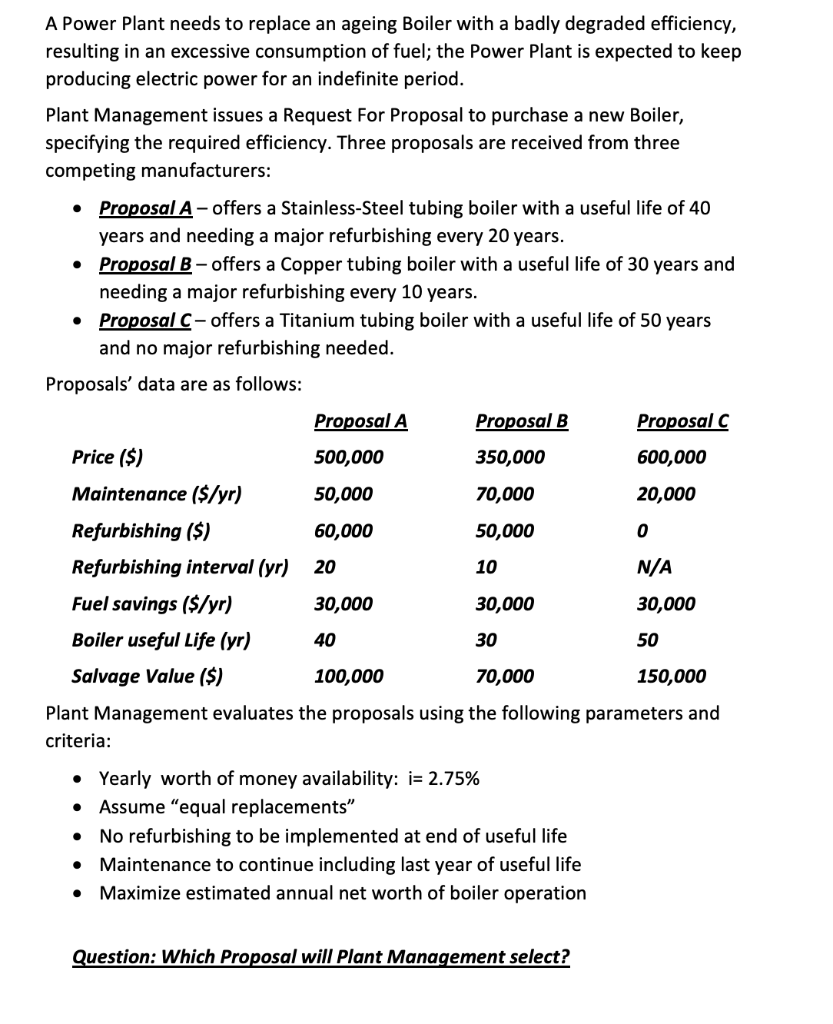

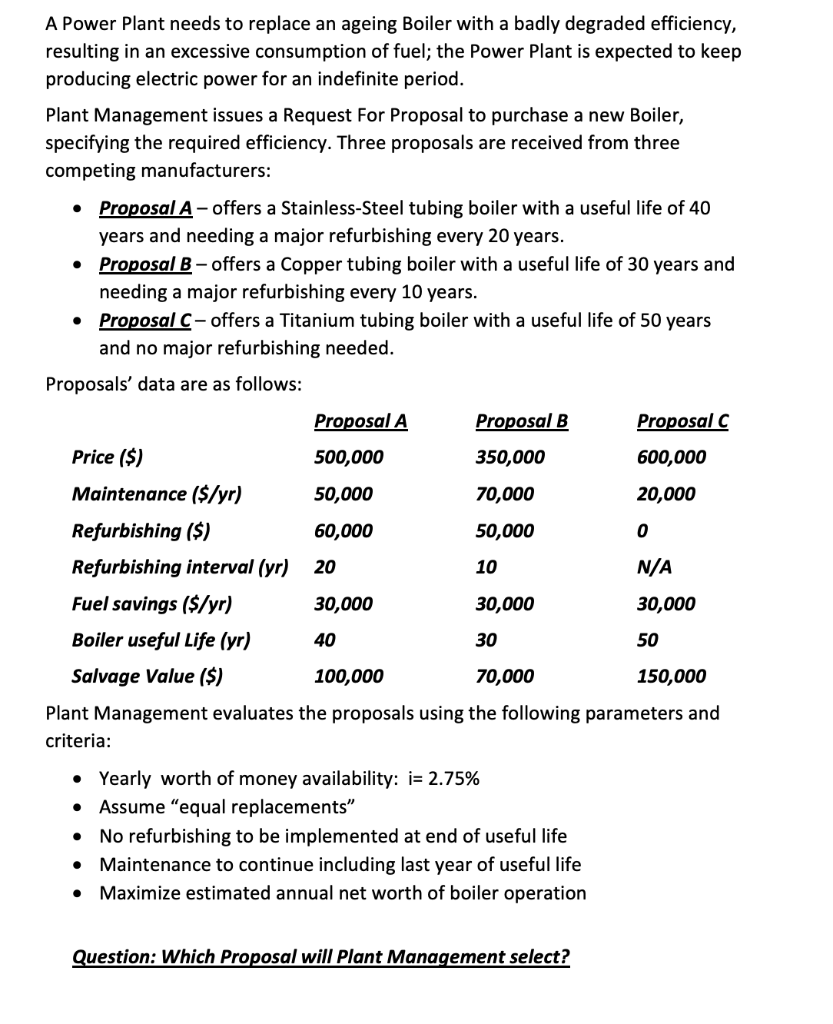

. A Power Plant needs to replace an ageing Boiler with a badly degraded efficiency, resulting in an excessive consumption of fuel; the Power Plant is expected to keep producing electric power for an indefinite period. Plant Management issues a Request For Proposal to purchase a new Boiler, specifying the required efficiency. Three proposals are received from three competing manufacturers: Proposal A -offers a Stainless-Steel tubing boiler with a useful life of 40 years and needing a major refurbishing every 20 years. Proposal B-offers a Copper tubing boiler with a useful life of 30 years and needing a major refurbishing every 10 years. Proposal C-offers a Titanium tubing boiler with a useful life of 50 years and no major refurbishing needed. Proposals' data are as follows: Proposal A Proposal B Proposal C Price ($) 500,000 350,000 600,000 Maintenance ($/yr) 50,000 70,000 20,000 Refurbishing ($) 60,000 50,000 0 Refurbishing interval (yr) 20 10 N/A Fuel savings ($/yr) 30,000 30,000 30,000 Boiler useful Life (yr) 40 30 50 Salvage Value ($) 100,000 70,000 150,000 Plant Management evaluates the proposals using the following parameters and criteria: Yearly worth of money availability: i= 2.75% Assume "equal replacements" No refurbishing to be implemented at end of useful life Maintenance to continue including last year of useful life Maximize estimated annual net worth of boiler operation . . Question: Which Proposal will Plant Management select? . A Power Plant needs to replace an ageing Boiler with a badly degraded efficiency, resulting in an excessive consumption of fuel; the Power Plant is expected to keep producing electric power for an indefinite period. Plant Management issues a Request For Proposal to purchase a new Boiler, specifying the required efficiency. Three proposals are received from three competing manufacturers: Proposal A -offers a Stainless-Steel tubing boiler with a useful life of 40 years and needing a major refurbishing every 20 years. Proposal B-offers a Copper tubing boiler with a useful life of 30 years and needing a major refurbishing every 10 years. Proposal C-offers a Titanium tubing boiler with a useful life of 50 years and no major refurbishing needed. Proposals' data are as follows: Proposal A Proposal B Proposal C Price ($) 500,000 350,000 600,000 Maintenance ($/yr) 50,000 70,000 20,000 Refurbishing ($) 60,000 50,000 0 Refurbishing interval (yr) 20 10 N/A Fuel savings ($/yr) 30,000 30,000 30,000 Boiler useful Life (yr) 40 30 50 Salvage Value ($) 100,000 70,000 150,000 Plant Management evaluates the proposals using the following parameters and criteria: Yearly worth of money availability: i= 2.75% Assume "equal replacements" No refurbishing to be implemented at end of useful life Maintenance to continue including last year of useful life Maximize estimated annual net worth of boiler operation . . Question: Which Proposal will Plant Management select