Question

A project for a new refined petroleum product did not yield estimated savings and is being terminated with no ($0) market value, because the refined

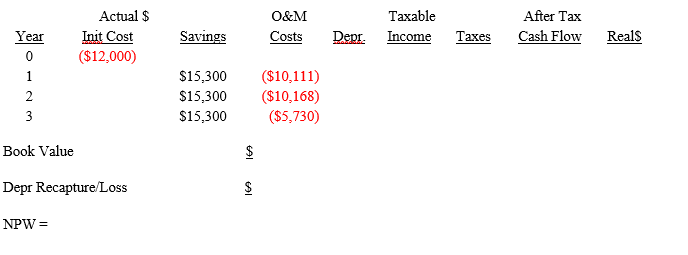

A project for a new refined petroleum product did not yield estimated savings and is being terminated with no ($0) market value, because the refined product will be converted to produce another product. The project had the following cash flows in actual dollars. The company uses a real interest rate i = 15% for this product, and inflation is expected to maintain at a 3% average. The petroleum refining uses MACRS depreciation and has a combined tax rate is 44%. Estimate the after tax cash actual dollar cash flows, convert the actual dollar cash flows to real dollars, and compute the net present worth in real dollars. Cash flows are in actual dollar x $1,000.

PLEASE ANSWER BY HAND. I am not allowed to use Excel.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started