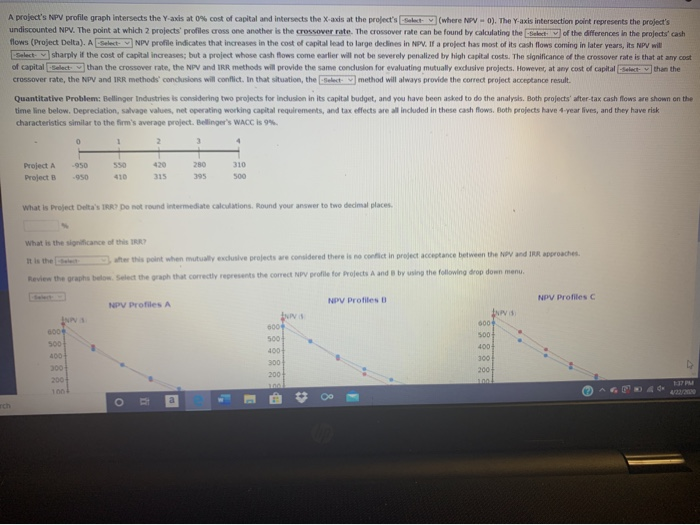

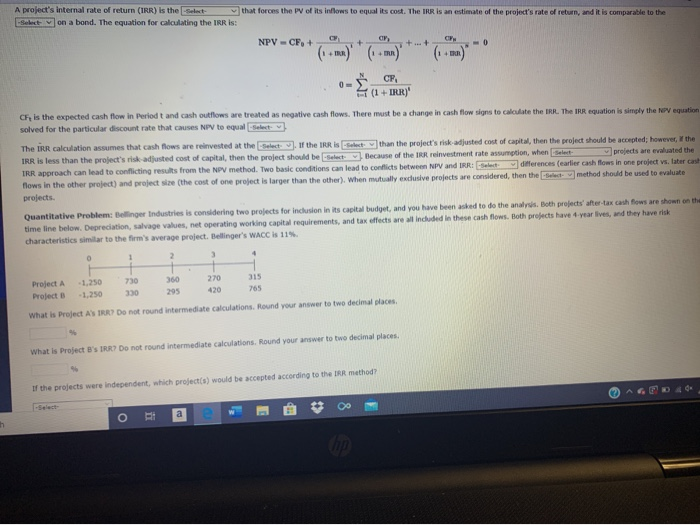

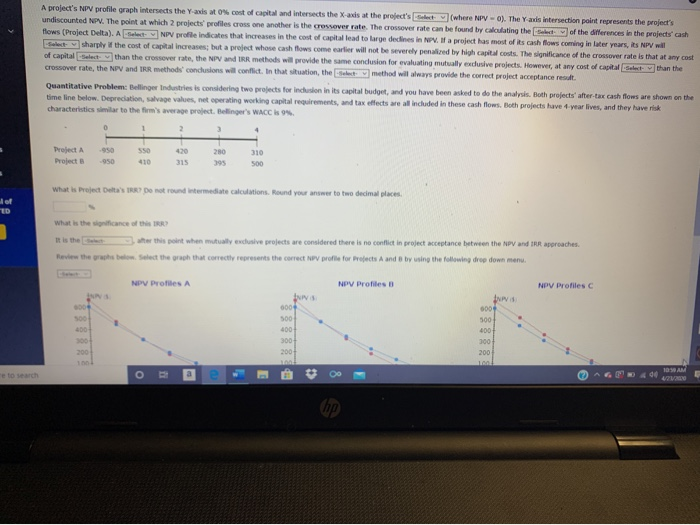

A project's NPV profile graph intersects the Yaxs to cost of capital and intersects the X-ads at the project's Seat (where NV-0). The Yaxis intersection point represents the project's undiscounted NPV. The point at which projects' profiles cross one another is the crossover rate. The crossover rate can be found by calculating the of the differences in the projects' cash Mows Project Delta). A NPV pro indicates that increases in the cost of capital lead to large deines in NPV. If a project has most of its cash flows coming in later years, IN Select sharply the cost of capital increases, but a project whose cash flows come earlier will not be severely penalized by high capital costs. The significance of the crossover rate is that at anycost of capital than the crossover rate, the NPV and IRR methods will provide the same conclusion for evaluating mutually exdusive projects. However, at any cost of capital elect than the Crossover rate, the NPV and IRR methods' conclusions will conflict. In that c ation, the method will always provide the correct project acceptance result Quantitative Problemelinger Industries is considering two projects for indusion in its capital budget, and you have been asked to do the analysis. Both projects wer-tax cash flows are shown on the timeline below. Depreciation, a ge , et peating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4 year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9% 310 Project A Project 1 050 050 550 410 420 215 280 395 What is Project Det's Do not und intermediate calculations. Round your answer to two decimal places oaches It is the this point when mutually exclusive projects are considered there is no conflict in project acceptance between the NPV and d the graph that correctly represents the correct NPV profile for projects A and B by using the following drop down menu. Review the orph o l NOV Profiles NIV Profilesc NPV Profiles trora INV tuwa 000 A project's Internal rate of return (IRR) is the select the forces the PV of its inflows to equal its cost. The IRR is an estimate of the project's rate of return, and it is comparable to the Select on a bond. The equation for calculating the IRR is: (1+IRR) CF, is the expected cash flow in Period t and cash outflows are treated as negative cash flows. There must be a change in cash flow signs to calculate the IRR. The IRR solved for the particular discount rate that causes NPV to equal Select on is simply the equation The IRR calculation assumes that cash flows are reinvested at the Select . If the IRR is Select than the project's risk-adjusted cost of capital, then the project should be accepted; however, the IRR is less than the project's risk-adjusted cost of capital, then the project should be select Because of the IRR reinvestment rate assumption, when Select projects are evaluated the IRR approach can lead to contacting results from the method. Two basic conditions can lead to codicts between NPV und derences (earlierchows in one pred vs. later Cars flows in the other project) and project size the cost of one project is larger than the other). When mutually exclusive projects are considered, then the the should be used to evaluate projects. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the timeline below. Depreciation Savage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have rear lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC 115 315 Project A Project -1.250 -1.250 750 200 200 205 270 420 What is Project AN IRR) Do not found intermediate calculations. Round your answer to two decimal places what is Project 'SIRRDo not found intermediate calculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? A project's NPV profile graph intersects the Yaxs to cost of capital and intersects the X-axis at the project's start (where NPV - 0). The Yaris intersection point represents the project's undiscounted NPV. The point at which 2 projects' profiles cross one another is the crossover rate. The crossover rate can be found by calculating the rest of the differences in the projects' cash flows (Project Delta). A Select NPV profile indicates that increases in the cost of capital lead to large dedines in V. If a project has most of Rs cash flows coming in later years, is sharply the cost of increase but a p et whose cash flows earlier will not be severely penaired by high costs. The significance of the crossover rate is that at any cost of capital Select than the crossover rate, the NPV and IRR methods will provide the same conclusion for evaluating mutually exclusive projects. However, at any cost of capital Select than the Crossover rate, the NPV and IRR methods' conclusions will conflict. In thattuation, the method will always provide the correct project acceptance red Quantitative Problem Hellinger industries is co timeline below. Depreciations when characteristics similar to the firm's average project p s in working inger's WACCI for indu c te d you have been to do the both projects ther-tax cath flows are shown on the requirements, and tax effects are all included in these cash flows. Both projects have year lives, and they have risk 20 305 Project 1 050 410 315 300 What the cance of Revhe a t the graph that correctly r esents the correct NPV pole for rejects A and B by using the following dree down menu. NV Profiles A NOW Prottesc My Profiles INS A project's NPV profile graph intersects the Yaxs to cost of capital and intersects the X-ads at the project's Seat (where NV-0). The Yaxis intersection point represents the project's undiscounted NPV. The point at which projects' profiles cross one another is the crossover rate. The crossover rate can be found by calculating the of the differences in the projects' cash Mows Project Delta). A NPV pro indicates that increases in the cost of capital lead to large deines in NPV. If a project has most of its cash flows coming in later years, IN Select sharply the cost of capital increases, but a project whose cash flows come earlier will not be severely penalized by high capital costs. The significance of the crossover rate is that at anycost of capital than the crossover rate, the NPV and IRR methods will provide the same conclusion for evaluating mutually exdusive projects. However, at any cost of capital elect than the Crossover rate, the NPV and IRR methods' conclusions will conflict. In that c ation, the method will always provide the correct project acceptance result Quantitative Problemelinger Industries is considering two projects for indusion in its capital budget, and you have been asked to do the analysis. Both projects wer-tax cash flows are shown on the timeline below. Depreciation, a ge , et peating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4 year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9% 310 Project A Project 1 050 050 550 410 420 215 280 395 What is Project Det's Do not und intermediate calculations. Round your answer to two decimal places oaches It is the this point when mutually exclusive projects are considered there is no conflict in project acceptance between the NPV and d the graph that correctly represents the correct NPV profile for projects A and B by using the following drop down menu. Review the orph o l NOV Profiles NIV Profilesc NPV Profiles trora INV tuwa 000 A project's Internal rate of return (IRR) is the select the forces the PV of its inflows to equal its cost. The IRR is an estimate of the project's rate of return, and it is comparable to the Select on a bond. The equation for calculating the IRR is: (1+IRR) CF, is the expected cash flow in Period t and cash outflows are treated as negative cash flows. There must be a change in cash flow signs to calculate the IRR. The IRR solved for the particular discount rate that causes NPV to equal Select on is simply the equation The IRR calculation assumes that cash flows are reinvested at the Select . If the IRR is Select than the project's risk-adjusted cost of capital, then the project should be accepted; however, the IRR is less than the project's risk-adjusted cost of capital, then the project should be select Because of the IRR reinvestment rate assumption, when Select projects are evaluated the IRR approach can lead to contacting results from the method. Two basic conditions can lead to codicts between NPV und derences (earlierchows in one pred vs. later Cars flows in the other project) and project size the cost of one project is larger than the other). When mutually exclusive projects are considered, then the the should be used to evaluate projects. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the timeline below. Depreciation Savage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have rear lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC 115 315 Project A Project -1.250 -1.250 750 200 200 205 270 420 What is Project AN IRR) Do not found intermediate calculations. Round your answer to two decimal places what is Project 'SIRRDo not found intermediate calculations. Round your answer to two decimal places. If the projects were independent, which project(s) would be accepted according to the IRR method? A project's NPV profile graph intersects the Yaxs to cost of capital and intersects the X-axis at the project's start (where NPV - 0). The Yaris intersection point represents the project's undiscounted NPV. The point at which 2 projects' profiles cross one another is the crossover rate. The crossover rate can be found by calculating the rest of the differences in the projects' cash flows (Project Delta). A Select NPV profile indicates that increases in the cost of capital lead to large dedines in V. If a project has most of Rs cash flows coming in later years, is sharply the cost of increase but a p et whose cash flows earlier will not be severely penaired by high costs. The significance of the crossover rate is that at any cost of capital Select than the crossover rate, the NPV and IRR methods will provide the same conclusion for evaluating mutually exclusive projects. However, at any cost of capital Select than the Crossover rate, the NPV and IRR methods' conclusions will conflict. In thattuation, the method will always provide the correct project acceptance red Quantitative Problem Hellinger industries is co timeline below. Depreciations when characteristics similar to the firm's average project p s in working inger's WACCI for indu c te d you have been to do the both projects ther-tax cath flows are shown on the requirements, and tax effects are all included in these cash flows. Both projects have year lives, and they have risk 20 305 Project 1 050 410 315 300 What the cance of Revhe a t the graph that correctly r esents the correct NPV pole for rejects A and B by using the following dree down menu. NV Profiles A NOW Prottesc My Profiles INS