may make what we thought was a positive cash flow a negative cash flow. Previous Next Activity Details Task: View this topic MacBook Air If we are looking at a machine with an incremental net operating income after all expenses of $10,000 and an initial investment of $50,000, what is the simple rate of return? 25% O 20% O 10% Previous Next Activity Details Task: View this topic MacBook Air The longer it takes to recover the initial investment the: The lower the risk of loss on the investment The safer the investment will be for the company. O Higher the risk of loss on the investment Previous Next Activity Details Task: View this topic Ends Jul 31, 2020 11:00 PM MacBook Air Sometimes it can be tempting to exaggerate a proposal that is really important to you as a manager. The postaudit helps by: O Letting managers know who to blame when proposals don't meet expectations. Use various methods, other than the initial method to determine why a project failed. Keeping managers accountable in their proposals since they know the outcomes will be reviewed Previous Next Submit Activity Details Task: View this tonic MacBook Air You have been tasked with choosing between two project options. The first has an initial cost of $25,000 and a project profitability index of 30%. The second option has an initial cost of $10,000 and a project profitability index of 15%. Which do you suggest to management? The $10,000 project as it has a lower initial investment. Either project will create profit, so it does not matter which one you choose. The $25,000 project as it haga higher profitability index. Previous Next Activity Details . Task: View this topic Ends Jul 31, 2020 11:00 PM MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started