Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Prepare a schedule of expected cash collections for October, November and December and for the quarter in total. (b) Prepare a cash budget for

(a) Prepare a schedule of expected cash collections for October, November and December and for the quarter in total.

(b) Prepare a cash budget for the fourth quarter ended 31 December (show monthly columns and a total for the quarter).

(c) The company is considering a dividend payout of $300,000 to shareholders. If the company needs to maintain a minimum cash balance of $100,000 for operating purposes, propose and explain the month for which dividend payment should be planned.

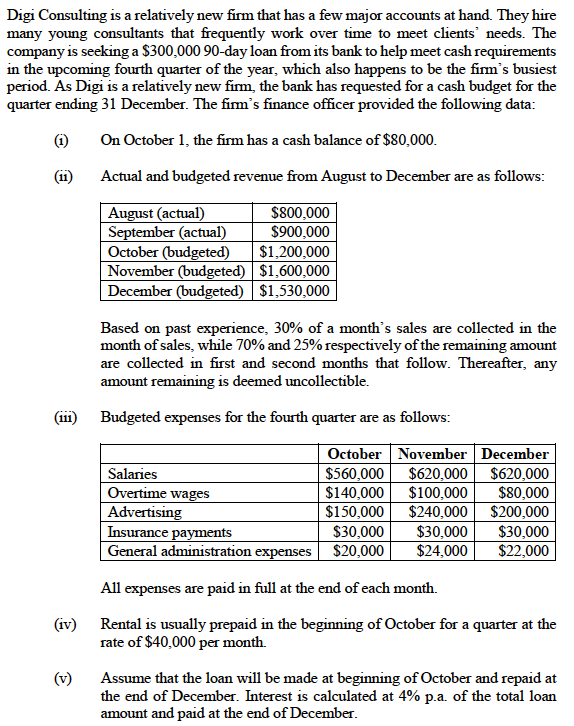

Digi Consulting is a relatively new firm that has a few major accounts at hand. They hire many young consultants that frequently work over time to meet clients' needs. The company is seeking a $300,00090-day loan from its bank to help meet cash requirements in the upcoming fourth quarter of the year, which also happens to be the firm's busiest period. As Digi is a relatively new firm, the bank has requested for a cash budget for the quarter ending 31 December. The firm's finance officer provided the following data: (i) On October 1, the firm has a cash balance of $80,000. (ii) Actual and budgeted revenue from August to December are as follows: Based on past experience, 30% of a month's sales are collected in the month of sales, while 70% and 25% respectively of the remaining amount are collected in first and second months that follow. Thereafter, any amount remaining is deemed uncollectible. (iii) Budgeted expenses for the fourth quarter are as follows: All expenses are paid in full at the end of each month. (iv) Rental is usually prepaid in the beginning of October for a quarter at the rate of $40,000 per month. (v) Assume that the loan will be made at beginning of October and repaid at the end of December. Interest is calculated at 4% p.a. of the total loan amount and paid at the end of DecemberStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started