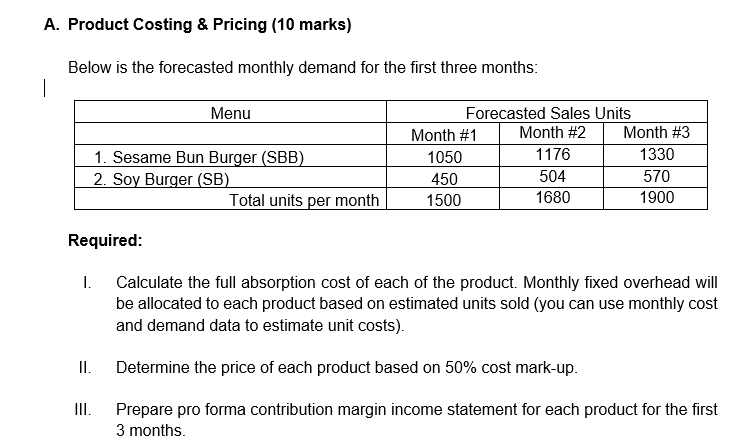

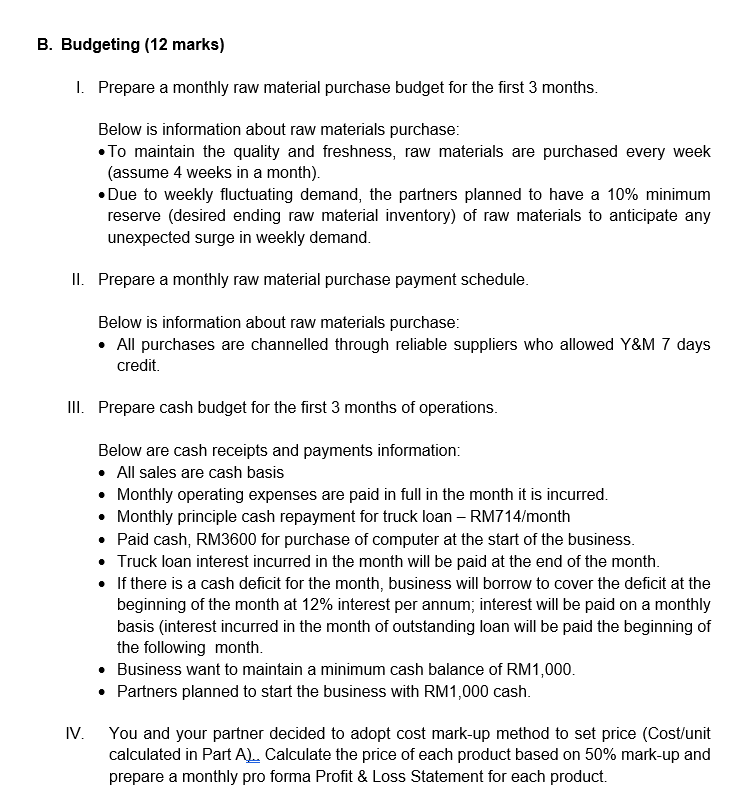

A. Product Costing & Pricing (10 marks) Below is the forecasted monthly demand for the first three months: Menu 1. Sesame Bun Burger (SBB) 2. Soy Burger (SB) Total units per month Forecasted Sales Units Month #1 Month #2 Month #3 1050 1176 1330 450 504 570 1500 1680 1900 Required: I. Calculate the full absorption cost of each of the product. Monthly fixed overhead will be allocated to each product based on estimated units sold (you can use monthly cost and demand data to estimate unit costs). II. Determine the price of each product based on 50% cost mark-up. III. Prepare pro forma contribution margin income statement for each product for the first 3 months. B. Budgeting (12 marks) 1. Prepare a monthly raw material purchase budget for the first 3 months. Below is information about raw materials purchase: To maintain the quality and freshness, raw materials are purchased every week (assume 4 weeks in a month). Due to weekly fluctuating demand, the partners planned to have a 10% minimum reserve (desired ending raw material inventory) of raw materials to anticipate any unexpected surge in weekly demand. II. Prepare a monthly raw material purchase payment schedule. Below is information about raw materials purchase: All purchases are channelled through reliable suppliers who allowed Y&M 7 days credit III. Prepare cash budget for the first 3 months of operations. Below are cash receipts and payments information: All sales are cash basis Monthly operating expenses are paid in full in the month it is incurred. Monthly principle cash repayment for truck loan - RM714/month Paid cash, RM3600 for purchase of computer at the start of the business. Truck loan interest incurred in the month will be paid at the end of the month. If there is a cash deficit for the month, business will borrow to cover the deficit at the beginning of the month at 12% interest per annum; interest will be paid on a monthly basis (interest incurred in the month of outstanding loan will be paid the beginning of the following month. Business want to maintain a minimum cash balance of RM1,000. Partners planned to start the business with RM1,000 cash. IV. You and your partner decided to adopt cost mark-up method to set price (Cost/unit calculated in Part A. Calculate the price of each product based on 50% mark-up and prepare a monthly pro forma Profit & Loss Statement for each product. A. Product Costing & Pricing (10 marks) Below is the forecasted monthly demand for the first three months: Menu 1. Sesame Bun Burger (SBB) 2. Soy Burger (SB) Total units per month Forecasted Sales Units Month #1 Month #2 Month #3 1050 1176 1330 450 504 570 1500 1680 1900 Required: I. Calculate the full absorption cost of each of the product. Monthly fixed overhead will be allocated to each product based on estimated units sold (you can use monthly cost and demand data to estimate unit costs). II. Determine the price of each product based on 50% cost mark-up. III. Prepare pro forma contribution margin income statement for each product for the first 3 months. B. Budgeting (12 marks) 1. Prepare a monthly raw material purchase budget for the first 3 months. Below is information about raw materials purchase: To maintain the quality and freshness, raw materials are purchased every week (assume 4 weeks in a month). Due to weekly fluctuating demand, the partners planned to have a 10% minimum reserve (desired ending raw material inventory) of raw materials to anticipate any unexpected surge in weekly demand. II. Prepare a monthly raw material purchase payment schedule. Below is information about raw materials purchase: All purchases are channelled through reliable suppliers who allowed Y&M 7 days credit III. Prepare cash budget for the first 3 months of operations. Below are cash receipts and payments information: All sales are cash basis Monthly operating expenses are paid in full in the month it is incurred. Monthly principle cash repayment for truck loan - RM714/month Paid cash, RM3600 for purchase of computer at the start of the business. Truck loan interest incurred in the month will be paid at the end of the month. If there is a cash deficit for the month, business will borrow to cover the deficit at the beginning of the month at 12% interest per annum; interest will be paid on a monthly basis (interest incurred in the month of outstanding loan will be paid the beginning of the following month. Business want to maintain a minimum cash balance of RM1,000. Partners planned to start the business with RM1,000 cash. IV. You and your partner decided to adopt cost mark-up method to set price (Cost/unit calculated in Part A. Calculate the price of each product based on 50% mark-up and prepare a monthly pro forma Profit & Loss Statement for each product