Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A project requires an initial investment of $1,000,000 to purchase equipment and it is expected to use for 5 yrs. The company expects to have

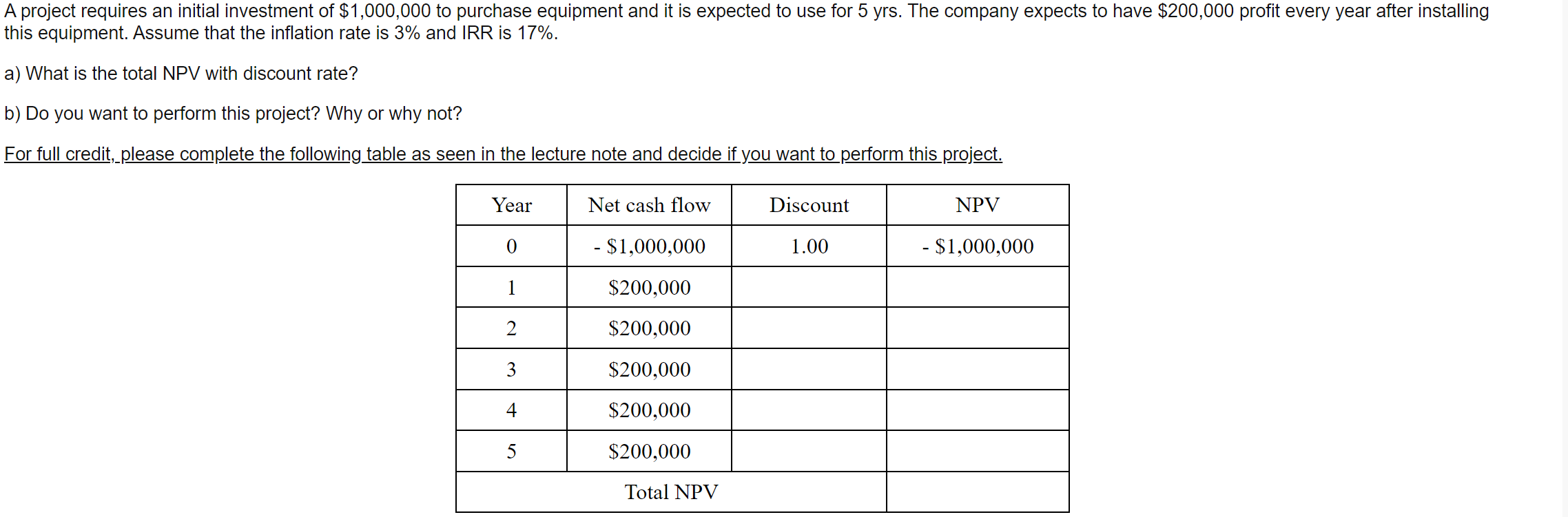

A project requires an initial investment of $1,000,000 to purchase equipment and it is expected to use for 5 yrs. The company expects to have $200,000 profit every year after installing this equipment. Assume that the inflation rate is 3% and IRR is 17%. a) What is the total NPV with discount rate? b) Do you want to perform this project? Why or why not? For full credit, please complete the following table as seen in the lecture note and decide if you want to perform this project

A project requires an initial investment of $1,000,000 to purchase equipment and it is expected to use for 5 yrs. The company expects to have $200,000 profit every year after installing this equipment. Assume that the inflation rate is 3% and IRR is 17%. a) What is the total NPV with discount rate? b) Do you want to perform this project? Why or why not? For full credit, please complete the following table as seen in the lecture note and decide if you want to perform this project Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started