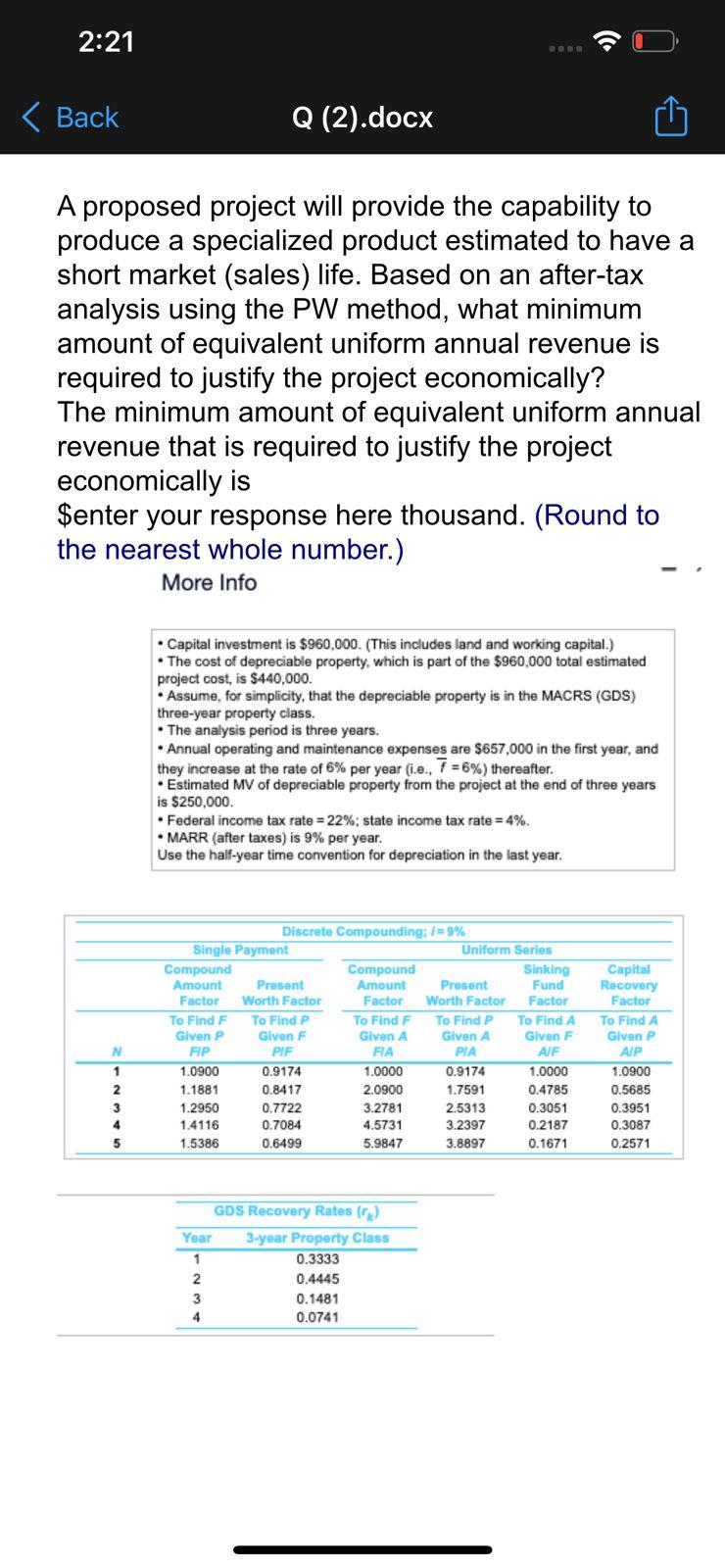

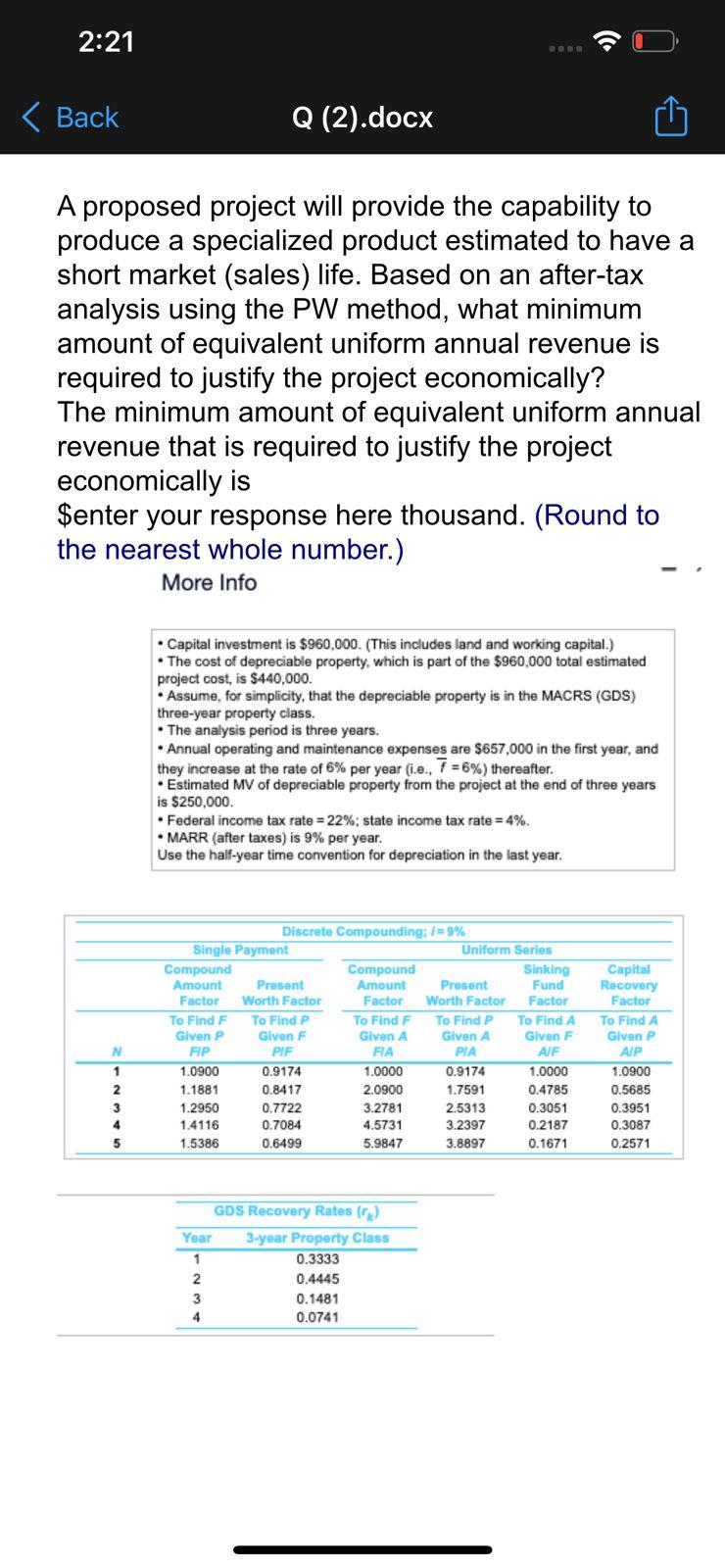

A proposed project will provide the capability to produce a specialized product estimated to have a short market (sales) life. Based on an after-tax analysis using the PW method, what minimum amount of equivalent uniform annual revenue is required to justify the project economically? The minimum amount of equivalent uniform annual revenue that is required to justify the project economically is Senter your response here thousand. (Round to the nearest whole number.) More Info - Capital investment is $960,000. (This includes land and working capital.) - The cost of depreciable property, which is part of the $960,000 total estimated project cost, is $440,000. - Assume, for simplicity, that the depreciable property is in the MACRS (GDS) three-year property class. - The analysis period is three years. - Annual operating and maintenance expenses are $657,000 in the first year, and they increase at the rate of 6% per year (i.e., f=6% ) thereafter. - Estimated MV of depreciable property from the project at the end of three years is $250,000. - Federal income tax rate =22%; state income tax rate =4%. - MARR (after taxes) is 9% per year. Use the half-year time convention for depreciation in the last year. A proposed project will provide the capability to produce a specialized product estimated to have a short market (sales) life. Based on an after-tax analysis using the PW method, what minimum amount of equivalent uniform annual revenue is required to justify the project economically? The minimum amount of equivalent uniform annual revenue that is required to justify the project economically is Senter your response here thousand. (Round to the nearest whole number.) More Info - Capital investment is $960,000. (This includes land and working capital.) - The cost of depreciable property, which is part of the $960,000 total estimated project cost, is $440,000. - Assume, for simplicity, that the depreciable property is in the MACRS (GDS) three-year property class. - The analysis period is three years. - Annual operating and maintenance expenses are $657,000 in the first year, and they increase at the rate of 6% per year (i.e., f=6% ) thereafter. - Estimated MV of depreciable property from the project at the end of three years is $250,000. - Federal income tax rate =22%; state income tax rate =4%. - MARR (after taxes) is 9% per year. Use the half-year time convention for depreciation in the last year