Question

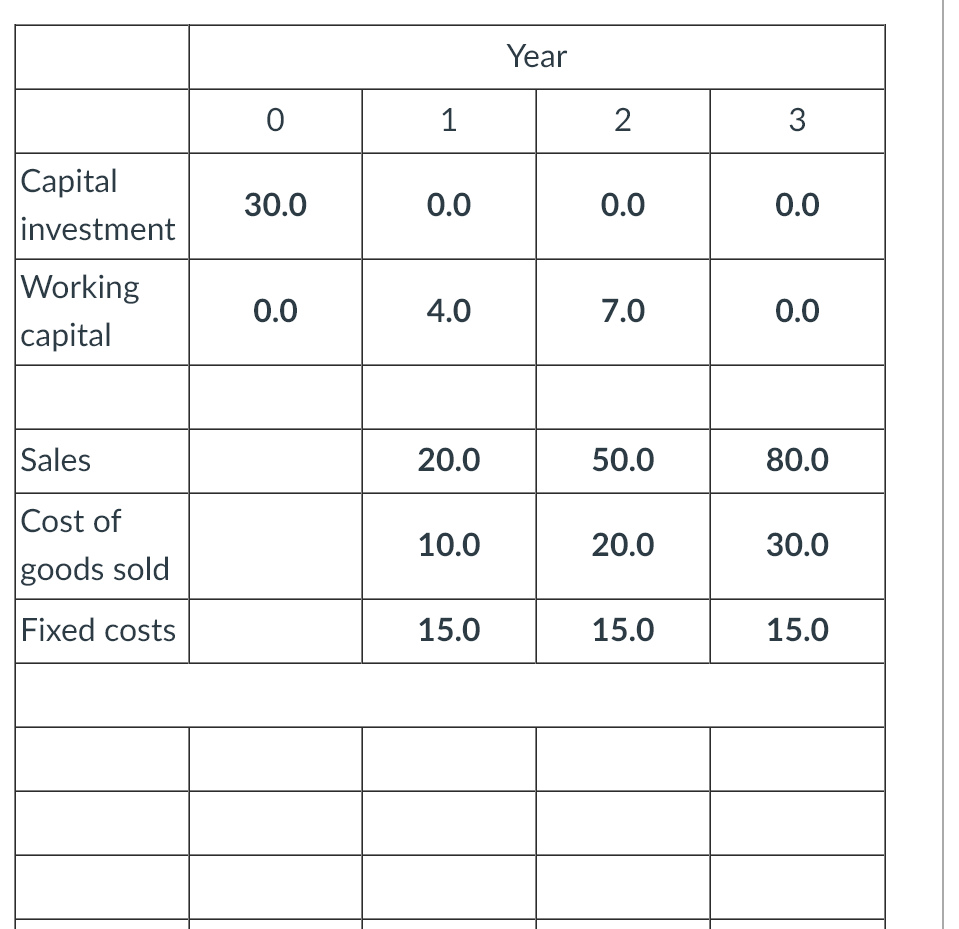

A project has a 3-year economic life, and entails an initial investment of $30 million in plant and machinery, which are expected to be worthless

A project has a 3-year economic life, and entails an initial investment of $30 million in plant and machinery, which are expected to be worthless after year 3. The initial investment will be fully depreciated from year 1 to year 3. The projects opportunity cost of capital is 5%, and the tax rate is 30%.

(a) Assume that the project uses a straight-line depreciation schedule. Fill out the blanks in the worksheet below and compute the projects NPV. (There are more rows than you need.)

(b) Whats the present value of tax savings from depreciation under the straight-line schedule?

(c) Whats the present value of tax savings from depreciation under an accelerated depreciation schedule in which 60% of the initial investment will be depreciated in year 1, 30% in year 2, and 10% in year 3?

(d) Whats the projects NPV under the accelerated depreciation schedule in part (c)? (Hint: Instead of redoing the above table, you can make use of your answers in parts b and c.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started