Question

A question requiring a 'True/False' answer. 1. Governments play a limited role in the money markets. Yes / No 2. Commercial paper is usually backed

A question requiring a 'True/False' answer.

1. Governments play a limited role in the money markets.

Yes / No

2. Commercial paper is usually backed by collaterals.

A question requiring a 'True/False' answer.

True/ False

3. Secondary markets facilitate the issuance of new securities.

A question requiring a 'True/False' answer.

True/ False

4. Money markets facilitate the sale of long-term loans (one year or more).

A question requiring a 'True/False' answer.

True/ False

2-1.

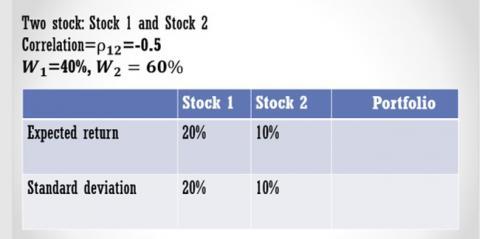

The standard deviation of the portfolio consisting of stock 1 and stock 2

A multiple-choice question with one possible answer.(Required)

- 10%

- 8%

- 11%

- 9%

- 7%

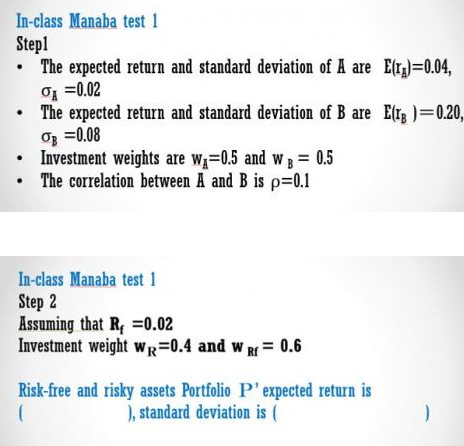

3-1. In step 1, you make a Risky-asset portfolio R, which includes assets A and B.

The expected return of the Risky-asset portfolio R is

A multiple-choice question with one possible answer.(Required)

- 12%

- 18%

- 20%

- 14%

- 16%

3-2. The standard deviation of the Risky-asset portfolio R' is

A multiple-choice question with one possible answer.(Required)

- 6%

- 1%

- 5%

- 2%

- 4%

In step 2, you make a Risky- and risk-free-asset portfolio P, which includes Risky-asset portfolio R created in step 1 and a risk-free asset .

3-3. Risky- and risk-free-asset portfolio P' expected return is

A multiple-choice question with one possible answer.(Required)

- 7%

- 5%

- 4%

- 8%

- 6%

3-4. Risky- and risk-free-asset portfolio P' standard deviation is

A multiple-choice question with one possible answer.(Required)

- 4.6%

- 1.6%

- 0.6%

- 0%

- 2.6%

- 3.6%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started