Question

a) Prepare a Basic DuPont Analysis of return on equity for 2020 please use average balances where necessary. b) During the year 2020, how much

a) Prepare a Basic DuPont Analysis of return on equity for 2020 please use average balances where necessary.

b) During the year 2020, how much did the company invest in net working capital and capex? Please use the Capex, net version of Capex you do not have the data to calculate the alternative.

c) Measured at an equity level, during 2020, how much did Waste Management reinvest back into the business, and what was the flow to equity for that year?

d) For 2020, what was NOPLAT for Waste Management?

e) Measured at an invested capital level, during 2020, how much did Waste Management reinvest back into the business, and what was the flow to the firm for that year?

SHOW WORK AND WILL RATE THUMBS UP!

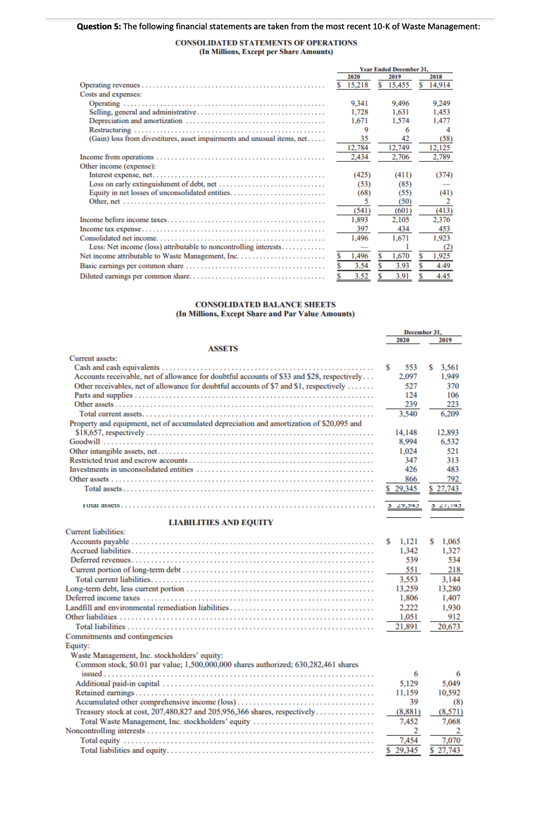

Question 5: The following financial statements are taken from the most recent 10-K of Waste Management: CONSOLIDATED STATEMENTS OF OPERATIONS (in Millions, Exeept per Share Amounts) Your Faded Deer 2019 15.218 15.455 $ 14914 9:341 9.496 9.249 1.728 1.453 1574 1.477 9 6 35 (58) 12,784 12.749 12.125 1.671 11 (374) Operating revenues Costs and expenses Operating Selling, general and administrative. Depreciation and mortiration Restructuring (Gain) loss from divestitures, asset impairments and unusual items, net Income from operations.. Other income (expense Interest expense net... Loss on carly extinguishment of debt, net Equity in net losses of unconsolidated entities Othernet Income before income taxes Income tax expense Consolidated net income Less: Net income (los) attributable to noncontrolling interests Net income tributable to Waste Management, Inc. Basic camings per common share Diluted camins per common share (425) (53) (68) (41) (541 1.193 397 1.496 (85) (55) (50) (601) 2.105 434 1.671 2.376 453 1.923 c) 1935 4.49 445 1.670 3.93 3915 $3.525 CONSOLIDATED BALANCE SHEETS (In Millions, Except Share and Par Value Amounts) December 553 $ 3.561 $ 29.345 S 27.743 ASSETS Current Cash and cash equivalents Accounts receivable, net of allowance for doubtful accounts of 33 and $28, respectively Other receivables, net of allowance for doubtful accounts of $7 and Si, respectively Parts and supplies Other assets... Total current Property and equipment, net of accumulated depreciation and amortization of $20,095 and $18.637, respectively Goodwill Other intangible assets, net Restricted trust and escrow accounts Investments in unconsolidated entities Other assets Total assets TO LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued liabilities Deferred revenues Current portion of long-term debt Total current liabilities.. Long-term debt, less current portion Deferred income taxes Landfill and environmental remediation liabilities Other liabilities Total liabilities Commitments and contingencies Equity Waste Management, Inc. stockholders' equity: Common stock, 50.01 par value; 1,500,000,000 shares authorized: 630,282,461 shares issued. Additional paid-in capital Retained camings Accumulated other comprehensive income (loss) Treasury stock at cost, 207,480,827 and 205.956,366 shares, respectively Total Waste Management, Inc. stockholders' equity Noncontrolling interests Total equity Total liabilities and equity agazals 31723 | 34 799091929371 salg g3a2* ***82224191992002 29.345 S 27,743 Question 5: The following financial statements are taken from the most recent 10-K of Waste Management: CONSOLIDATED STATEMENTS OF OPERATIONS (in Millions, Exeept per Share Amounts) Your Faded Deer 2019 15.218 15.455 $ 14914 9:341 9.496 9.249 1.728 1.453 1574 1.477 9 6 35 (58) 12,784 12.749 12.125 1.671 11 (374) Operating revenues Costs and expenses Operating Selling, general and administrative. Depreciation and mortiration Restructuring (Gain) loss from divestitures, asset impairments and unusual items, net Income from operations.. Other income (expense Interest expense net... Loss on carly extinguishment of debt, net Equity in net losses of unconsolidated entities Othernet Income before income taxes Income tax expense Consolidated net income Less: Net income (los) attributable to noncontrolling interests Net income tributable to Waste Management, Inc. Basic camings per common share Diluted camins per common share (425) (53) (68) (41) (541 1.193 397 1.496 (85) (55) (50) (601) 2.105 434 1.671 2.376 453 1.923 c) 1935 4.49 445 1.670 3.93 3915 $3.525 CONSOLIDATED BALANCE SHEETS (In Millions, Except Share and Par Value Amounts) December 553 $ 3.561 $ 29.345 S 27.743 ASSETS Current Cash and cash equivalents Accounts receivable, net of allowance for doubtful accounts of 33 and $28, respectively Other receivables, net of allowance for doubtful accounts of $7 and Si, respectively Parts and supplies Other assets... Total current Property and equipment, net of accumulated depreciation and amortization of $20,095 and $18.637, respectively Goodwill Other intangible assets, net Restricted trust and escrow accounts Investments in unconsolidated entities Other assets Total assets TO LIABILITIES AND EQUITY Current liabilities: Accounts payable Accrued liabilities Deferred revenues Current portion of long-term debt Total current liabilities.. Long-term debt, less current portion Deferred income taxes Landfill and environmental remediation liabilities Other liabilities Total liabilities Commitments and contingencies Equity Waste Management, Inc. stockholders' equity: Common stock, 50.01 par value; 1,500,000,000 shares authorized: 630,282,461 shares issued. Additional paid-in capital Retained camings Accumulated other comprehensive income (loss) Treasury stock at cost, 207,480,827 and 205.956,366 shares, respectively Total Waste Management, Inc. stockholders' equity Noncontrolling interests Total equity Total liabilities and equity agazals 31723 | 34 799091929371 salg g3a2* ***82224191992002 29.345 S 27,743Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started