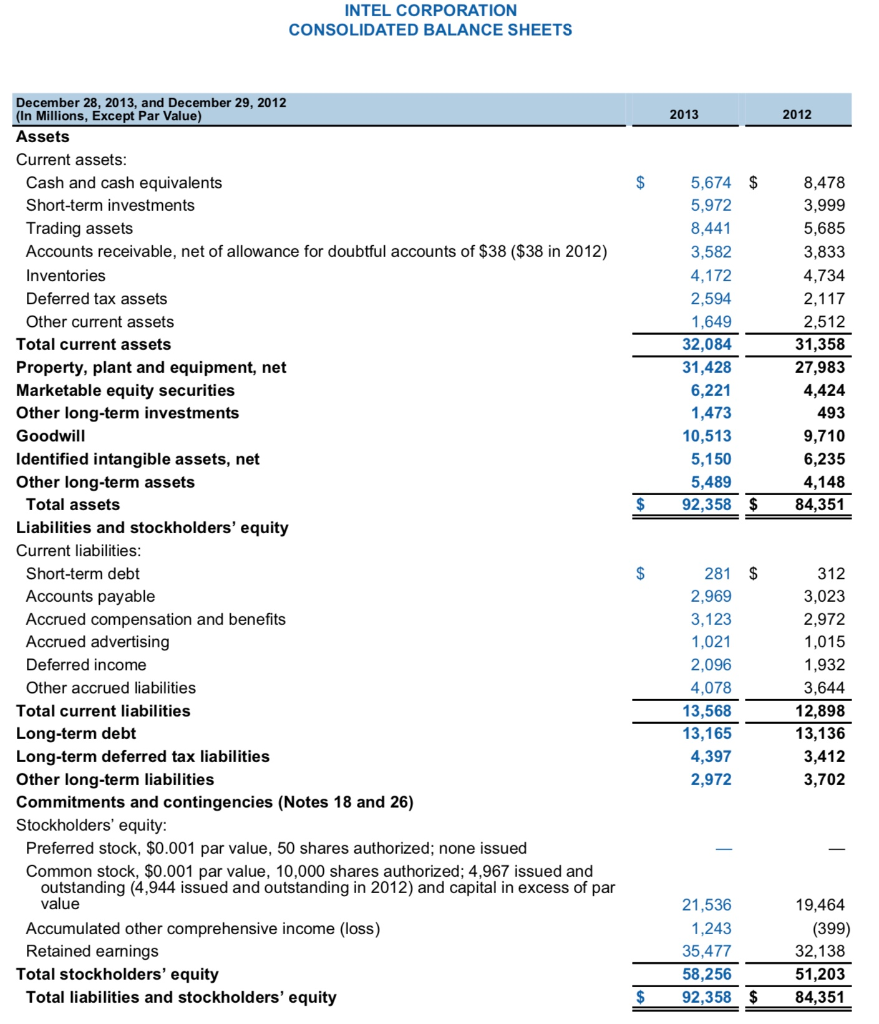

(a) Prepare a common-size balance sheet for Intel for all years presented. (b) Describe the types of assets Intel owns. Which assets are the most significant to the company? Using the notes to the financial statements, discuss the accounting methods used to value assets. What other information can be learned about the asset accounts from the notes? Have there been significant changes to the asset structure from 2012 to 2013? (c) Analyze the accounts receivable and allowance for doubtful accounts (d) Describe the types of liabilities Intel has incurred. Which liabilities are the most significant to the company? Have there been significant changes to the liability and equity structure from 2012 to 2013? (e) Describe the commitments and contingencies of Intel. (f) Under which classification(s) are deferred taxes listed? What item is the most significant component of deferred taxes? (g) What equity accounts are included on the balance sheet of Intel? INTEL CORPORATION CONSOLIDATED BALANCE SHEETS December 28, 2013, and December 29, 2012 (In Millions, Except Par Value) 2013 2012 Assets Current assets: $ 5,674 $ Cash and cash equivalents Short-term investments 8,478 5,972 3,999 Trading assets 8,441 5,685 Accounts receivable, net of allowance for doubtful accounts of $38 ($38 in 2012) 3,582 3,833 Inventories 4,172 4,734 Deferred tax assets 2,594 2,117 Other current assets 1,649 2,512 Total current assets 32,084 31,358 31,428 Property, plant and equipment, net 27,983 Marketable equity securities 6,221 4,424 Other long-term investments 1,473 493 Goodwill 10,513 9,710 Identified intangible assets, net 5,150 6,235 5,489 92,358 $ 4,148 Other long-term assets $ Total assets 84,351 Liabilities and stockholders' equity Current liabilities: $ 281 $ Short-term debt 312 Accounts payable 2,969 3,023 Accrued compensation and benefits Accrued advertising 3,123 2,972 1,021 1,015 Deferred income 2,096 1,932 Other accrued liabilities 3,644 4,078 Total current liabilities 13,568 12,898 Long-term debt Long-term deferred tax liabil ities Other long-term liabilities Commitments and contingencies (Notes 18 and 26) Stockholders' equity: Preferred stock, $0.001 par value, 50 shares authorized; none issued Common stock, $0.001 par value, 10,000 shares authorized; 4,967 issued and outstanding (4,944 issued and outstanding in 2012) and capital in excess of par value 13,165 13,136 4,397 3,412 3,702 2,972 21,536 19,464 Accumulated other comprehensive income (loss) Retained earnings 1,243 (399) 35,477 32,138 Total stockholders' equity 58,256 51,203 $ 92,358 $ Total liabilities and stockholders' equity 84,351